Omega Trend EA is a professional Forex robot that claims to use methods that are powerful enough to enhance performance and returns. This FX EA works mainly on the EURUSD, EURJPY, and GBPUSD pairs. It uses an exclusive indicator for identifying trends and utilizing them effectively. Other features in the system include spread and broker protection, effective exit logic, and more.

To purchase this ATS, you have to pay $117. The price is a discounted amount and the original price of the package is $187. As per the vendor, the features included in the package are 1 real and 3 demo accounts, 24/7 customer support, and a 60-day money-back guarantee.

Is Omega Trend EA good?

As an automated software, this system, promoted by the FxAutomater group, offers backtesting reports and verified live trading results. The vendor has info on the various settings and the price is not expensive when compared to the market average.

Features of Omega Trend EA

Some of the key feature highlights that the vendor focuses on for this MT4 tool are:

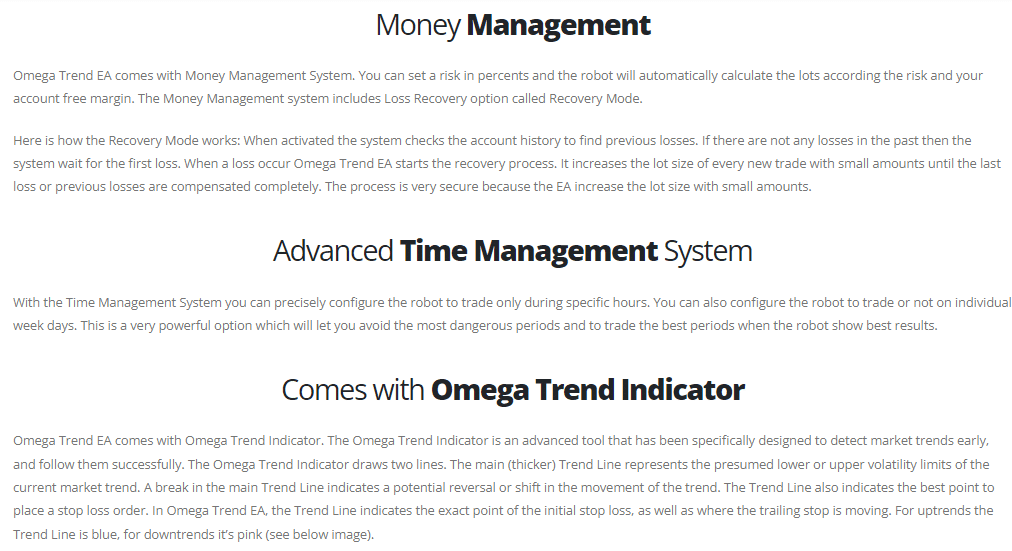

- It employs a money management feature where you can customize the risk level using which the robot will calculate the lot size.

- Recovery mode incorporated in the system changes the lot size in the case of a loss to cover the prior losses.

- Time management feature enables making the software work only on specific periods to ensure best results.

- The proprietary indicator helps to spot trends early on and follow them effectively ending in high returns.

| Trading Terminals | MT4, MT5 |

| Strategy | Martingale + Grid Combo |

| Timeframe | H1 |

| Price | $117 |

| Money Refund | 60 days |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Omega Trend EA use?

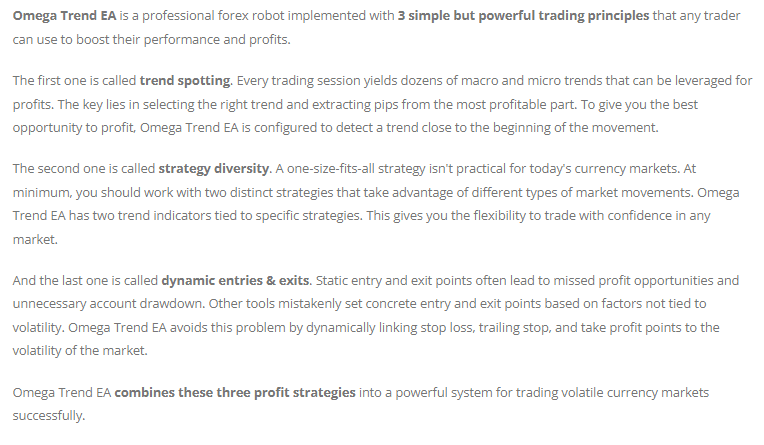

As the title implies, this is a trend-based system that uses three methods: trend identifying, strategy diversity, and dynamic trade orders for successful trading. The vendor claims that these approaches help to trade volatile pairs effectively.

