FXMath X-Trader is a Forex expert advisor built to run on the Metatrader 4 trading platform. According to the developer, the system is based on a profitable mathematical model having the lowest drawdown and the highest possible profit.

We don’t know exactly when this robot was launched, but it’s live trading account is only 74 days old. There are three pricing plans for this robot, namely Silver, Gold, and Diamond. The Silver plan costs $99 and it provides you with lifetime licenses for one real and one demo account.

With the Gold plan, you get access to two real and two demo accounts in exchange for $123. The Diamond plan costs $149 and it comes with three real and four demo accounts. Unfortunately, the vendor does not offer a money-back guarantee.

Is FXMath X-Trader good?

Compared to other EAs, FXMath X-Trader is quite affordable. The vendor has shared the verified trading results and backtests, but the trading history is quite short. Also, there is a lack of a refund policy to consider.

Features of FXMath X-Trader

You can run this EA on an MT4 account with leverage of 1:100-1:1000. The basic currency pair is EUR/USD, but you can run the EA on other pairs as well. It works on real live accounts and can adapt itself to changing market conditions. The robot scans the market 24/7 for profitable trading opportunities.

FXMath X-Trader supports different account types like ECN, Pro, Standard, Mini, Micro, and Cent. It is compatible with all MT4 brokers and you can install it on different operating systems like Windows 2003, XP, Vista, 7, 8, and 10. The traders have the freedom to change the settings and choose different trading parameters.

| Trading Terminals | MT4 |

| Strategy | Trend |

| Timeframe | N/A |

| Price | $90 |

| Money Refund | No |

| Recommended Deposit | N/A |

| Recommended Leverage | 1:100-1:1000 |

| Money Management | No |

| Customer Reviews | Bad (2 out of 5 rating based on 4 reviews on FPA) |

What strategy does FXMath X-Trader use?

We don’t know much about the strategy used by this robot. It finds the most likely trend direction for the next few days and opens the orders at a specified time. It performs signal calculations based on mathematical logic. The vendor claims that this system manages to win more than 90% of its trades.

Backtesting vs live trading results

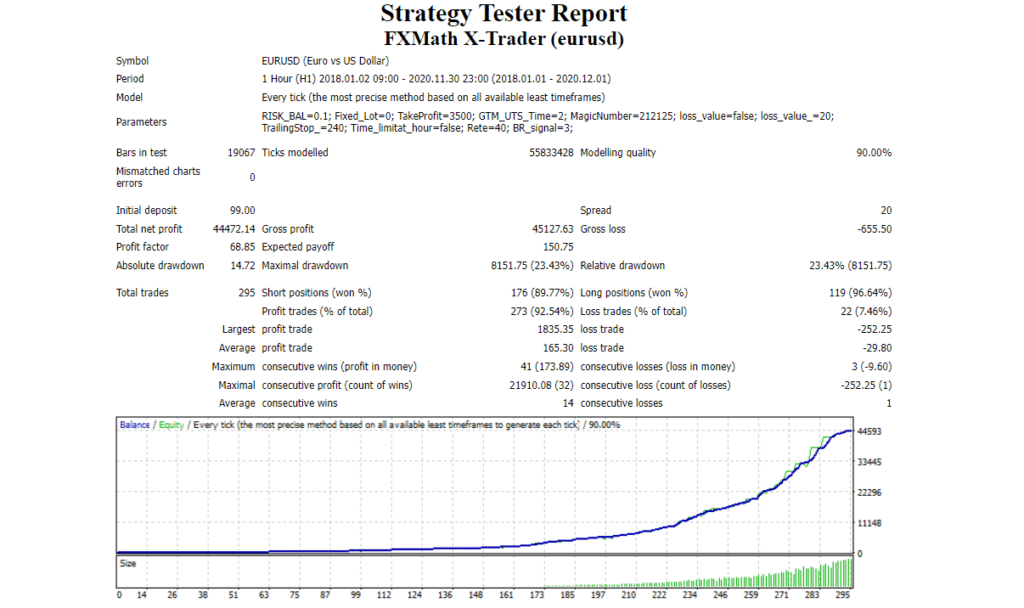

For this backtest, the EA placed 295 trades between January 2018 and November 2020. It had a win rate of 92.54% and generated a total net profit of $4472.14. There were 41 maximum consecutive wins and 3 maximum consecutive losses for the testing period. The relative drawdown was a bit high at 23.43%, and this means the robot conducted the trades with high risk.

