Darwin Evolution is a robot that works with the Forex market completely automatically. The developers provide us with information about the system and its features, backtest reports and trading results. To decide whether it is a good trading tool, we will analyze all the key aspects of this FX ATS.

Is Darwin Evolution good?

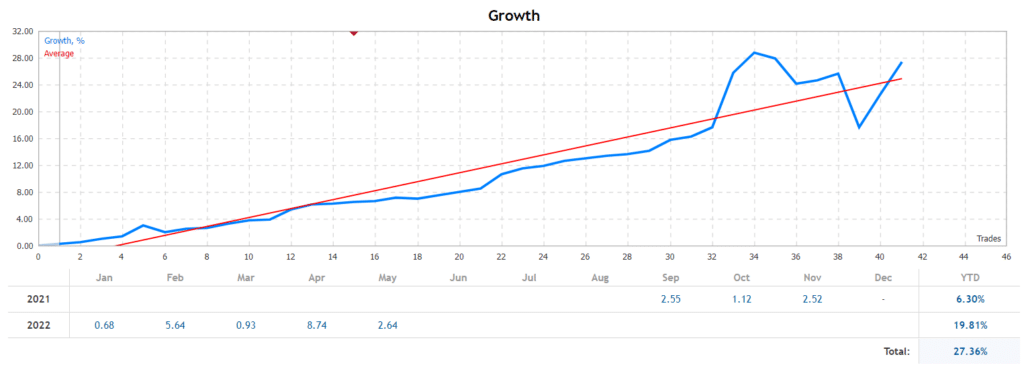

The system looks average if we make decision based on the growth chart and stability. There still are possibilities to lose much in a day.

Features of Darwin Evolution

The presentation includes information about features, settings, parameters, and risks.

- The presentation includes information that the system manages orders completely automatically for us.

- The current price of $999 isn’t final.

- The ultimate one will be $1490.

- We have various explanations available in the blog.

- We can work on a demo or a real account.

- There’s a user manual.

- We are allowed to work with risks we can handle.

- The system trades with low frequency.

- It can keep orders for a week on a terminal.

- There are eight indicators behind the system.

- Trading is possible on 28 pairs.

- The news filter feature is applied.

- EURUSD is the only cross pair to trade.

- It works on the M1 time frame.

- The default risks can be 5%.

- It tries to trade, using a Hedge strategy.

- We should use it on a balance of $200.

- The leverage can be from 1:30.

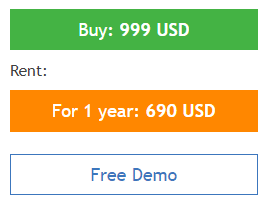

The robot is available for $999 for a copy. We can rent it out for $690 annually. The platform allows us to download a demo copy of the system to give it a try.

| Trading Terminals | MT4/MT5 |

| Strategy | Hedge, Grid, and Martingale |

| Timeframe | N/A |

| Price | $690 and $999 |

| Money Refund | N/A |

| Recommended Deposit | $200 |

| Recommended Leverage | 1:30 |

| Money Management | Yes |

| Customer Reviews | Yes |

What strategy does Darwin Evolution use?

- The system works with a Hedge strategy. Most likely it is based on Price Action.

- We can work with EURUSD.

- The time frame to trade is M1.

