The principle of forex trading robots excites many traders. “Everything is possible for robots”, they think. But unfortunately, most newbies see themselves reclining in a hammock when they think of a forex robot. There is more to that. This guide will justify if forex robots work or it’s just hype.

What are FX robots?

Robot in the forex business is a systematic process where technical indications are used to deal with trades. The FX robot works continually under the command of a single click, making trades based on calculations applicable to the prior price narrative. For the people who don’t understand forex robots, the following is a general guideline.

In short, users perform the automated process with or without sitting in front of the computer. Let’s dig a bit deeper into FX robots.

Expectations vs. results in forex robots

When many people hear about FX robots, they consider them as some Aladdin lamp. However, at every ease, they are machines, not humans. Although they can monitor the trade operations 24 hours a day and cut the emotions in trading, in the end, they will always remain automated machines.

A significant issue is, FX robots and their pre-programmed thinking does not account for continuously shifting market circumstances. Market behavior is zestful, constantly shifting between three possible directions:

- Up

- Down

- Sideways

Most of the robots are not designed to operate with all conditions. They are neither designed for detecting shifts in trading situations. This results in loss, and they can be remarkable if you manage or monitor them. Let’s use an example.

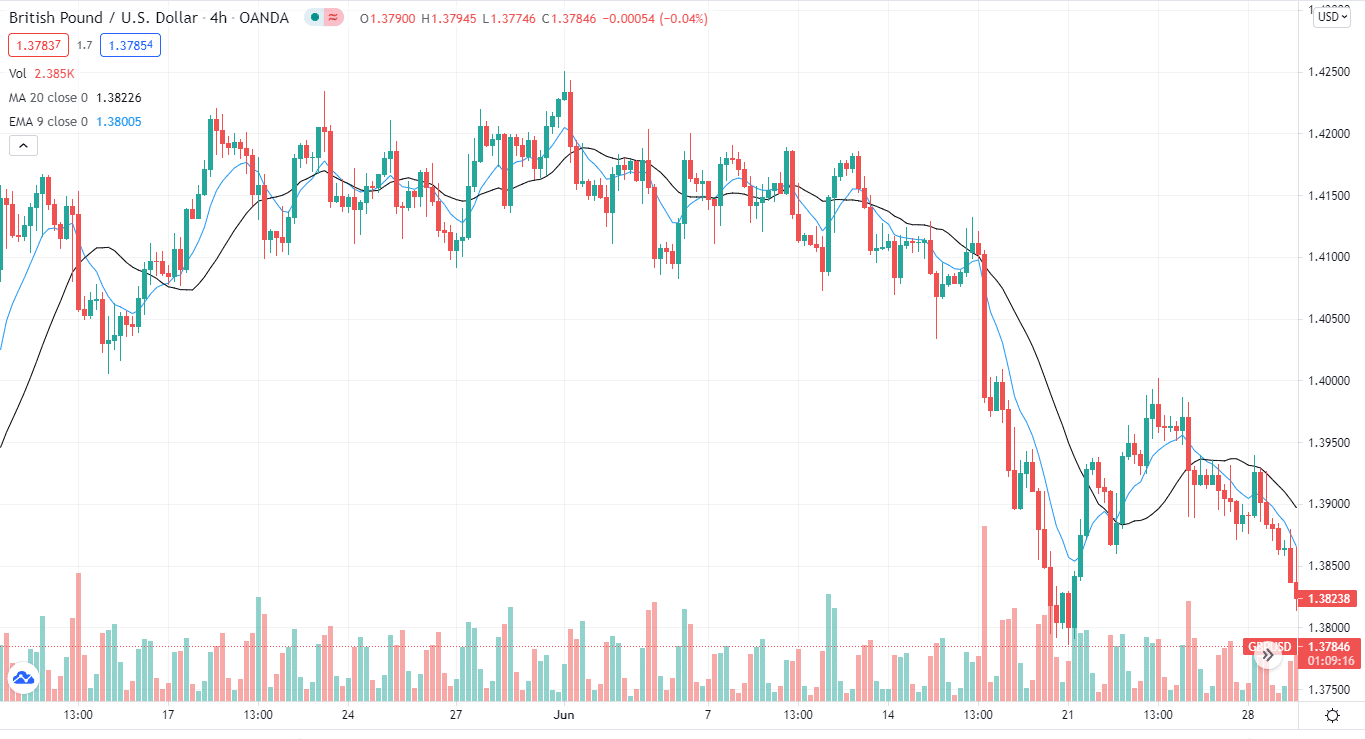

- You can see two moving averages, short and long, applied on the GBP/USD pair on the above chart.

