FX Fortnite is a trading solution for working on Forex markets. The presentation looks short and medium informative. Its owners insisted that it is “100% Full Automated MT4/MT5 Expert Advisor.”

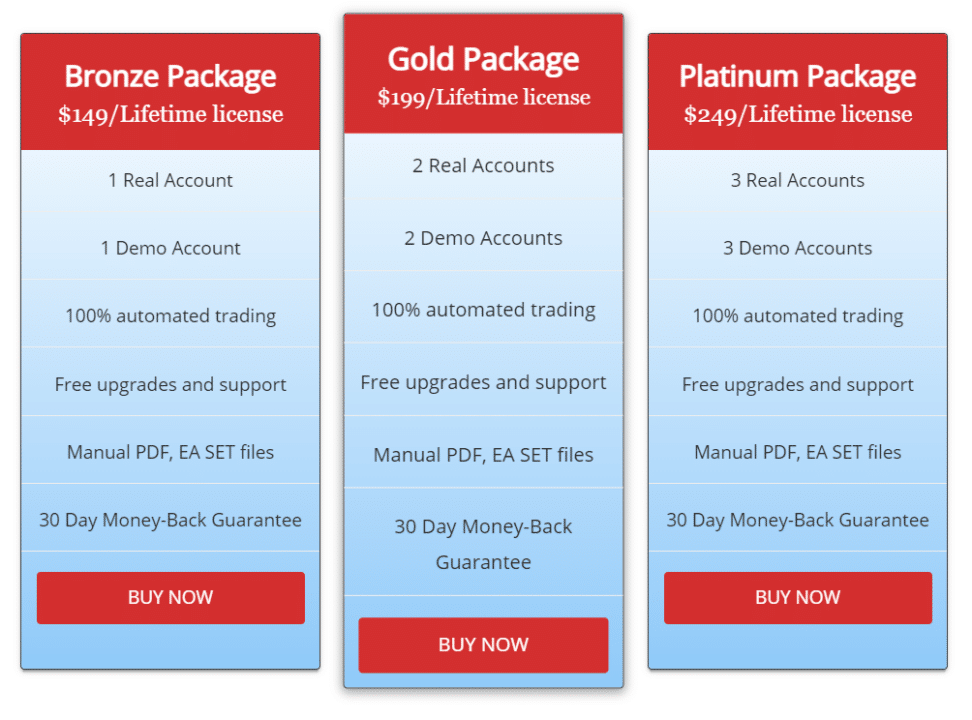

We can work with one of three offer packages. The bronze pack costs $149 (one real and demo account). The good pack costs $199 (two real and demo accounts). The platinum pack costs $249 (three real and demo accounts). There’s a manual in PDF, set files, support and upgrades for free, and a 30-day refund policy provided.

Is FX Fortnite good?

After a detailed analysis of FX Fortnite EA we have found that the system has its upsides and downsides. So, you should decide whether the trading style of this EA fits your trading needs and expectations.

Features of FX Fortnite

We have some details about the system, features, and other useful information provided. You can read them in the list:

- We have information that the system is an automatic trading solution that helps with opening and closing orders on the terminal.

- We can work with the MT4 platform.

- The core strategy is trend trading.

- We can use a Hedge strategy either.

- The system provides three risk levels: Conservative, Medium, and Aggressive.

- We may decide what risks we are comfortable with.

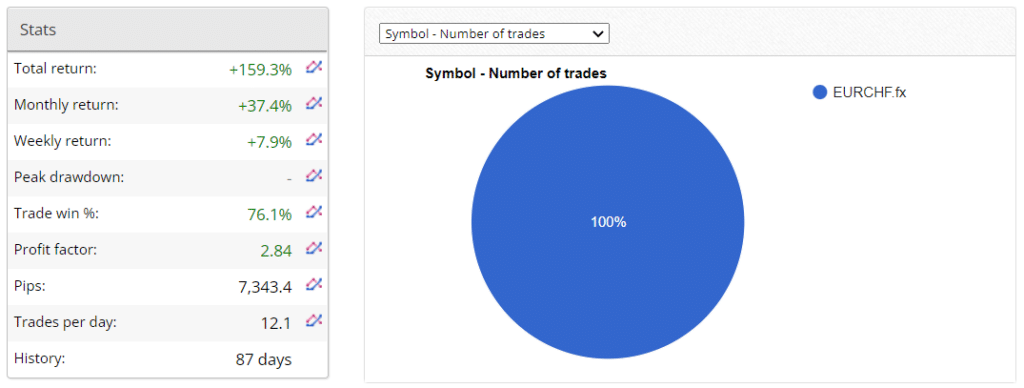

- It opens orders on EURCHF.

- The only time frame is H1.

- We can use any broker to work with the robot.

- The deposit requirements are $1000.

- We should trade with leverage of 1:100 or higher.

- “Inbuilt indicators analyze the market’s divergences and convergences.”

- We can rely on welcome support.

- IC Markets is a suggested broker.

| Trading Terminals | MT4 |

| Strategy | Trend |

| Timeframe | H1 |

| Price | $149, $199, $249 |

| Money Refund | 30 days |

| Recommended Deposit | $1000 |

| Recommended Leverage | 1:100 |

| Money Management | Yes |

| Customer Reviews | No |

What strategy does FX Fortnite use?

