WallStreet Forex Robot is a Metatrader trading tool that claims to be accurate and reliable. As per the vendor, this FX robot spots the right trades and executes them in an unbiased manner. The system boasts verified live results and 20-year backtesting results. It works on multiple currency pairs and has been in the market for a decade.

Is WallStreet Forex Robot good?

As part of the FXautomater group, this FX EA claims to provide high returns. Our evaluation of the features, results, support and other characteristics reveal it is not worth buying. While the vendor provides verified results, the stats reveal a risky approach. The lack of vendor transparency and inadequate support methods are other drawbacks that make this ATS unreliable.

Features of WallStreet Forex Robot

Some of the key features that this trading system offers include an average winning transaction of 10 to 15 pips, steady spreads that ensure consistent profits with the integrated spread protection, broker protection, and automatic detection of 4/5 digit brokers. The MT4 tool has a stealth mode and is ECN broker compatible. An advanced time management system is used by the ATS and it is compatible with all NFA regulated brokers. Push notifications are sent via mobile and email.

| Trading Terminals | MT4, MT5 |

| Strategy | Trend-following |

| Timeframe | M15 |

| Price | $267 |

| Money Refund | 60 days |

| Recommended Deposit | $1000-$5000 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | Bad (2.891 out of 5 ratings based on 18 reviews on FPA) |

What strategy does WallStreet Forex Robot use?

As per the vendor, the FX robot uses a low-risk approach that can give minor but probable profits by following medium and short-term trends. This is not an aggressive scalper as per the vendor. There is no further explanation provided for the approach which makes us suspect this is not a reliable FX EA.

Backtesting vs live trading results

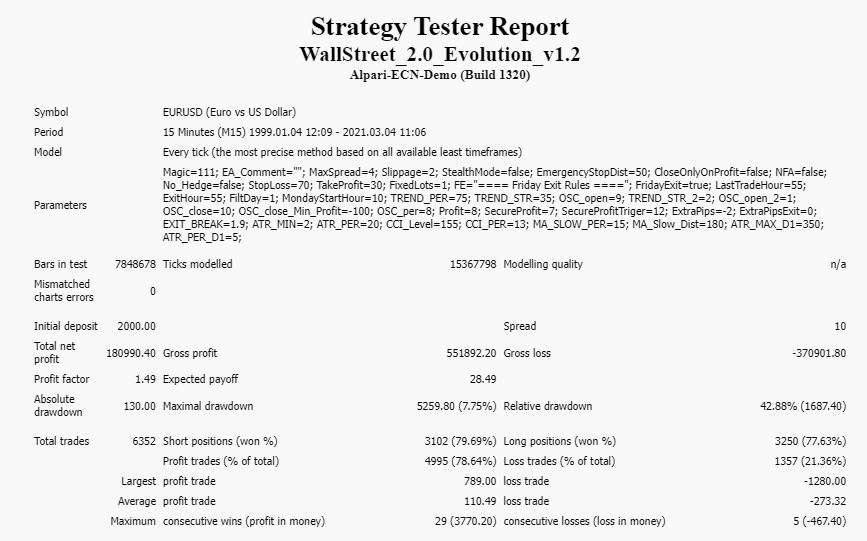

A few backtesting reports are present on the official site. Shown above is one of the backtests done on the EURUSD pair using the M15 Timeframe from 1999 to 2021. For an initial deposit of $2000, the EA had generated a total net return of 180990.40 with profitability of 78.64% and a profit factor value of 1.49. For a total number of 6352 trades, the maximum drawdown for the account was 7.75%. While the drawdown is low, the profits are not high indicating an ineffective approach.

