NorthEastWay uses a pullback method of trading that works mainly on the NZDCAD, AUDNZD, and AUDCAD pairs. As per the developer, Pavel Udovichenko, this fully automated system uses the return of price momentum after a sharp movement in any direction.

This FX robot is available for $9987. The developer claims that only 6 copies are left of the 10 copies available at this price after which it is raised to $12483. Compared to the market average we find the price is exorbitant. Further, besides a free demo, there are no details present on the features included in the package. There is no money-back guarantee present, which raises doubts regarding the reliability of the system.

Is NorthEastWay good?

We have evaluated the various aspects of this ATS in this review. The developer provides backtesting results and a demo trading account verified by the Myfxbook site. From the results, we find that the drawdown is very high indicating a risky approach. Further, the expensive price and lack of a money-back guarantee are other downsides that you should consider if you are interested in this trading tool.

Features of NorthEastWay

The developer does not provide much info on the features and functionality of the system. From the info present, the key features of this EA are:

- It works mainly on the NZDCAD, AUDCAD, and AUDNZD pairs, and the additional pairs the system works on are the GBPCAD, EURCAD, USDCAD, GBPUSD, EURUSD, and EURGBP pairs.

- All the pairs can work from a single chart..

- The M15 timeframe is used by the expert advisor.

- It is not sensitive to slippage, spread, and other variables related to the broker.

- For backtesting, the developer recommends the use of the multi-currency mode.

- A minimum balance of $5000 is the developer’s recommendation for the initial deposit.

- The leverage for the system starts from 1:200.

| Trading Terminals | MT4/5 |

| Strategy | Pullback method |

| Timeframe | M15 |

| Price | $9987 |

| Money Refund | N/A |

| Recommended Deposit | $5000 |

| Recommended Leverage | 1: 200 |

| Money Management | N/A |

| Customer Reviews | N/A |

What strategy does NorthEastWay use?

As per the author, the system uses the pullback method. The method involves making entries when the price reverts to its original position after a movement in any direction. There is no further explanation provided for the strategy. The lack of explanation makes it difficult to assess the efficacy of the system.

Backtesting vs live trading results

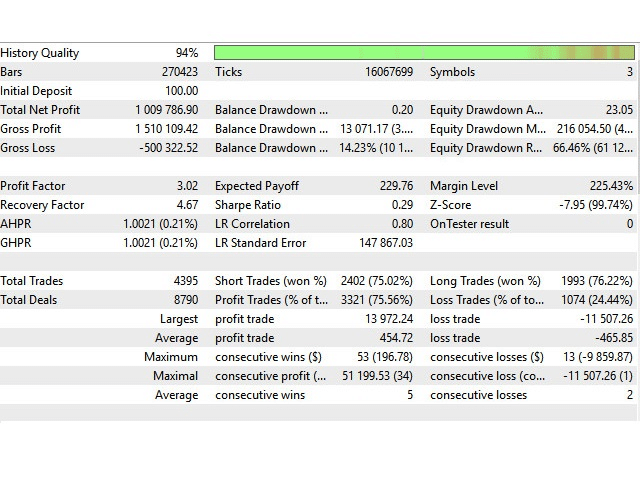

A backtesting report present for the FX robot on the MQL5 site is shown above. From the stats, we can see that a total net profit of $1009786 was generated for an initial deposit of $100. For a total of 4395 trades, the profitability of 75.56% and a profit factor of 3.02 were present. A drawdown of 14.23% for the balance and 66.46% for the equity was recorded. From the results, it is clear that although the profits are high, the drawdown indicates a risky approach.

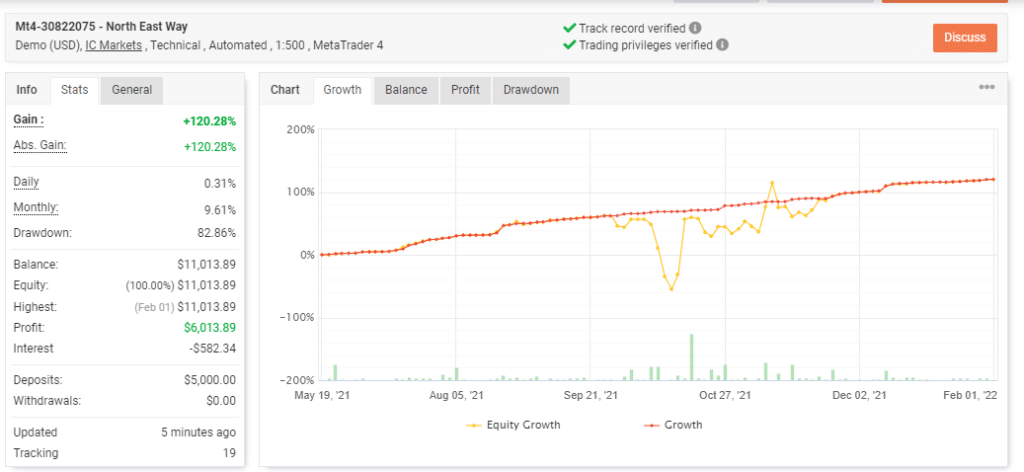

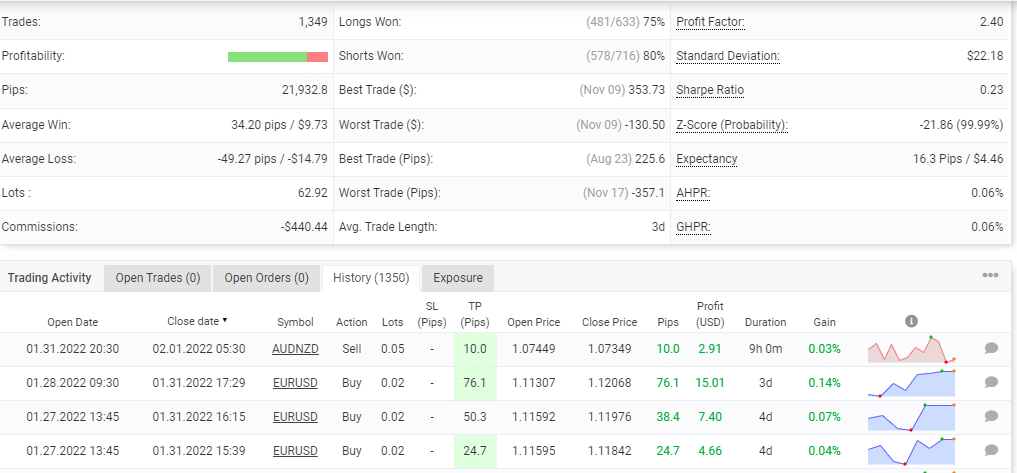

A demo USD account verified by the Myfxbook site is present for the FX robot. A total profit of 120.28% and an absolute profit of similar value are present. The daily and monthly returns for the account are 0.31% and 9.61%, respectively. For the initial deposit of $5000, the account that started in May 2021, shows a drawdown of 82.86%. A total of 1349 trades have been executed with 79% profitability and a profit factor of 2.40.

From the trading history, we can see different lot sizes are used ranging from 0.02 to 0.13. The big lot size and high drawdown show that the approach used is of a high-risk category. You can easily lose a majority of your capital with such risky methods. Further, comparing the backtesting results with the demo results, we find the drawdown is higher and profits are low indicating the performance seen in the backtests are not reflected in the demo trading.

The core team

Pavel Udovichenko is the author of this FX EA. He has over 10 years of experience in developing FX trading tools and has made 4 products and 24 signals. For support, the developer provides a Telegram channel link and the messaging feature on the MQL5 site.