- The robot works with a trend strategy on a volatile market.

- We can work with EURCHF.

- It trades on H1.

Backtesting vs live trading results

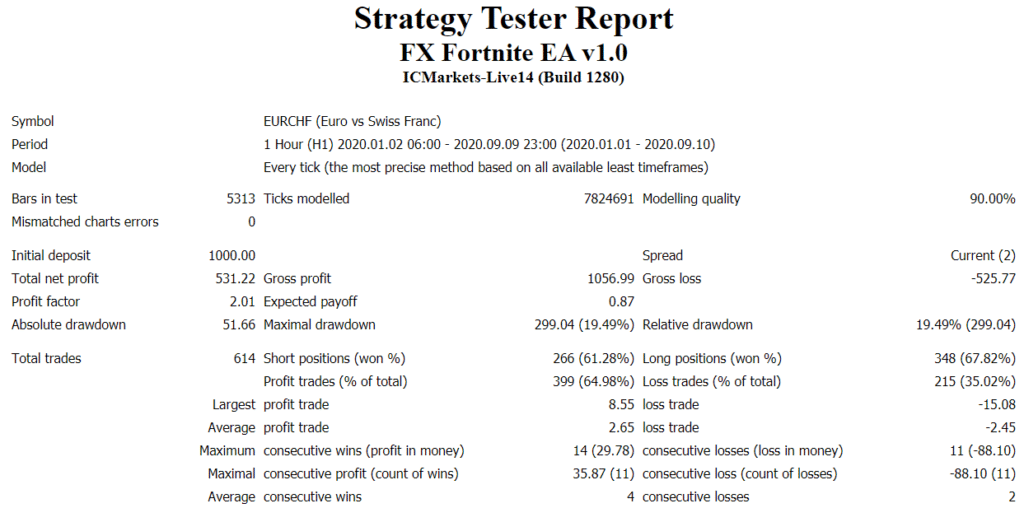

The system was roughly tested on EURCHF on the H1 time frame. The data period was 9 months of 2020. The modeling quality was 90.00% with a 2-pip spread. An initial deposit was set at $1000. It has turned into $531.22 of the total net profit. The profit factor was 2.01. The maximum drawdown was 19.49%. The robot had 614 deals traded with a 61% win rate for shorts and 67% for longs. So, these results were average.

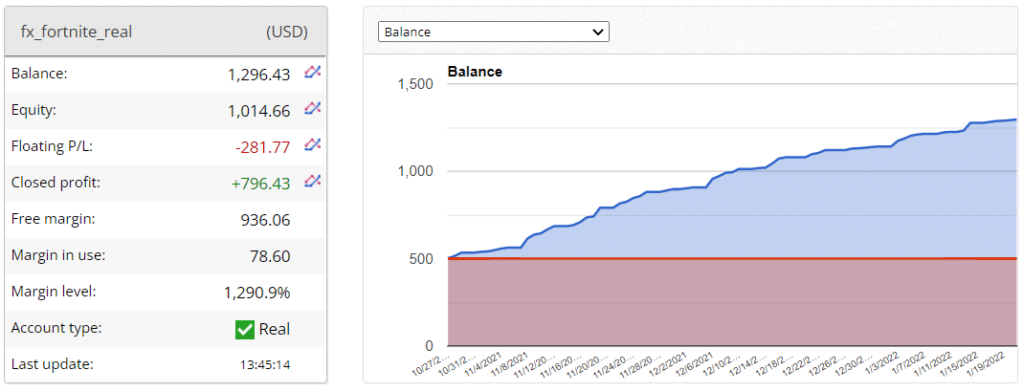

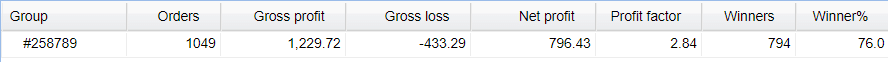

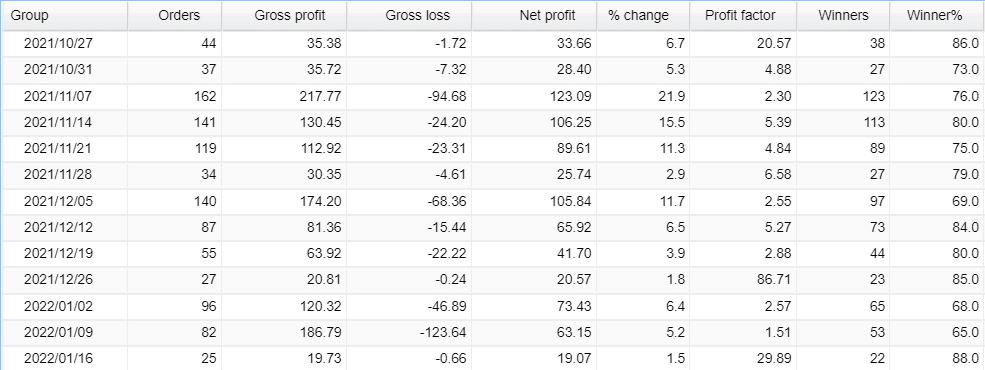

We have the system working on a real account. The balance has become $1296. The floating loss is -$281.77. The closed profit is $796.43. The margin level is 1290.9%.