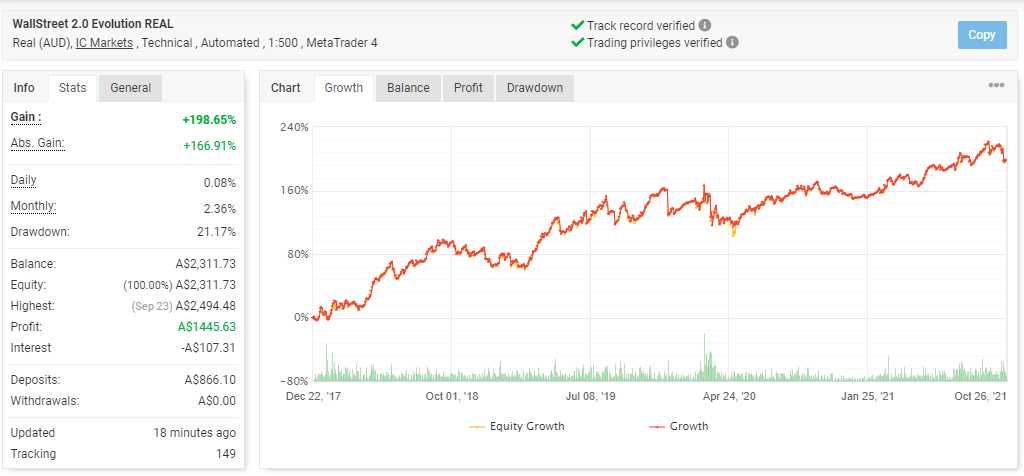

The vendor provides verified live trading results on the website. Here is a live real AUD account using IC Markets broker and the leverage of 1:500 on the MT4 platform.

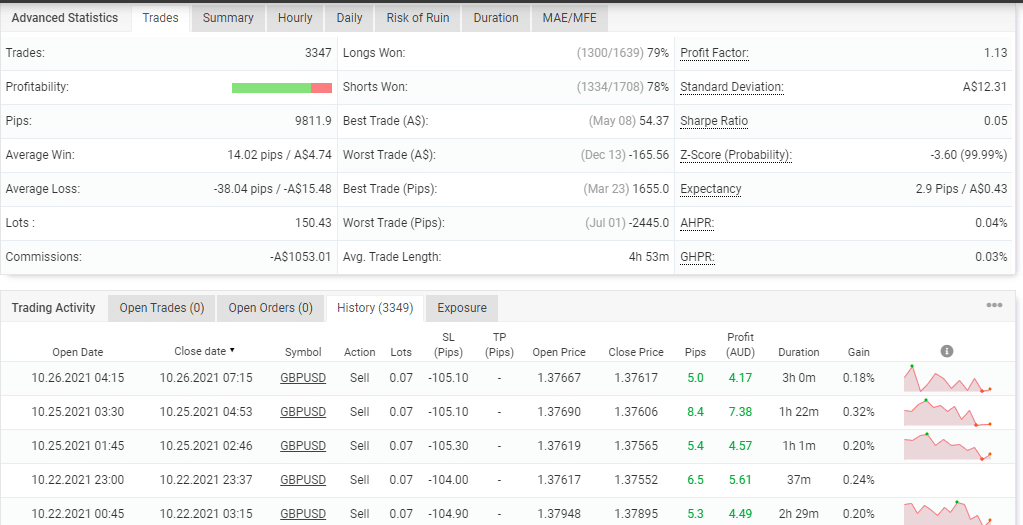

From the trading stats shown above, we can see a total profit of 198.65% and an absolute profit of 166.91%. The difference in the two values makes us suspect the approach is not effective. Other trading stats include a daily profit of 0.08% and a monthly profit of 2.36%. The drawdown for the account is 21.17%. For the account that started in December 2017, 3347 trades have been executed with 79% profitability and a profit factor of1.13.

From the trading history, we can see a lot size of 0.07 is used. The big lot size, low profit factor, and high drawdown indicate the approach used is risky. Further, comparing the backtesting report and the real trading results we find the results in the real trading are not as high as in the historical data testing.

The core team

We could not find info on the company, its team of developers, their expertise, and their experience. There is no location address, phone number, etc. present on the official site. For customer support, an online contact form is the only method found. The lack of vendor transparency raises a red flag for this EA.