FXCipher EA trades on AUDUSD, EURUSD, EURJPY, GBPUSD, and USDCAD. The algorithm comes with technical support that the developer claims to provide 24/7. The robot can use one of the two strategies that are coded within. Let us go through the algorithm’s function to see if we can get any good results from it.

Is FX Cipher EA good?

FX CIpher EA is not a good choice for trading as it uses a martingale strategy which is common amongst many algorithms in the market. Traders can find such EAs for a much cheaper price.

Features of FXCipher EA

FXCipher EA has the following features:

- It comes with free updates and support that is available 24/7

- It includes a user manual for easy installation.

- It can work with two different strategies: Grid and Martingale.

- The robot is available for both MT4 and MT5.

| Trading Terminals | MT4, MT5 |

| Strategy | Martingale + Grid |

| Timeframe | H1 |

| Price | $295 |

| Money Refund | 30 days |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does FXCipher EA use?

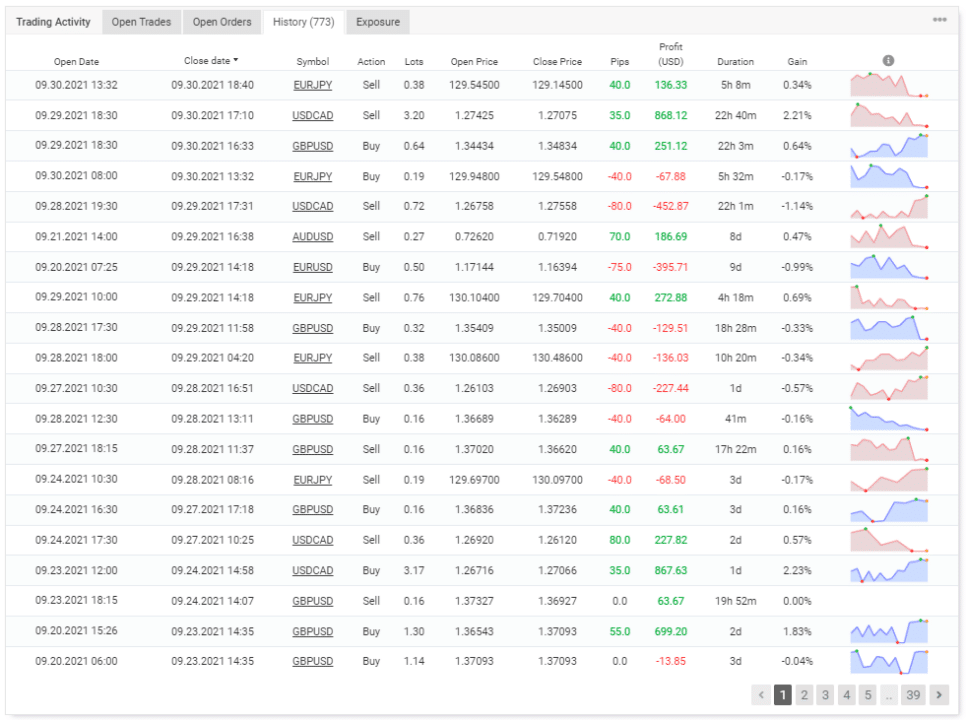

The developer rarely shares any information on the system’s strategy, so we use the records present on Myfxbook for our analysis. From there, we can see that the algorithm uses a martingale approach for trades that are losing. It does trade on multiple currency pairs and holds positions for an average duration of 2 days. It takes its place between swing and day trading algorithms.

Backtesting vs live trading results

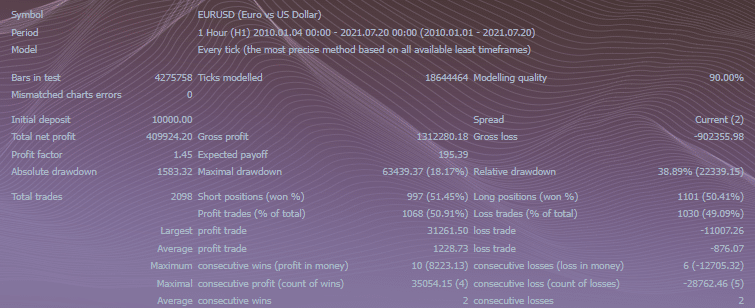

Backtesting results are available for multiple currency pairs. The duration of all the tests is around 11 years. Traders can download the outcome from the website. For EURUSD H1, the robot had a maximum drawdown of 38.69% and turned an initial deposit of $10000 into $409924.20. It had a winning rate of 50.91% with a profit factor of 1.45. The average amount of profitable trades was $1228.73, while the average amount of losing deals was -$876.07. There were a total of 2098 trades executed during this period.

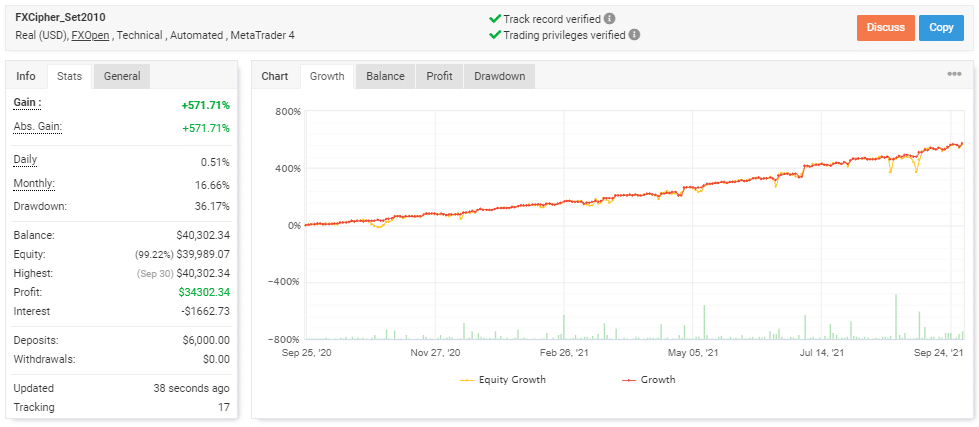

Live trading results are available on Myfxbook, which show performance from September 25, 2020, till the current date. The robot had an average monthly gain of 16.66%, with a drawdown of 36.17%. There were 772 trades in total, with 380.75 lots traded. The expert advisor traded with a winning rate of 48% with a profit factor of 1.58. The average winning trade was $251.92, while the worst one was -$148.53.

These results are in accordance with the ones that we had during backtesting. The value of relative drawdown matches. There is a chance that the values might increase in the future as the robot trades.

The core team

The developers are not keen to provide information on their whereabouts and trading experience. We are left stranded while trying to find out the portfolio of the traders behind the program. This type of practice is not good and keeps us in doubt about their software.