Backtesting vs live trading results

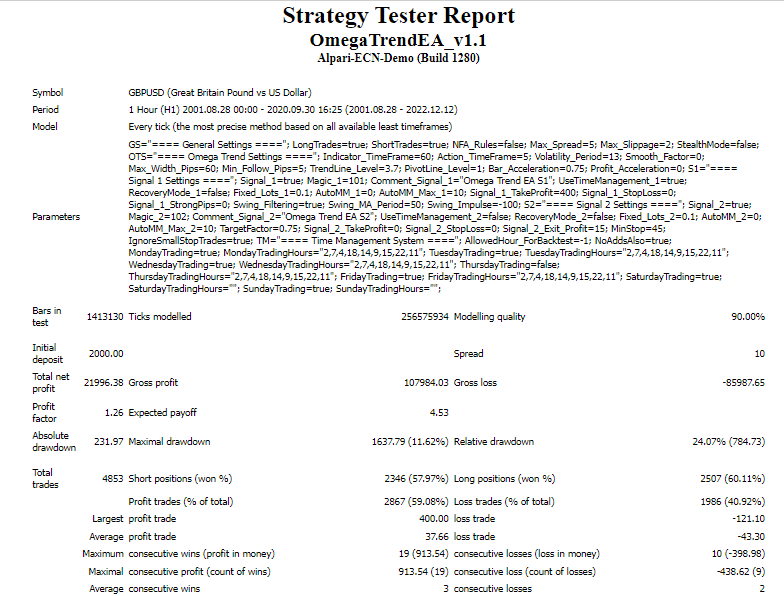

A few backtests and verified live trading stats are found on the official site. Here is one of the backtests:

From the above stats, we find the backtesting was done on the GBPUSD pair on the H1 timeframe. For a deposit of 2000, the test done from 2001 to 2022 had generated a net profit of 21996.38. The profit for a total of 4853 trades was 59.08%. A profit factor of 1.26 was present and the highest drawdown was 1.62%. Although the net profit is not high, the drawdown is low indicating the strategy was not of high-risk type.

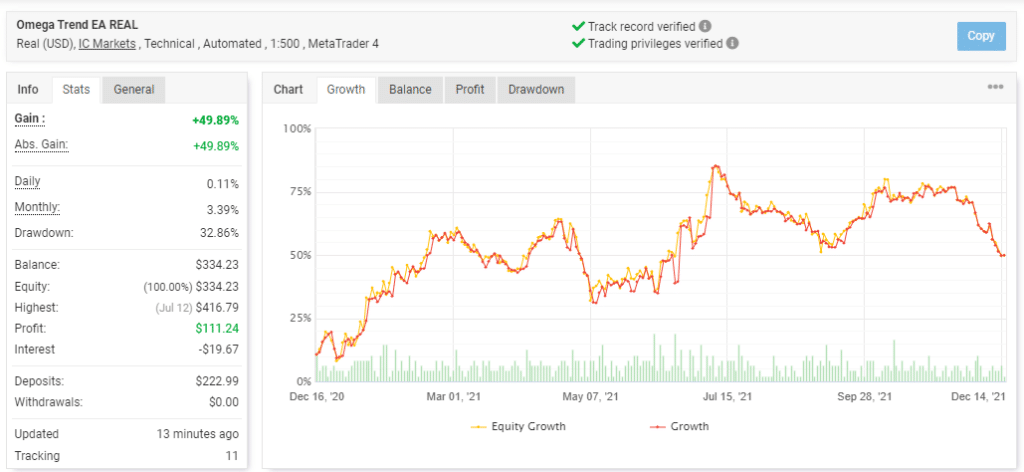

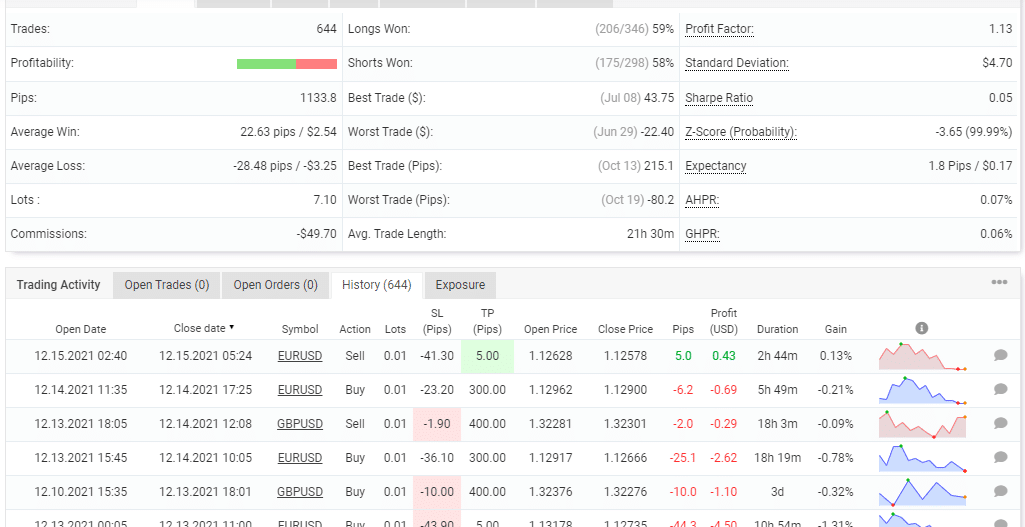

The vendor has real live trading stats for this FX EA verified by the myfxbook site. Here is a real USD account using the leverage of 1:500 on the Metatrader 4 platform.

From the stats shown above, we can see the total and absolute profits are similar in value. A daily and monthly profit of 0.11% and 3.39% are present. The drawdown is 32.86% which indicates a risky approach unlike that seen in the backtesting. For a total of 644 trades completed from December 2020, a 60% profitability is present with a profit factor of 1.13. A lot size of 0.01 is used for the account. Comparing the backtesting result with real trading stats we find the drawdown is higher in the latter indicating a risky approach.

The core team

FxAutomater is the company that creates and promotes this FX EA. We could gather only minimal details on the company. Other than mentioning the team has 50 years of combined experience, the vendor does not reveal info related to the members and their credentials. There is no location address, phone number, or other contact info.