FXRapidEA is an FX robot that claims to be highly profitable due to its effective strategy. This FX EA uses a trend-based method for identifying and executing orders. It supports MT4 and MT5 platforms and is compatible with brokers regulated by the FIFO and NFA.

This ATS is available in two packages, namely Due and Quattro. While the former costs $269 and works on two currency pairs, the latter costs $349 and works on four currency pairs. Lifetime updates, one real account license, a user guide, and 24/7 support are the features available with the packages. A 30-day refund offer is present as well.

Is FXRapidEA good?

Backtesting and verified real trading results are present for this FX robot. The vendor provides a money-back guarantee. But, the product is overpriced, and more importantly, the trading results show a very high drawdown that indicates a risky approach.

Features of FXRapidEA

The key features that the vendor focuses on for this FX Robot are:

- It uses a trend trading approach with special algorithms for identifying trend direction and trade entries.

- The system trades at a quick pace to avoid protracted trades with the holding time not exceeding 1-2 days or just a few hours.

- It uses an effective drawdown control that includes calculation of lot sizes based on risk setting and using a SL that will limit the losses.

- The installation and configuration of the EA take only a few minutes and can be done with the provided manual easily.

| Trading Terminals | MT4, MT5 |

| Strategy | Trend-based |

| Timeframe | H1 |

| Price | $269 -$349 |

| Money Refund | 30 days |

| Recommended Deposit | $460 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does FXRapidEA use?

A trend-following approach is used by this FX EA, according to the vendor. It employs special algorithms for spotting trend direction and opening trades. In case of a rollback of price, the EA opens a separate order in the new direction for better profits. If the trades are against the prevailing trend, the FX EA closes the trades at a loss. It recovers the losses with the future trades it opens.

Backtesting vs live trading results

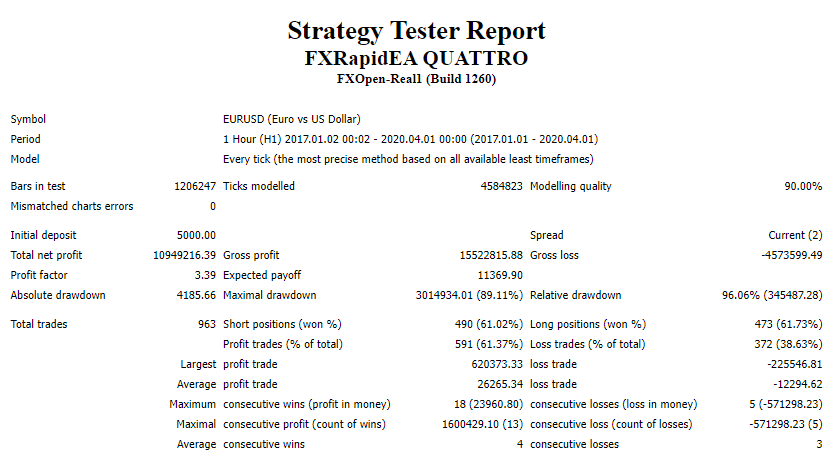

A backtesting report of the FX EA with the testing done from 2017 to 2020 is shown in the screenshot below:

From the above report, we can see that the test was done using the H1 timeframe and EURUSD currency pair. For an initial deposit of $5000, the EA had generated a total net profit of 10949216.39. Profitability of 61.37% and a profit factor of 3.39 were present for the account. A total of 963 trades were completed with a maximal drawdown of 89.11%. From the high drawdown, we can see the strategy used is very risky.

