Odin Forex Robot is an expert advisor that claims to have won $169,557 for the last 30 days of trading. According to the vendor, it is a system with high trading accuracy. It is fully automated and compatible with more than 20 Forex pairs.

The current price of the robot is $99, but the original price is $199. It is currently available at a 50% discount. The price is significantly lower compared to other Forex EAs on the market. However, the vendor has a strict no-refund policy. We don’t know exactly when the EA was launched, but the trading results are available from January 2013.

Is Odin Forex Robot good?

This robot is available at an affordable price, but we have no way to verify the vendor’s claims. This is because of the absence of verified trading statistics. The vendor has not shared the backtesting data either, and there is no background information on the company.

Features of Odin Forex Robot

Odin Forex Robot can open, manage, and close trades without you lifting a finger. It has a real-time broker shield and prevents dishonest brokers from accessing your trade information. The vendor provides optimized settings for multiple pairs. Setting up the robot takes less than five minutes.

This EA uses tight stop losses and take profits to safeguard your balance and secure profit. The vendor claims that this minimizes the risk, but we don’t have any way to verify it. While the order is open, the EA moves automated protective stops behind each candle.

Odin Forex Robot remains active 24 hours a day, 5 days a week. It instantly diversifies account equity and can work with micro, mini, and full-sized lots. You can use it with any Forex chart on the Metatrader 4 platform.

| Trading Terminals | MT4 |

| Strategy | Grid |

| Timeframe | N/A |

| Price | $99 |

| Money Refund | No |

| Recommended Deposit | $250 |

| Recommended Leverage | N/A |

| Money Management | No |

| Customer Reviews | N/A |

What strategy does Odin Forex Robot use?

This EA uses a grid trading strategy. It plots the smaller price movements on the charts against a grid in order to find patterns. Afterward, it analyzes the patterns to make future predictions. The vendor has coded all the rules for this strategy directly into the robot.

Backtesting vs live trading results

We don’t have the backtesting data for this robot. EA vendors often test their automated strategies using archival data. These tests are carried out over long time periods, thus revealing the long-term performance of the system. Although historical performance doesn’t always translate into live trading, many traders use the results to determine whether it is worth conducting live trades through the automated system.

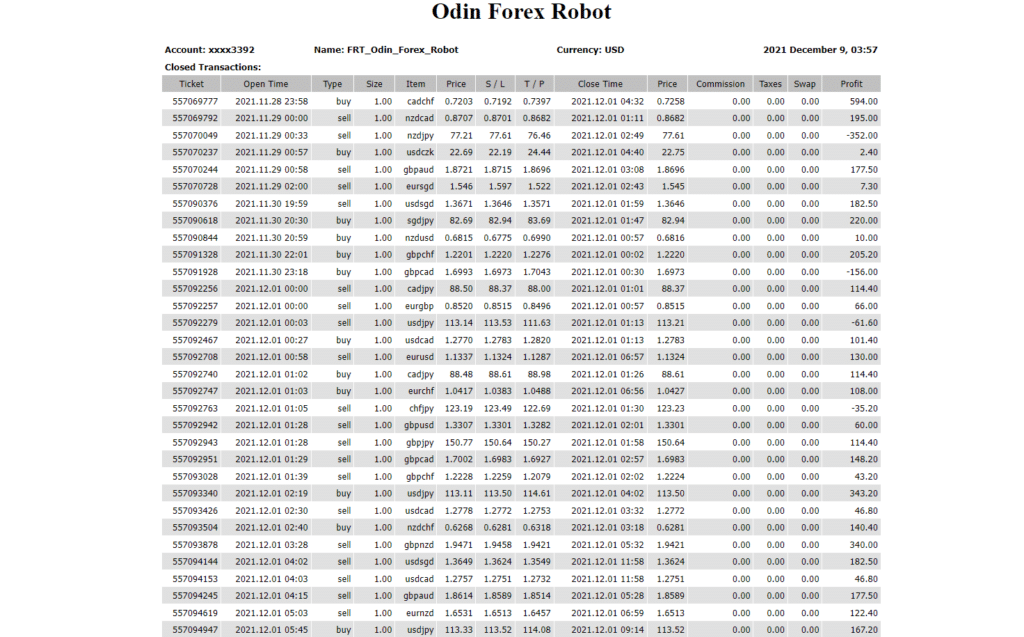

The vendor has shared the live result for this robot in tabular format. Since the results are not published on third-party websites like Myfxbook, FXBlue, or FXStat, we have no way to confirm their authenticity. These results show us the opening and closing time of the trade, the type of trade, the pair, opening and closing price, stop loss, take profit, commissions, taxes, swap, and profit.

Since backtesting results are not available, we cannot draw a comparison between the two. Also, it is not possible to determine the trading approach of the system from these results.

The core team

The parent company behind this robot is called Forex Robot Trader. It was founded by an LA-based former gambler known as Don Steinitz. This person works with a team of MQL programmers. The developer has not revealed the identities of team programmers. Also, we don’t have the official contact details, so the only way to get in touch with the support team is to message them through the official website.