Zeus is an expert advisor promising 5% to 15% monthly returns. The FX EA is compatible with the MT4 platform and is fully automated ensuring error-free and instant orders. This MT4 tool uses a proprietary strategy to achieve successful returns. The vendor assures that it is suitable for investors who do not want high-risk trading.

Different packages are available for this FX EA. The packages range from a rental package (€699) recurring yearly, a lifetime package (€999) one-time payment, a rental sponsored (€399) recurring yearly, and a managed account with no upfront fees. Features included in the packages are support, onboarding, and VPS. No refund offer is present which makes us suspect the reliability of the product. Further, when compared to the market average we find the pricing is expensive.

Is Zeus good?

Our evaluation of the FX EA reveals that the vendor has real trading results to prove the efficacy of the system. However, on analyzing the results, we find that many of the crucial values are hidden making us suspicious of the performance. Further, the drawdown is high and monthly profits are not as claimed by the vendor.

Features of Zeus

Some of the major characteristics of this FX EA that make it competitive as per the vendor are:

- It works on the EURUSD pair only due to its market liquidity and volatility.

- A monthly profit of 3% to 15% is assured by the vendor based on the volatility of the market.

- The vendor recommends a minimum deposit of 2,500 EUR as the starting equity.

- A timeframe of M5 is recommended for this FX EA.

- The FX robot does ultra-fast, complex market monitoring and effective performance on a big scale.

- It has achieved 15% monthly profits in live trading results done since 2019.

| Trading Terminals | MT4 |

| Strategy | Proprietary strategy |

| Timeframe | M5 |

| Price | €699 – €999 |

| Money Refund | N/A |

| Recommended Deposit | €2500 |

| Recommended Leverage | N/A |

| Money Management | N/A |

| Customer Reviews | Good (4.499 out of 5 ratings based on 86 reviews on FPA) |

What strategy does Zeus use?

As per the vendor, the exact details of the strategy cannot be revealed. Instead, the vendor claims that the system is designed to work only on the EURUSD pair which has high liquidity and its volatility allows you to withstand risks.

Backtesting vs live trading results

Although the vendor mentions backtesting performance there is no detailed strategy tester report for the FX EA. Instead, the vendor provides two different backtests performed from 2018 to 2020 with a 9.14% drawdown and from 2016 to 2020 with a drawdown of 14.36%. The backtests were done with 99% model accuracy.

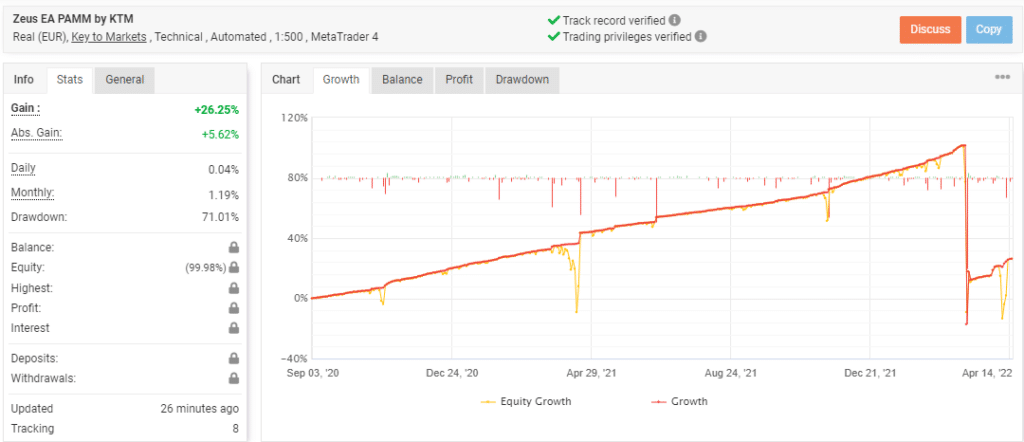

A live real EUR account verified by the myfxbook site is present. The account using the Key to Markets broker and the leverage of 1:500 on the MT4 platform is shown here:

From the above stats, it is clear that the system has generated a total profit of 26.25%. The daily and monthly profits are 0.04% and 1.19%. A drawdown of 71.01% is present. All other values like the balance, equity, profit, deposits, lots, etc. are hidden by the vendor. The unrevealed data makes us suspicious of the performance of the system. From the growth curve, we can see the system has suffered a big drawdown in March 2022 and has not managed to recover to its original profit levels. The data indicates poor risk management. Further, unlike the backtesting that shows a low drawdown, we find the drawdown is higher in real trading.

The core team

Elitecurrensea is the name of the company that promotes this FX EA. The company comprises highly skilled FX traders, and custom-made and successful strategies, tools, and indicators to ensure steady profits. Chris Svorcik and NenadKerkez are the main team members and are also called Tarantula FX. For support, the vendor provides an email address and a location address.