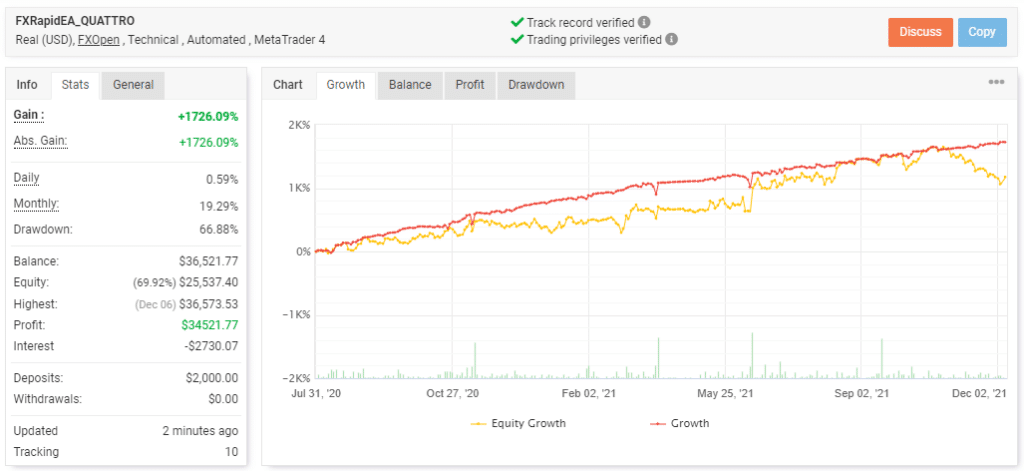

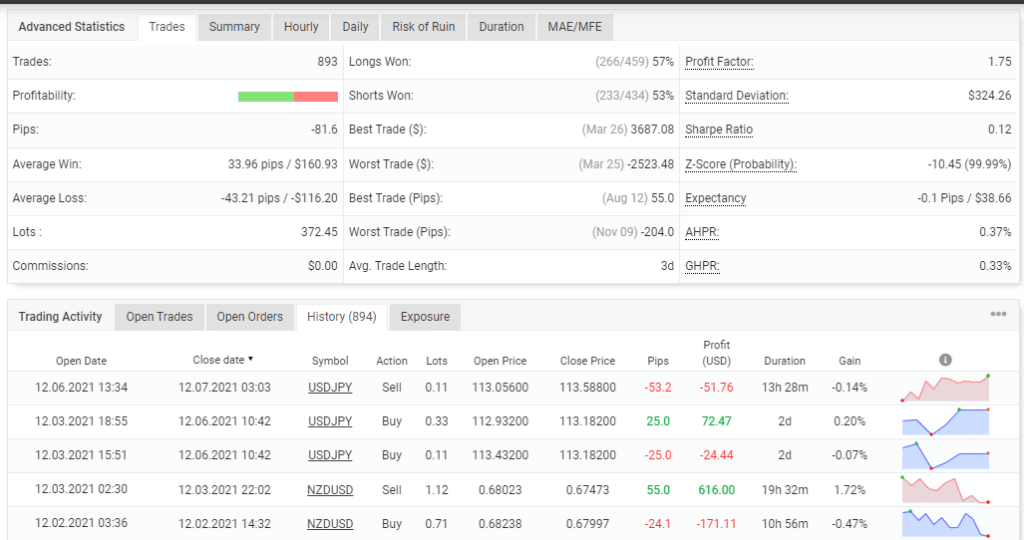

A real USD account using the FXOpen broker on the MT4 platform is present for the ATS. Here are a few screenshots of its trading results:

From the above trading stats, a total profit of 1726.09% and an absolute profit of 1726.09% are present for the account. A daily and monthly profit of 0.59% and 19.29% respectively are present. The drawdown is 66.88% for the account that started in July 2020. A total of 893 trades have been completed with 56% profitability and a profit factor of 1.75.

From the trading history, we can see that the lot sizes vary from 0.10 to 0.33. Plus, the robot increases the lot size to recover after losses by using a combination of Martingale and Grid of orders strategies. These approaches are risky as they can lead to high drawdown and a series of losses. This is also seen in its backtesting report. Traders stand to lose their capital with such a risky approach.

The core team

Vendor transparency is lacking in this FX EA. Other than the mention of Forex Store, there is no info on the company, its founding date, location address, phone number, etc. The absence of info makes us suspicious of the reliability of the company. For support, the vendor offers an online contact form, which is inadequate.