Volatility Factor 2.0 is an expert advisor that claims to possess a six-year unbroken winning streak. The vendor claims this system is ready for the 2021 market conditions. Priced at $197, this Forex robot gives you access to a single real account and an unlimited number of demo accounts. The vendor offers a 60-day money-back guarantee for this robot. We don’t exactly know when it was launched on the Forex market, but the live trading account has been active since January 2020.

Is Volatility Factor 2.0 good?

While the vendor claims to maximize profit and minimize risk with this trading system, the reality is a bit different. The live results tell us that the robot trades with high drawdown, which means it carries a fair amount of risk. There is no proper explanation for the trading strategy and we have very little information on the parent company. Thus, we don’t think Volatility Factor 2.0 is worth its price.

Features of Volatility Factor 2.0

This Forex EA has a broker spy module that hides your trades from brokers. It prevents them from cheating you with high spreads and negative slippage. Volatility Factor 2.0 supports four currency pairs, namely USD/CHF, USD/JPY, EUR/USD, and GBP/USD. It is compatible with FIFO and NFA and has an optimal money management system.

This EA has in-built protective features for minimizing price slippage and spread. It has a news filter that lets you trade Forex-related news announcements. You can use it with micro, mini, and standard account types. It is compatible with all MT4 brokers, including ECN brokers, and operates with 4 and 5 digits after the decimal point.

| Trading Terminals | MT4 |

| Strategy | Volatility-based |

| Timeframe | M15 |

| Price | $197 |

| Money Refund | 60 days |

| Recommended deposit | $1000-$5000 |

| Recommended Leverage | 1:500 |

| Money Management | Yes |

| Customer Reviews | Bad (Only 1 review on FPA) |

What strategy does Volatility Factor 2.0 use?

Volatility Factor 2.0 looks to exploit the existing trend and market volatility. In this volatility-based strategy, trades are placed in the direction of the market. When it senses a unidirectional movement, it trades in the direction of the medium-term impulse. Sometimes the EA might take limited positions anticipating a correction. It calculates entry and exit points using mathematical logic based on the volatility borders.

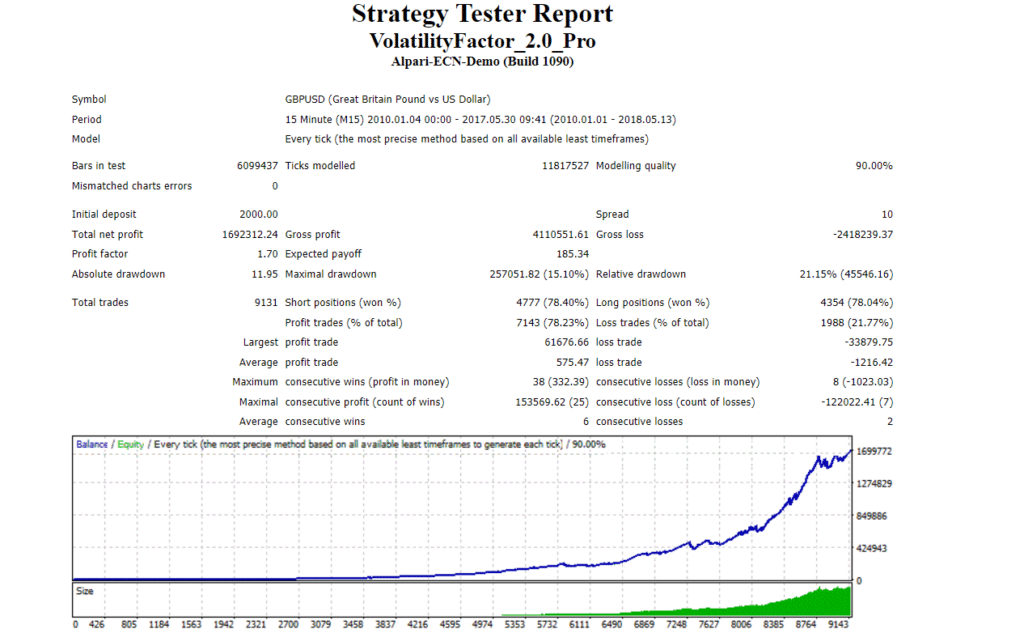

Backtesting vs live trading results

From 2010 to 2017, Volatility Factor 2.0 conducted a total of 9131 trades for this backtest. It won 78.23% of all trades, thus generating a total profit of $1692312.24. The profit factor for this backtest was 1.70, while the drawdown was a bit high at 21.15%. There were 38 maximum consecutive wins and 8 maximum consecutive losses during the testing period.

