Gratified Long Term Day Trader can trade on Metatrader 4 and 5 platforms. According to the developer, $50 to $80 of loss should be expected while using his robot. The algorithm can trade multiple currencies from a single chart and uses virtual exits to get out from the trades. To better understand the performance, functionality, and profitability, we will analyze the algorithm and check its adaptability to the real market scenarios.

Is Gratified Long Term Day Trader good?

The developer failed to provide clear insight into the initial deposit, leverage, money management, indicators, lot size, and detailed strategy of the algorithm. The live signals shows the poor performance of the product raising concerns on its efficiency.

Features of Gratified Long Term Day Trader

The Gratified Long Term Day Trader comes with the following feature:

- It can trade on both Metatrader 4 and 5 terminals.

- The EA is not sensitive to spread and works with all brokers.

- The system is easy to set up and install.

- The algorithm is 100% automated.

- It comes with free updates and upgrades.

- It can trade on 14 currency pairs on a single EURUSD chart.

- The robot uses a Virtual TP and SL strategical approach and various Moving Averages.

To install the Gratified Long Term Day Trader, use the following steps:

- Buy the system from the MQL5 website

- Open Metatrader 4/5 and log in to your account

- Download the product to your computer

- Drag the EA to charts

- Enable auto trading

| Trading Terminals | MT4, MT5 |

| Strategy | Moving Averages, Virtual TP and SL |

| Timeframe | H1 |

| Price | $299 |

| Money Refund | N/A |

| Recommended Deposit | N/A |

| Recommended Leverage | 1 : 50 ( From Myfxbook live records) |

| Money Management | N/A |

| Customer Reviews | 4.5 for 9 reviews on MQL 5 |

What strategy does Gratified Long Term Day Trader use?

Gratified Long Term Day Trader uses various moving averages to determine the entry level of each symbol and opens ten or more trades at a time. It uses trend and counter-trend strategies to place executions. The robot trades on AUDCAD, AUDJPY, AUDNZD, AUDUSD, EURCHF, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPNZD, GBPUSD, NZDCAD, NZDUSD, and USDCAD symbols from a single EURUSD H1 chart.

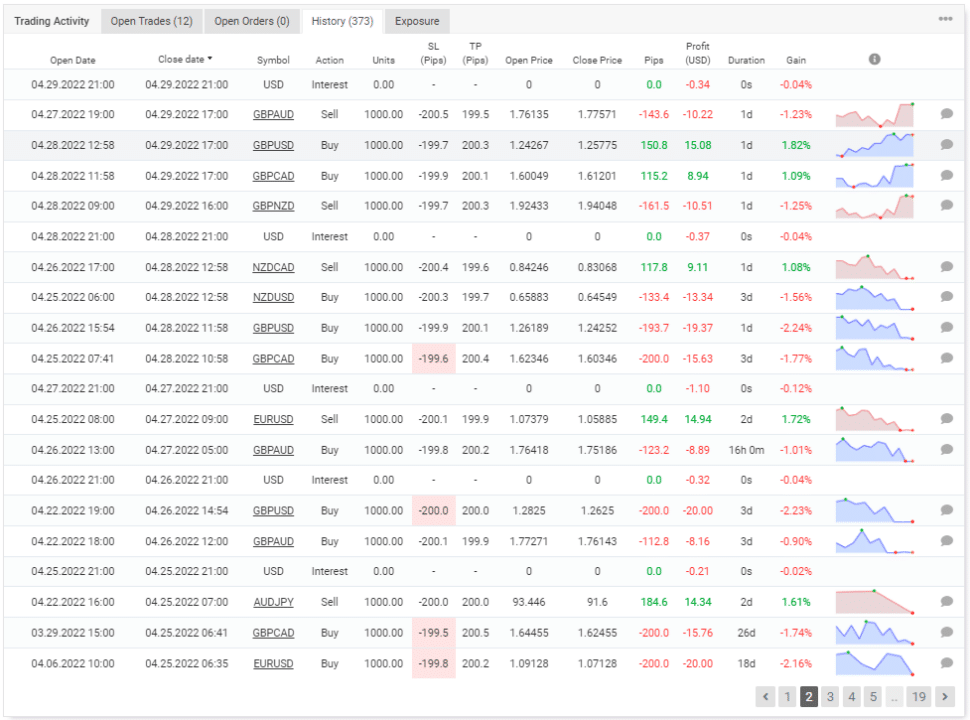

The history on Myfxbook records show us that it uses a stop loss and take profit of 200 pips. It trades most on GBPAUD and uses currency correlation which is obvious when trades on multiple instruments close at the same time.

