Red Fox EA is an MT4 tool that claims to provide a low drawdown and consistent profits for traders. It uses two types of settings namely aggressive and low drawdown settings. This is a fully automated system that can be set up in less than 5 minutes. It uses smart indicators for trade analysis.

To purchase this EA, you need to pay $266. The vendor provides a 14-day refund offer using which you can test the EA on a demo account and if not satisfied can get your money back. We could not find info on the developer or the founding year of the company. This shows a lack of vendor transparency.

Is Red Fox EA good?

On evaluating the various aspects of this FX EA, we find that it is not a trustworthy product. While the vendor claims it to provide stable profits and a low drawdown the real trading results prove the claims to be false. We feel it is an overpriced EA that is not worth the price.

Features of Red Fox EA

Some of the features that the vendor highlights for this ATS are listed below:

- A drawdown ranging from 9% up to 18% for the low drawdown setting and 15% up to 38% for the aggressive mode.

- Profit ranging from 10% up to 48%

- Automated management of lots based on the funds in the account.

- Use of news filters to prevent trading during the big event days.

- Use of smart indicators for market analysis.

- Spread control feature to avoid trading in a volatile market condition.

From the above-mentioned features, we find that there are no new or innovative features that set this system apart.

| Trading Terminals | MT4 |

| Strategy | Market Reverse Price |

| Timeframe | N/A |

| Price | $266 |

| Money Refund | 14 days |

| Recommended Deposit | $1000 |

| Recommended Leverage | 1: 500 |

| Money Management | Yes |

| Customer Reviews | Bad |

What strategy does Red Fox EA Use?

As per the vendor, this FX robot uses the market reverse price approach. It makes use of inbuilt indicators for the market analysis and uses a non-Martingale approach. The vendor claims that this ATS is designed to produce a low drawdown and it is not possible to blow an account with this EA. There is no further info on the approach. The lack of explanation of the strategy raises a red flag for this FX EA.

Backtesting vs live trading results

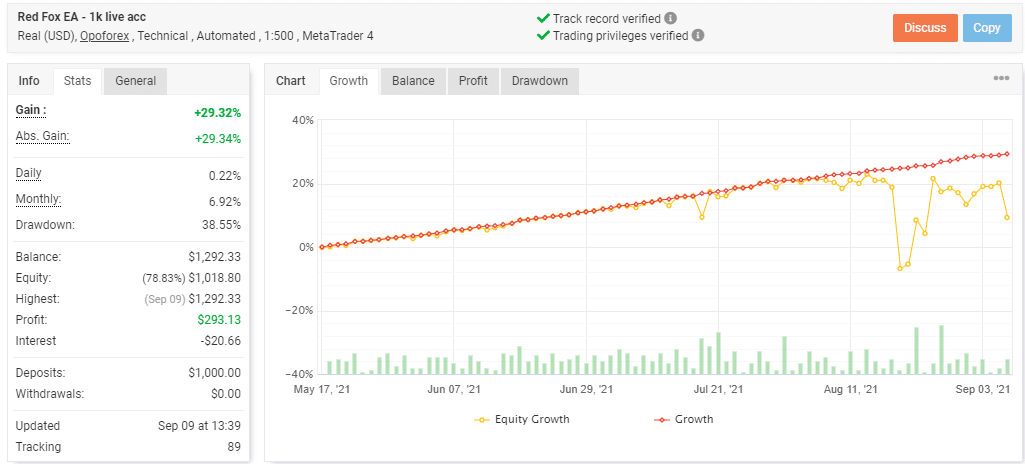

The vendor does not provide backtesting results. However, a real account verified by the myfxbook site is present for this EA.

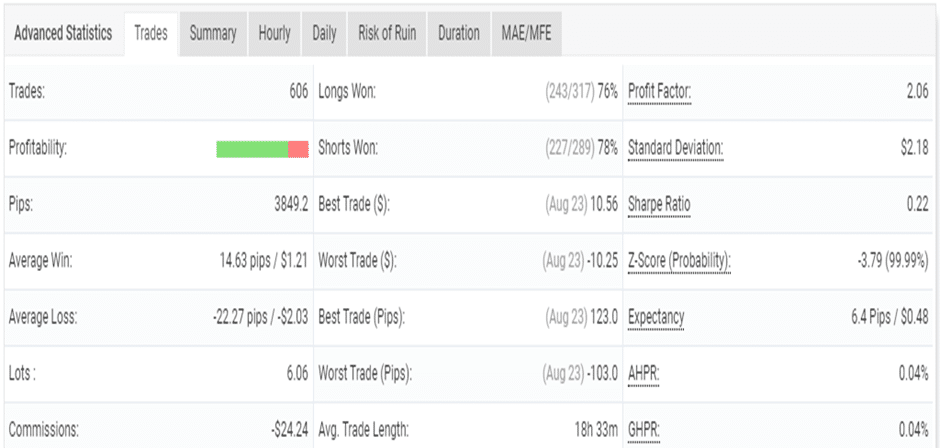

From the above screenshots, we can see the real USD account using the leverage of 1:500 on the MT4 platform has both track record and trading privileges verified. A total profit of 29.32% and an absolute profit of 29.34% are present in the account. It shows a drawdown of 38.55%. For a deposit of $1000, the account started in May 2021 has completed 606 trades and reveals profitability of 78%. The profit factor value is 2.06.

From the trading history, we can see a lot size of 0.01 is used for the trades. Although there is no mention of the type of setting used for the account, the high drawdown indicates the strategy used is very risky. Further, the profits are not as high as the vendor claims, making this EA a bad investment of traders.

The core team

The My EA Academy site promotes this FX robot. It is part of the SinryAdvice Worldwide company which is based in Malaysia. We could not find info on the developers or the team behind the products of this company. A location address is provided for the firm but there is no telephone number. For support, the vendor provides an email address, live chat feature, and social media links.