iProfit EA claims to make trading easy and lucrative with its neural network approach. As per the vendor, this MT4 tool is relied upon by fund managers and expert traders for high profits. The unique approach the system uses helps to adapt to the recent price changes and it provides instant updates on the changes every hour.

This FX Robot costs $470 per year. The package includes two real or demo accounts, an MT4 Strategy Tester compatible, and the ability to trade the EURUSD, AUDUSD, XAUUSD, EURJPY, and GBPUSD pairs. A 30-day refund policy is present. When equated with the market average this product is overpriced.

Is iProfit EA good?

Our evaluation of the various characteristics of this FX EA reveals the system has verified real trading results and backtesting reports. The vendor claims the MT4 tool does not use the hedging, grid, or Martingale methods. However real trading results show hidden data which makes us suspect the reliability of the system. Further, the profits shown in the backtests are not high.

Features of iProfit EA

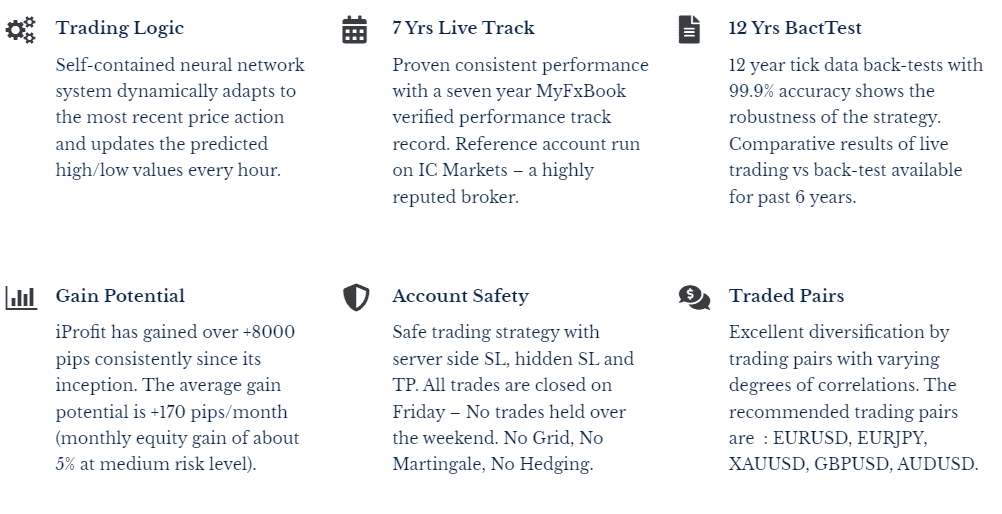

Some of the key features of this trading tool that the vendor claims make this FX Robot competitive are:

- The MT4 tool uses an inbuilt neural network system that adapts to market changes and provides instant updates.

- A proven track record verified by the myfxbook site is provided by the vendor.

- Backtesting done for 12 years with modeling quality of 99.9% demonstrates the effectiveness of the approach.

- A monthly profit of 5% and an average profit probability of more than 170 pips are assured.

- The system uses a safe trading method with hidden SL, TP, and a server-side SL.

| Trading Terminals | MT4 |

| Strategy | Price action, neural network |

| Timeframe | H1 |

| Price | $470 -$1099 |

| Money Refund | 30 days |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does iProfit EA use?

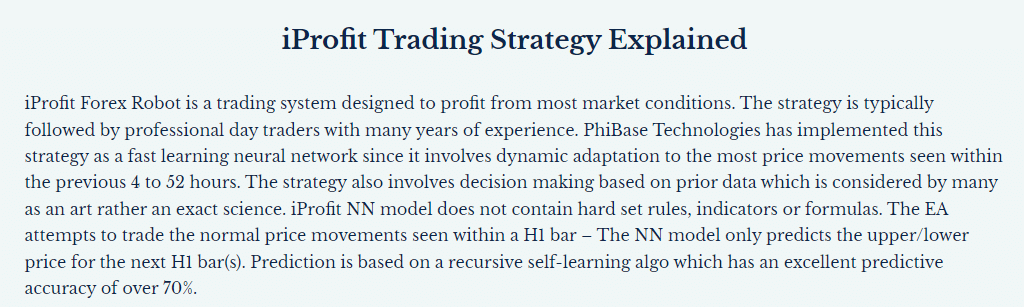

According to the vendor, this MT4 tool uses a method that uses a neural network for dynamic price movement adaptation. Orders are executed based on prior data also. The EA uses regular price movements in an H1 timeframe and uses a self-learning algorithm for forecasting the trend. As per the vendor, a 70% predictive accuracy is present.

