FXPro Dragon is an expert advisor that is designed to work as a standalone system or along with other EAs. The vendor claims that the EA makes sure your deposit is safe with its efficient money management. A unique algorithm is used by the FX robot to ensure it works on multiple currency pairs.

Two pricing packages are present for the FX EA namely a Standard pack costing $129 and a Premium package costing $169. An MT4 license, free updates, lifetime access, and 24/5 support are common features included in the two packages. The main difference is the number of real and demo accounts the two come with. No money-back assurance is present for this EA which makes us suspect the reliability of the product.

Is FxPro Dragon good?

From our initial perusal of the features, backtesting results, and live trading stats, we find that this product is not worth its price. Although the results show high profitability, the stats look suspicious, and further the sample size for the real trading is very small. The lack of strategy explanation and lack of vendor transparency are other downsides that make this an unreliable EA.

Features of FxPro Dragon

As per the vendor, the main features of this FX Robot are:

- It is completely automated and you need to make changes to the settings after installation.

- Easy installation process enabled by a responsive support team.

- Works mainly on the USDCAD on the H4 timeframe but can also work on other currency pairs.

- Verified live trading results.

The features mentioned by the vendor are minimal and do not provide the necessary info needed for understanding the working of the system. The lack of transparency makes us suspect the efficacy of the EA.

| Trading Terminals | MT4 |

| Strategy | N/A |

| Timeframe | H4 |

| Price | $129 – $169 |

| Money Refund | N/A |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | No reviews |

What strategy does FxPro Dragon Use?

Other than mentioning that the FX EA uses an automated FX strategy and analytical system, the vendor does not reveal further info. Proper management of the customer capital and the use of carefully calculated trade orders are the two main features of the trading approach this FX robot uses. The vague explanation raises a red flag for this EA.

Backtesting vs live trading results

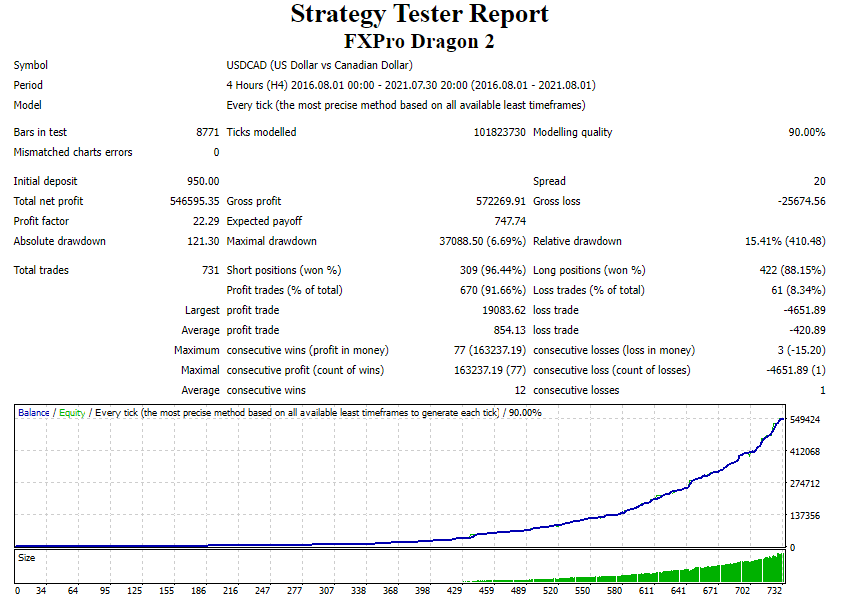

The vendor provides a backtesting report for this EA. Here is a screenshot of the strategy tester report.

From the above report, we can see that the backtesting was done from 2016 up to 2021 on the USDCAD pair using the H4 timeframe. For an initial deposit of $950, the total profit generated was 546595.35. The profit factor was 22.29 and the profitability was 91.66%. A maximum drawdown of 6.69% was present for the account.

The modeling quality is 90% which is not sufficient to know about details like the slippage, commission, etc. While the backtesting results show decent profits, they cannot predict a similar result in real trading as the report is based on historical data.

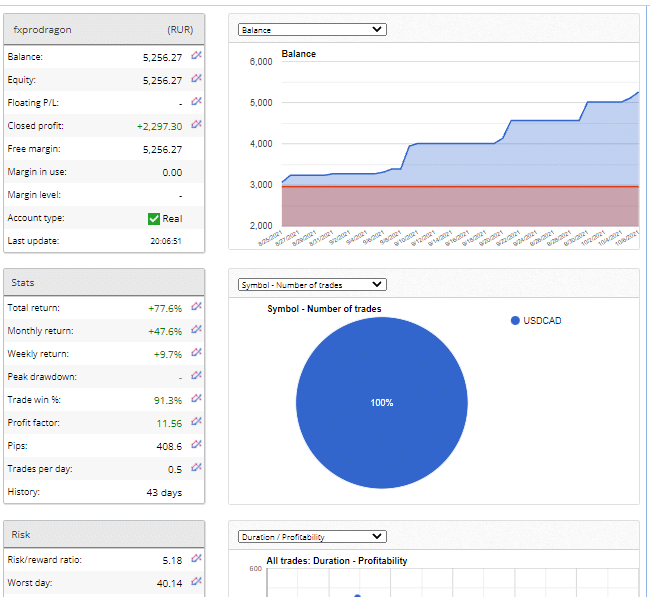

The vendor provides a real RUR account verified by the FXBlue site. Here is a screenshot of the trading statement.

From the above trading stats, we can see a total profit of 77.6% with the monthly and weekly profits being 47.6% and 9.7%. The profit factor is 11.56 and profitability is 91.3%. A trading history of 43 days is present with a risk to reward ratio of 5.18. Comparing the backtesting result with the real trading stats we can see the profits are not as high in the real trading. Further, the high risk to reward ratio value indicates a risky approach. Due to the small sample size, the high profits have less significance as this does not imply a stable profit.

The core team

We could not find info on the developer, the team, or the company behind this FX EA. There is no location address, phone number, or other relevant details. The lack of vendor info raises a red flag for this EA.

What are the pros & cons of investing in FxPro Dragon?

From our evaluation of the different characteristics of this FX robot, we find that it is not a trustworthy EA. Besides not divulging the trading approach, the vendor provides a small sample size which makes it difficult to evaluate the EA.