DDMarkets is a signal provider focusing on swing and day trading. The company has been in the market since 2014 and boasts easy-to-use and conservative entries. Daily updates and a seven-year track record are part of the feature highlights for this service.

We could not find vendor details like the location address, phone number, etc. For support, the vendor has an online contact form. The lack of vendor transparency and insufficient support methods raises doubts regarding the dependability of the company.

Different pricing packages are present for this service including the Global Trade Alerts plan which ranges from $59.90 up to $230.60 based on the subscription duration. An intraday strategies plan ranges from $49.70 up to $74.40 while the advanced integration pack cost ranges from $138.70 to $392.40.

Is DDMarkets good?

Our evaluation of the company, its functionality, trading approach, and track record reveals this is not a profitable or reliable system. The lack of a proven track record and expensive pricing package are downsides that make this product not worth the price it is sold at.

Features of DDMarkets

As per the vendor, here are the main feature highlights of this company that gives it a competitive edge:

- Daily updates to subscribers.

- Complete email support.

- Broker compatibility.

- Proven trading approaches.

- A transparent track record.

The team of expert traders in this company monitors the prevailing market conditions and a potential drawdown of all the open trades. They take care to prevent overexposure to a specific currency and assess the potential drawdown that will necessitate activation of the SL order to protect your investment.

| Trading Terminal | MT4 |

| Strategy | Multiple strategies with technical analysis |

| Timeframe | N/A |

| Price | $59.90 to $392.40 |

| Money Refund | No refund |

| Minimum deposit | $500 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | Bad (2.538/5 rating based on 4 reviews on FPA) |

What strategy does DDMarkets use?

As per the vendor, many strategies are used for signal accuracy and these include reversal patterns and continuation patterns of trend-following type.The approaches used include medium, swing, and long-term methods used for Forex, crypto, and CFDs.

Instead of using automated systems for the generation, the company prefers using manually researched signals. The manual operation enables them to change their approaches as per the changing volatility in the market.

Backtesting vs live trading results

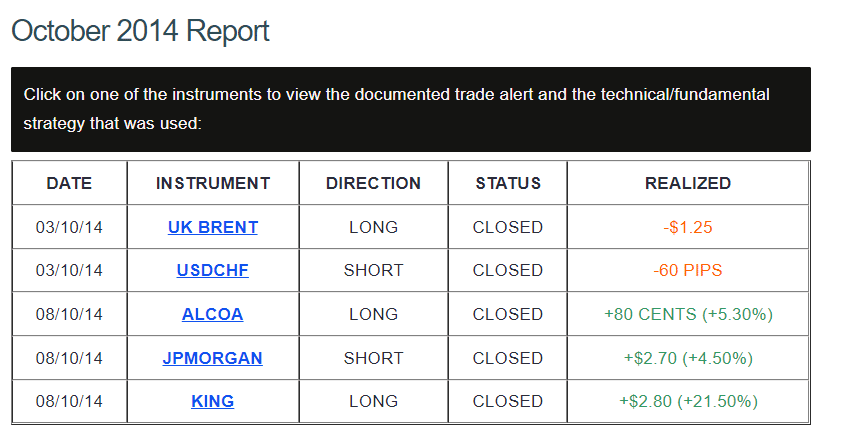

Although the vendor mentions using multiple trading approaches there is no elaboration of the approaches used. Further, there are no backtests to assess the efficacy of the strategies. For live results, the vendor does not provide verified results. Instead, the monthly performance results for every year since 2014 are displayed on the performance section of the official site.

The reports reveal the number of pips gained or lost and the instrument used along with the date of trading. But the report does not reveal crucial details of the results like the drawdown, profit factor, lot size, risk to reward ratio, and more. With results verified by sites like myfxbook, such details can be found. We find the lack of a verified track record suspicious. The absence raises a red flag for this provider.

The core team

Other than mentioning serving traders since 2014, the vendor does not reveal info on the team members, their expertise, or experience. There is no location address or phone number for contact. An online form is the only support method the vendor offers. The lack of vendor transparency makes us suspect this is not a reliable firm.

What are the pros & cons of investing in DDMarkets?

After assessing the different aspects of this provider, we find that the firm fails to provide proof of its trading efficacy and an explanation of the approaches it uses. Since these are important factors in determining the reliability and trustworthiness of a company, we find this service unreliable.