- You programmed the robot to take buy positions if the longer MA crosses above, the shorter one.

- An FX robot trades in this way and will give you buy positions. But the trade market dynamic will shift in an instant.

Solid economic data from Feds and the market’s volatility becomes high. An FX robot won’t work in the prevailing situation and will take random positions based on your programmed instructions.

That’s what most people don’t get about forex robots. They expect it to work perfectly. However, there isn’t a perfect trading setup. So, this section doesn’t belong to forex robots.

Risk allocation or total deterioration?

Every forex forum you search, surf websites, you will find that risk management is the most important aspect of forex trading. But what about when making trade operations through forex robots?

Robots perform considerably at multitasking compared to humans; employing an automated system gives you the privilege to have many circumstances for objects like entries, exits, stop loss patterns, and profit goals all running in the meantime.

Moreover, FX robots provide risk management features. Using these, you can teach the robot how to change the size of your lot based on the number of funds you already have.

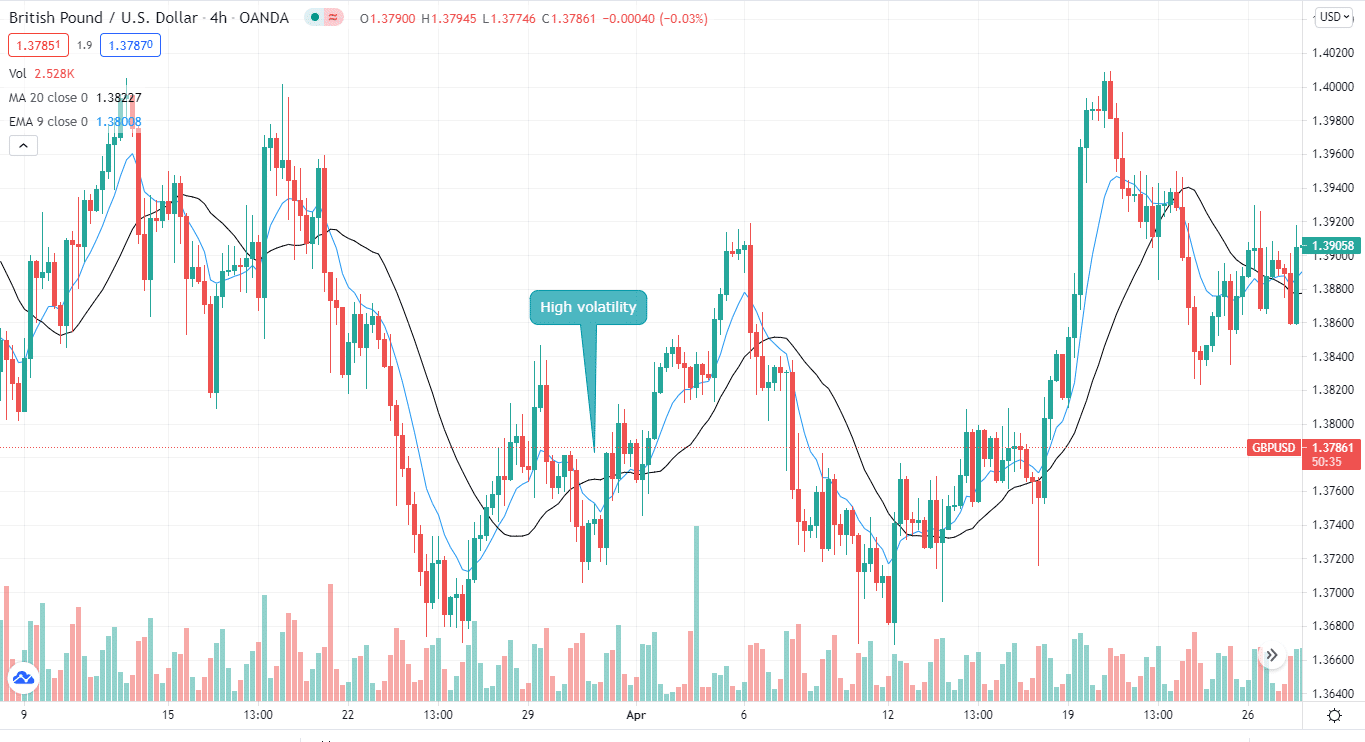

Some robots can even avoid continuing trades if your account’s equity reaches a certain threshold or a certain number of active trades. For instance, you programmed the robot not to enter the trade when the trade market is highly volatile.