The total net return is 159.3% when an average monthly return is 37.4%. An average accuracy is 76.1%. The profit factor is 2.84. It has decreased since our last visit. An average trade frequency is 12.1 deals a day. The advisor has been working for 87 days.

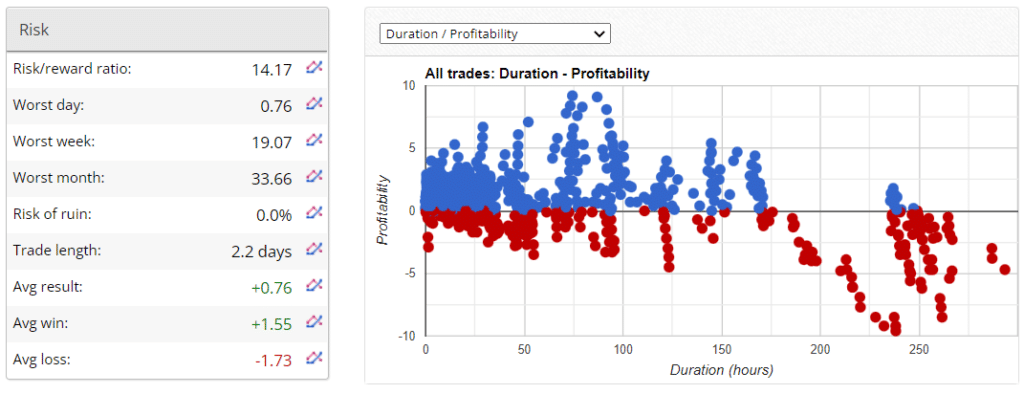

The ROI is 14.17. An average win is $1.55 when an average loss is $1.73. The risk of ruining is 0.0%.

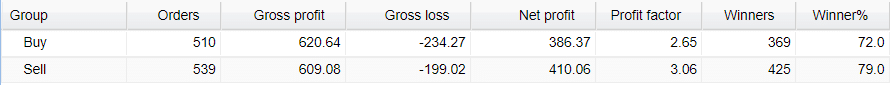

Both directions are traded equally.

We have only one magic number behind the robot.

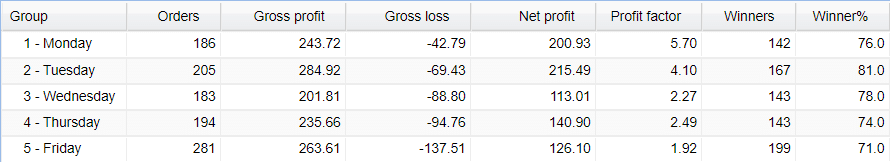

Friday with 281 orders is the most desirable day to trade.

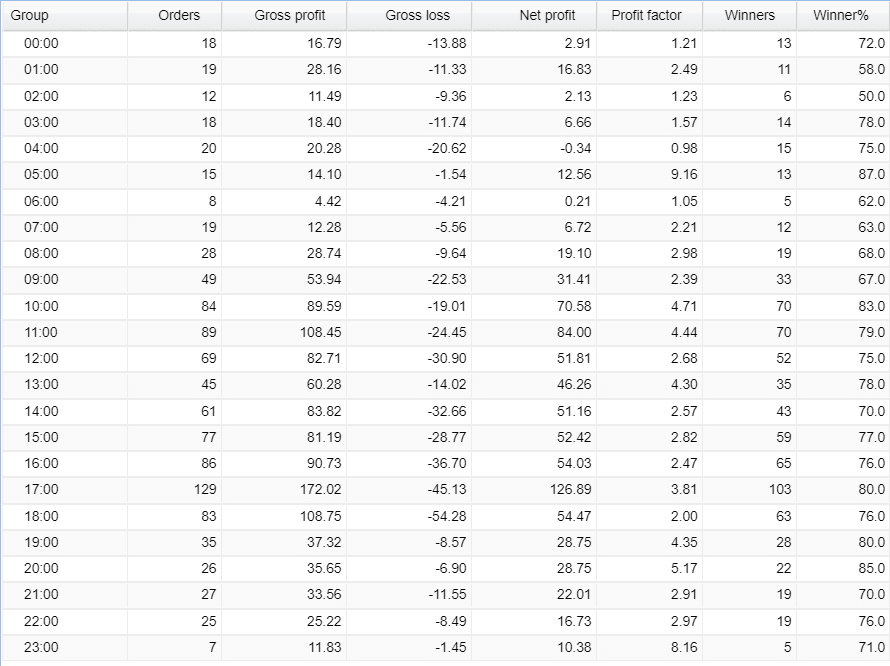

The system trades almost all trading sessions.

We may note that a profit factor (1.91) is much less than in December (3.24).

The advisor works with various frequencies.

The core team

We don’t know who is behind this service. The developers don’t provide a proper level of transparency.