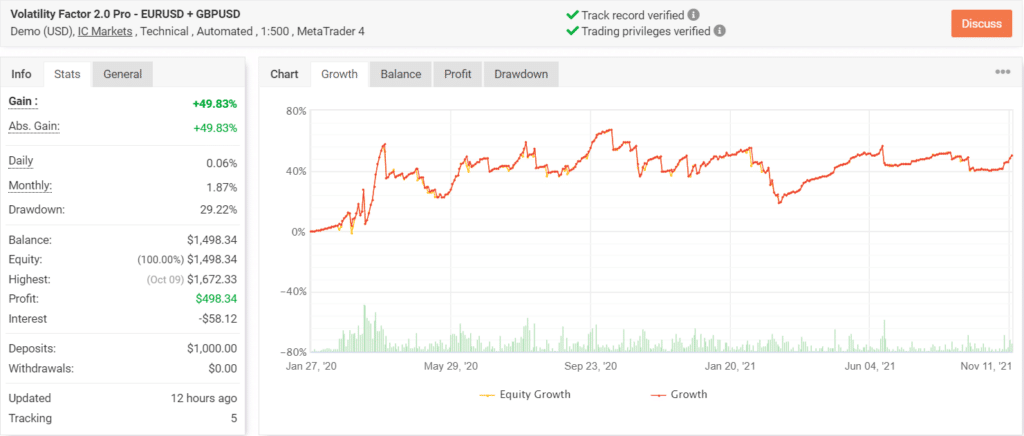

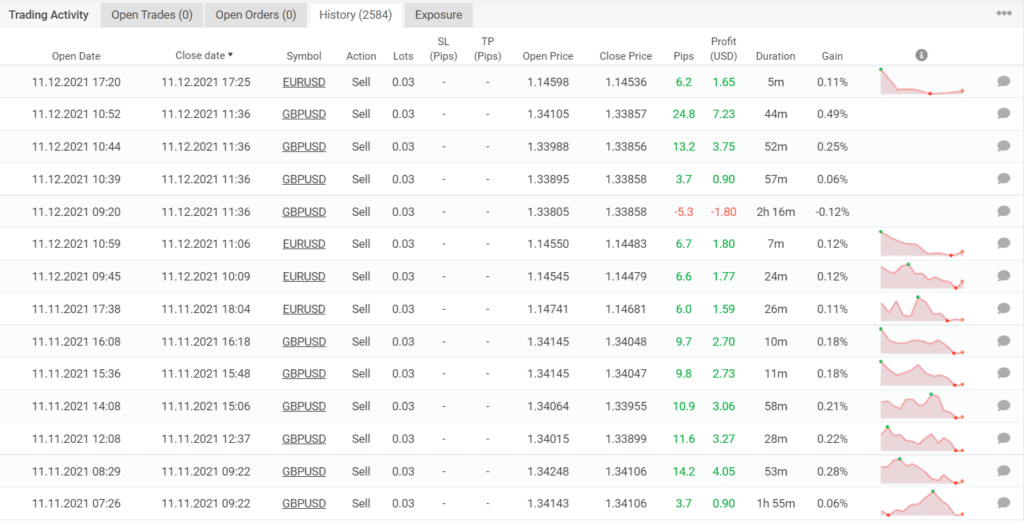

This Myfxbook live trading account was launched on January 27, 2020, and to date, it has only generated a small profit of $498.34. The win rate, after 2583 trades, is 73% and the profit factor is 1.11. While the daily and monthly gains are 0.06% and 1.87% respectively, the drawdown is 29.22%, which is slightly higher compared to the backtest. Evidently, the robot follows a high-risk strategy.

By studying the trading history, we can see that the robot only generates small profits for each trade. It places a large number of trades every day, and the strategy looks similar to scalping.

The core team

The parent company, FXautomater, has its headquarters located somewhere in Seychelles. We don’t know the identities of the dev team members and the vendor has not shared any contact information. We don’t know how long this company has been manufacturing expert advisors. Other robots built by this company include Omega Trend EA, BF Scalper EA, BF Smart Scalper EA, Gold Scalper Pro, Grid Master Pro, etc.