Overall, when you take an observation, forex robots work in terms of risk allocation. So, as a result, forex robots are responsible for this point.

Recovery setup in forex robots

Being a trader, you must have probably experienced a situation where you saw a losing trade and thought, “If only I could get the market to shift in my favor.”

Well, as we mentioned earlier, the market makes its path. However, we can do some tweaking through robots. FX robots can be coded to recover losses by opening an opposite position. This process is also called hedging. Ok, we know you must have plenty of questions, so let’s explain this on the chart.

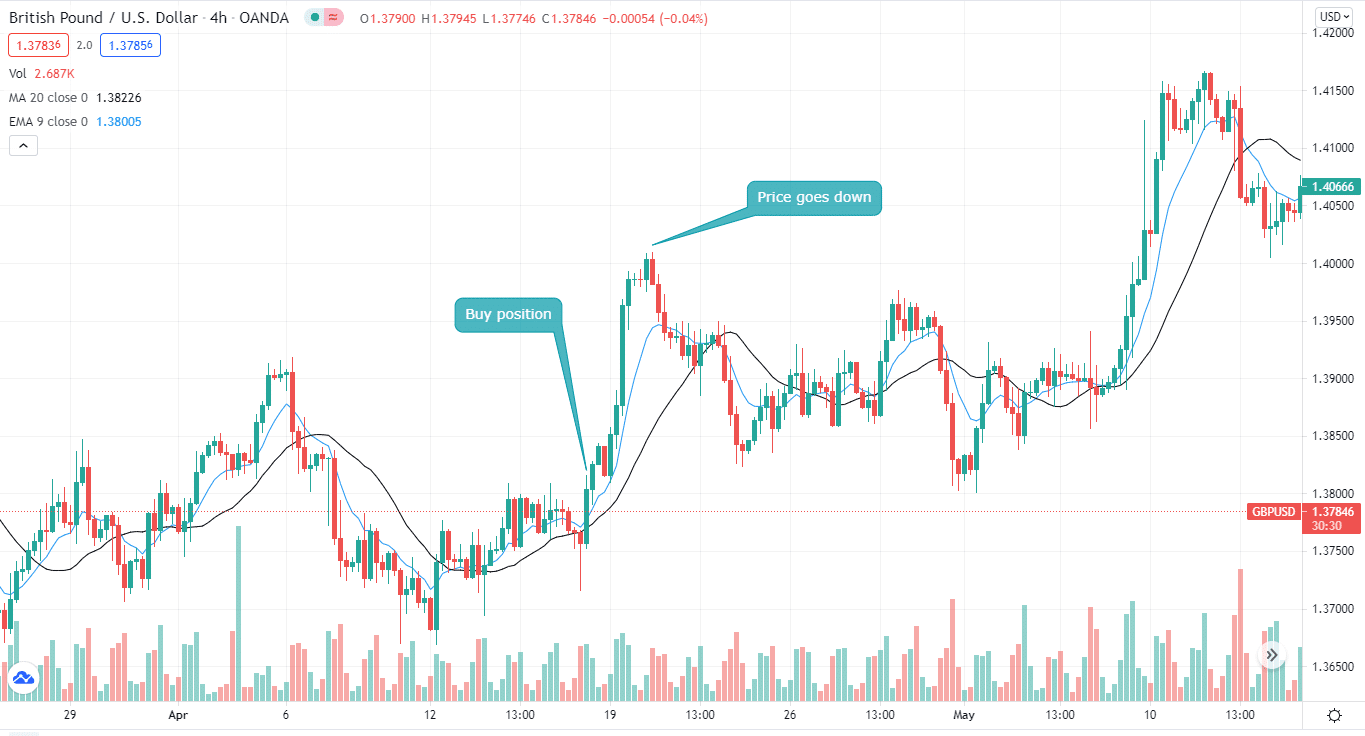

There’s a perfect buy position on the chart. You enter the position and anticipate that the price will continue moving forward. But as you can see, the price changed its course, and the trend shifted downwards.

Without a hiccup, at this point, your forex robot will take an opposite position. In this way, you’ll end up in a profitable trade rather than a losing one.

You might be thinking, “Can’t I do this myself? What is the point here”? Yes, it’s easy for you to do it yourself, but maybe you play with a dog and miss the opportunity; what is the next to happen then?

A forex robot will not miss this opportunity. So, a big cheer for robots, as the point belongs to the robots too.