Backtesting vs live trading results

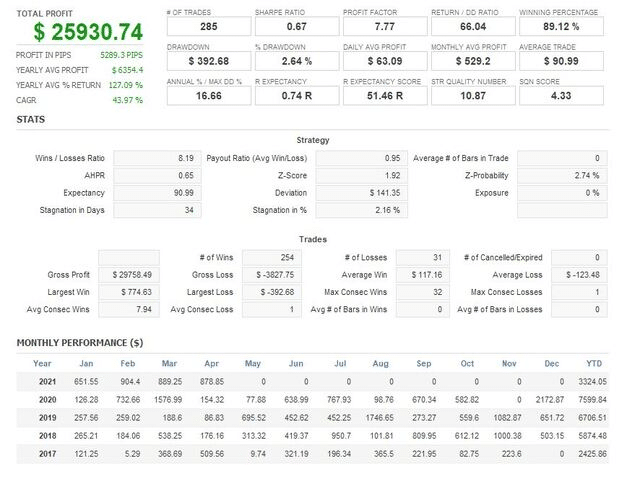

The presentation includes a backtest report where we can note that the system traded 285 deals and obtained $25,930 profits. An average annual return was 127.09%. The profit factor was 7.77. It’s a good number. An average accuracy was 89.12%. The maximum drawdown was 2.64%.

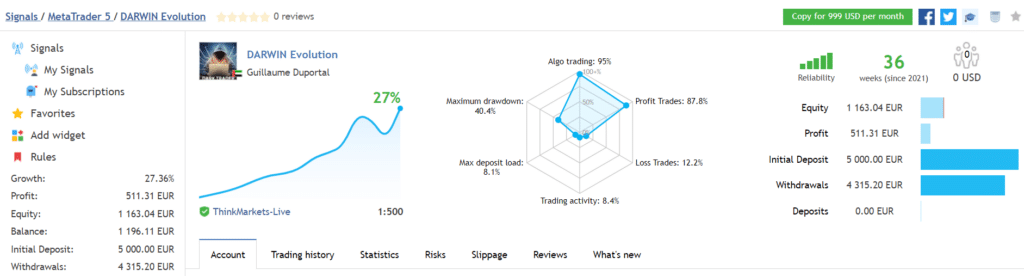

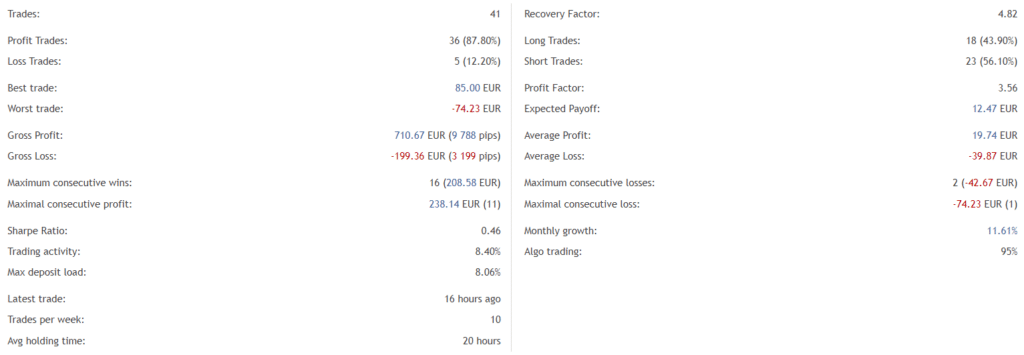

The robot works on the rarely-used broker–ThinkMarkets. The leverage is common–1:500. It works with maximum drawdowns of 40.4% and maximum deposit loads of 8.1%. The win rate is high–87.8%. It performs also trading in 95% of the cases only.

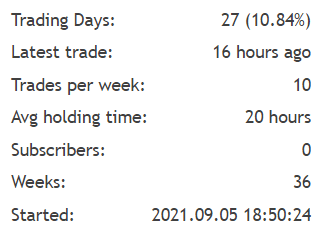

An average trade frequency is 10 deals weekly. The average holding time is 20 hours. The account was created 36 weeks ago on September 09, 2021.

We don’t know why the reason was to skip trading in December 2021.

The robot uses various lot sizes and grids of orders to make profits.

Darwin Evolution traded 41 orders only. The best trade is €85.00 when the worst one is -€74.24. The recovery factor is 4.82 when the profit factor is 3.56. An average monthly profit is 11.61%.