Backtesting vs live trading results

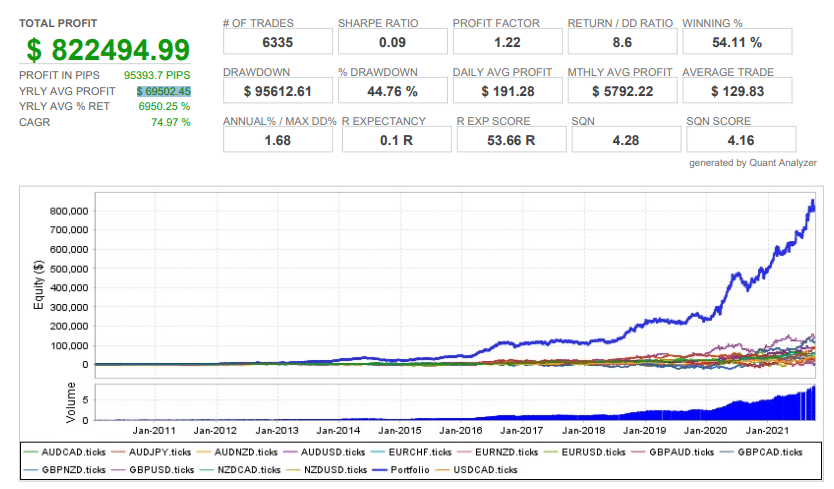

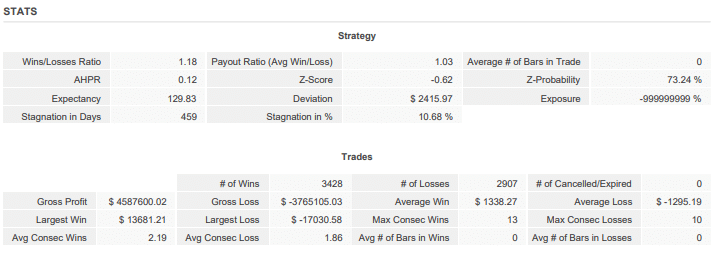

1-hour backtesting stats are available on multiple currency pairs from 2010.01.01-2021.01.01. The system made 6335 trades, of which 3428 were winners and 2907 were lost. The total profit of the expert advisor stands at $822494.99, with a yearly average profit of $69502.45.

The value of absolute drawdown was 44.76%, which shows that the system traded with high risk. The gross loss is -$3765105.03, with a profit factor of 1.22.

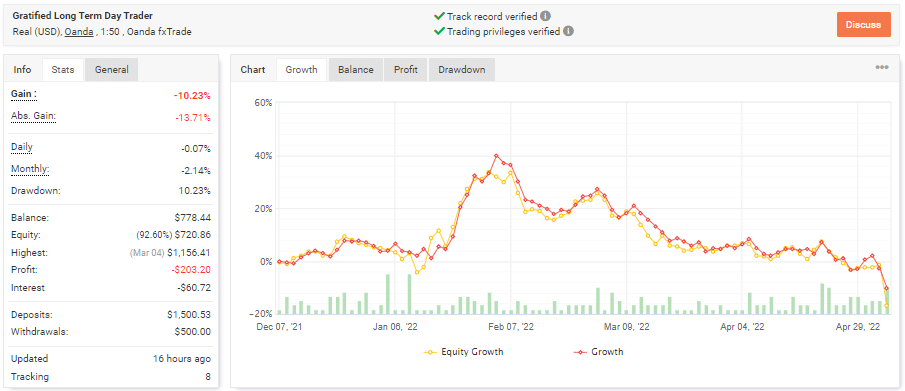

The developer didn’t share the verified trading records, but we researched and found the account on Myfxbook. The system was added on January 24, 2022, and the developer deposited an initial amount of $1500.53. The account shows poor performance with an average gain of -10.23%. The EA participated in 219 executions, out of which 52% were lost. The win rate of the robot is disastrous, and the profit factor can be seen as 0.89. The account balance stands at $778.44, and the net profit is -$203.20.

The live records do not go hand in hand with the backtesting performance. The win rate and the profit factor is poor here.

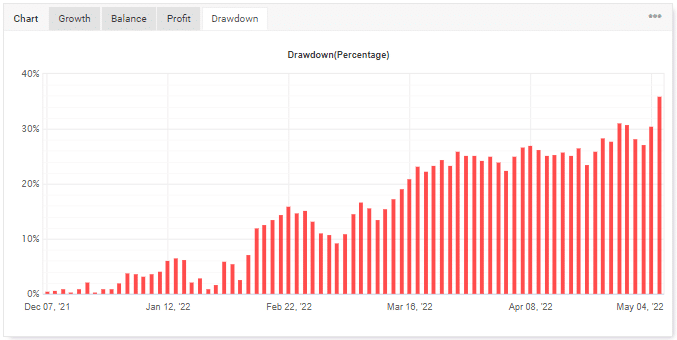

The average drawdown value seems normal at 10.23% but evaluating the drawdown chart leaves no doubt that the account will blow up sooner or later, as the candles are going higher with no sign of recovery.

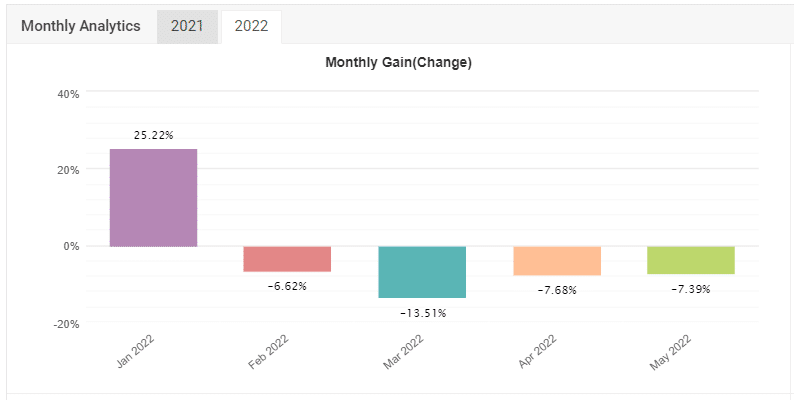

The EA was profitable in the first month but suffered a great loss afterward. It is struggling to recover, but the deficient is still negative, which portrays the poor strategic approach of the expert advisor.

The verified live trading records of Gratified Long Term Day Trader are for a short period. Furthermore, the account has been negative for the last three months and has a fluctuating drawdown value. These stats should be taken into consideration before investing in this algorithm.

The core team

Scott Fredeman is the developer of the robot, who has been selling his products on MQL5 for more than five years. There is no background information about his company or any other certifications to prove his forex trading expertise. The vendor is shy in sharing personal information with the traders, which puts the legitimacy of the algorithm at stake.