Hit and trial in FX robot trading

All you need is to test forex strategy somewhere, whether on a live or the demo account. This way, you get to know if the strategy is profitable. You can do this process manually. However, it is super time-consuming. It would help if you glued to the screen, noting price movement on longer or shorter time frames.

On the other hand, forex robots can be downloaded. They can store and analyze vast amounts of traditional data, allowing you to test the efficacy of various trading methods before putting them into practice on the current market.

With mechanized trading, you only need to set currency pairs you want to analyze, select your time frame, and voila. This short procedure saves you a lot of hassle. So, another point in the sack regarding forex robots.

Effect of cyclic terms in forex robots

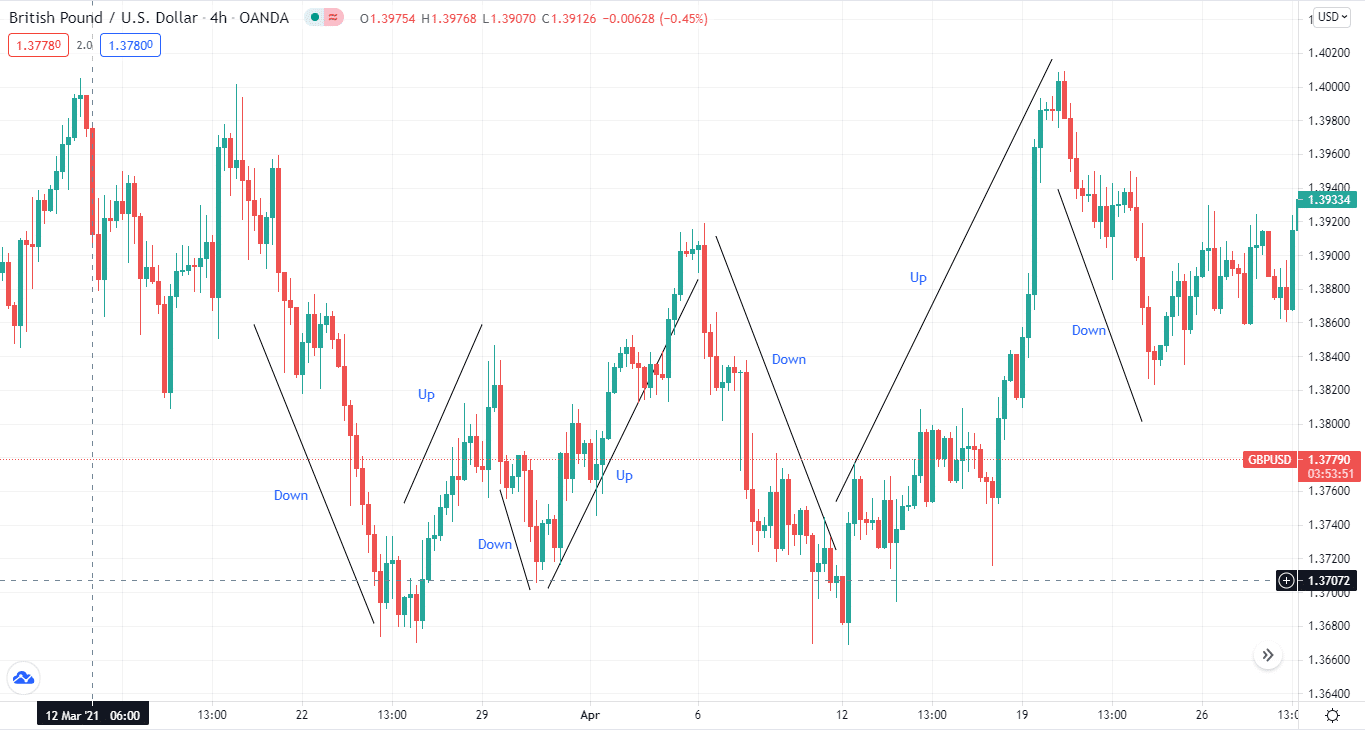

Forex market travels in cycles. These rotations are a result of human behavior. Market trends repeat themselves. You will never observe a forex pair going one way. It can go in a single direction for a specific time; soon after, it will move in the other direction. See for yourself.

So, what is the forex robot’s reaction to the cyclic terms? They will track these trends and predict future price movements. In addition, they can recognize different stages of the price, presenting you with an overall picture.

Final thoughts

Forex robots do work; however, if you are a beginner, we advise you first to know the basic trading concepts. Only then can you work on the forex robot.