Backtesting vs live trading results

A backtesting result shown in the above screenshot is present on the official site. As per the report, the EA had generated a net profit of 3306.18 for an initial deposit of 10000. The maximum drawdown was 6.31. Profitability of 56.09% and a profit factor of 1.16 were present indicating a below-average performance.

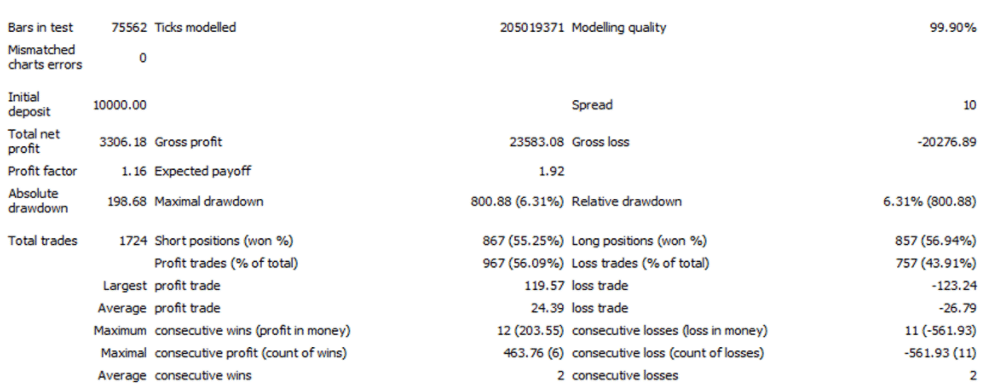

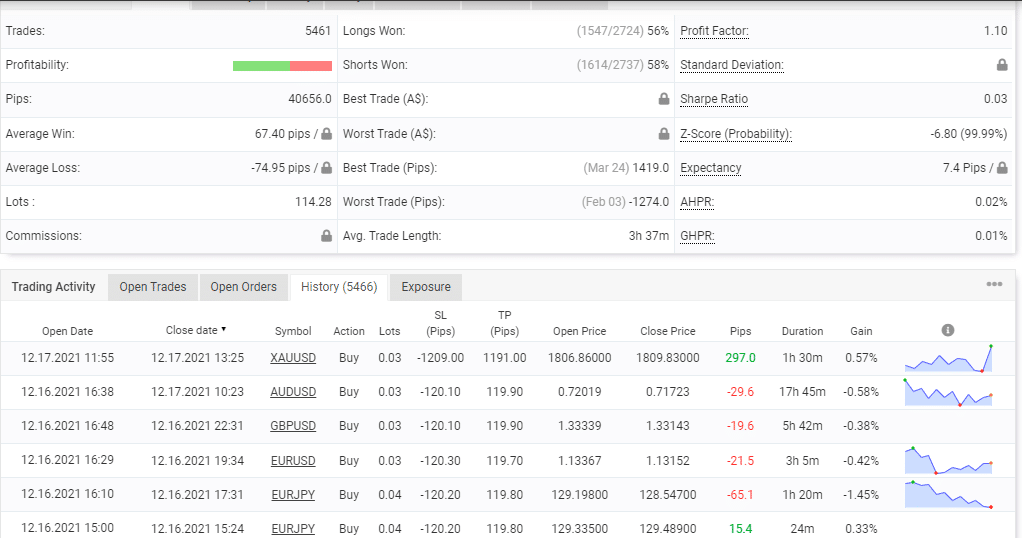

A real AUD account verified by the myfxbook site using the IC Markets broker and the leverage of 1:500 is present for this EA. Here are a couple of screenshots of the stats.

A total profit of 170.99% and an absolute profit of 90.4% are present. The discrepancy between the two values looks suspicious. The difference may be indicative of a risky approach or due to withdrawals from the account. Since the vendor has hidden the concerned data, we are unable to find out more about the efficacy of the EA.

A drawdown of 25.47% is present. Any value above 20% indicates a certain level of risk that most traders would not be comfortable with. From the trading history, we can see lot sizes of 0.03 and 0.04 are used. With the vendor hiding most of the important data, it is difficult to assess the performance.

The core team

Phibase Technologies is the company behind this FX EA. The company claims to create top-rated EAs. It also provides regular technical reports and the best customer support as per the vendor. We could not find further info on the company like its founding year, location, team members, phone contact, etc. The absence of info indicates a lack of vendor transparency.