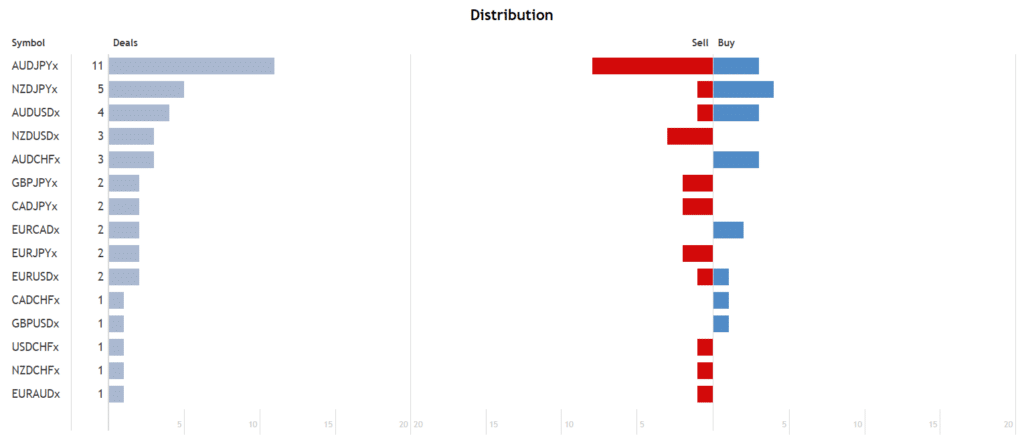

AUDJPY is still the most active day to trade with 11 deals closed.

The core team

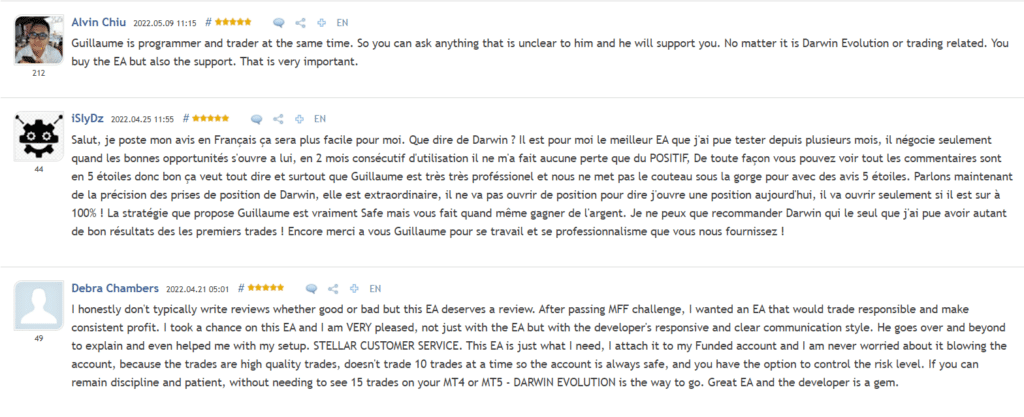

The advisor received many positive testimonials from former and current clients.

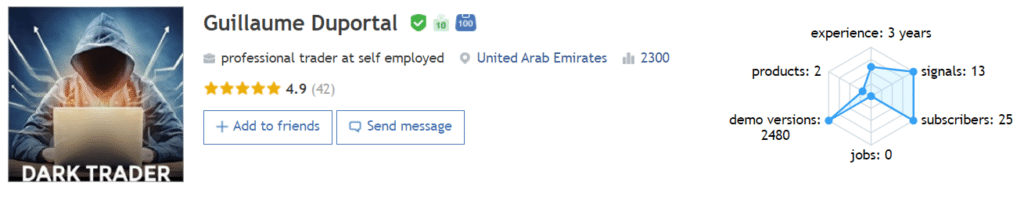

The developer is from UAE and he has a 2300 rate. This rate can be treated as a beginner one. There are two products and thirteen signals on a board. The portfolio has a 4.9 rate in total.