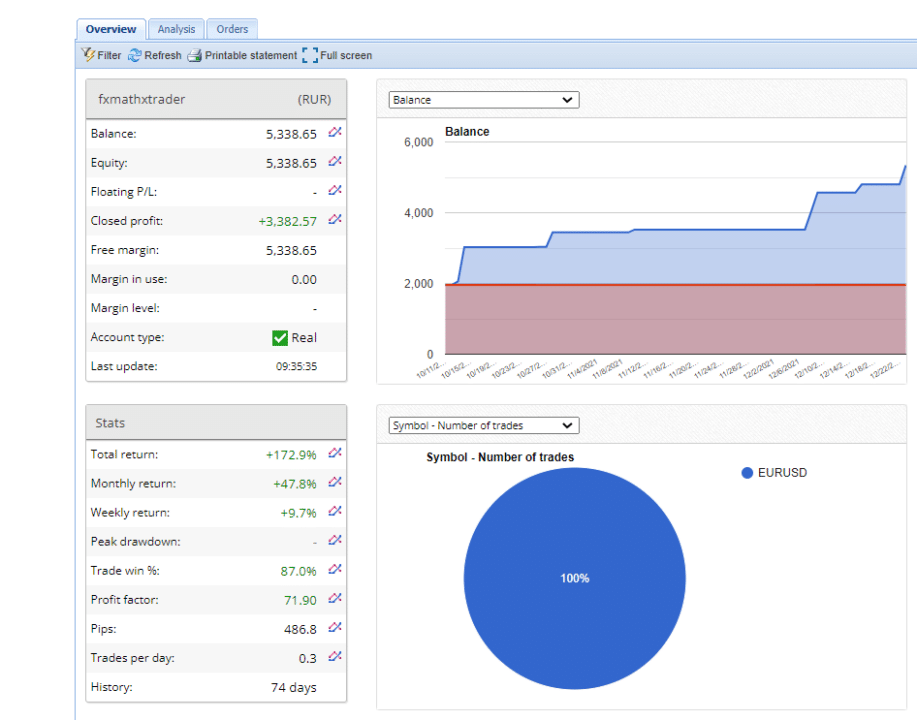

Here we have a live trading account on FXBlue that has been active for 74 days. To date, the EA has conducted only 23 trades through this account, winning 20 and losing 3. As a result, its win rate currently stands at 87%, which is slightly less compared to the backtest. The daily, weekly, and monthly returns for this account are 1.88%, 9.74%, and 47.77%, respectively. At this moment, the total profit generated through this account is 3,382.57 Rubles.

The average trade length for this account is 23.5 hours and there is a 27.1% risk of ruin. It has an average win and loss of 171.51 pips and 15.90 pips, respectively.

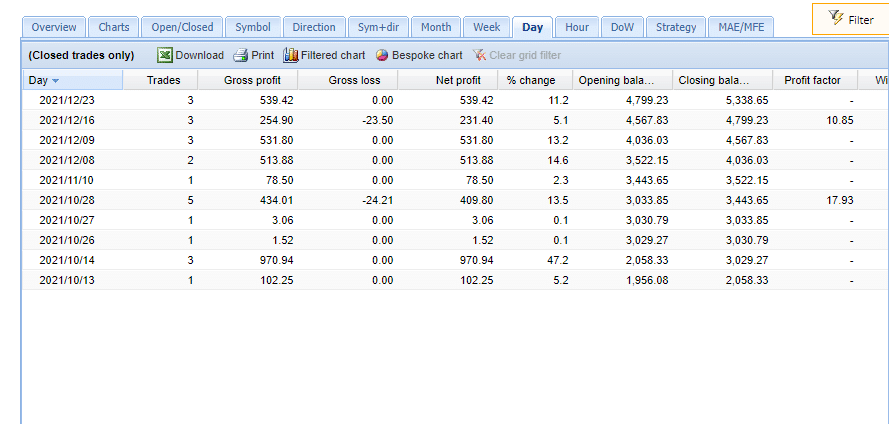

From the daily trading history, we can see that the robot has a very low trading frequency. In the month of November, it only conducted a single trade.

The core team

The vendor has not shared any information on the parent company behind this EA. We don’t know where it is located or when it was founded. The vendor has shared the official email address and there is also a contact form you can use to get in touch with the support team.