Advanced Scalper is an expert advisor using integrated filters and algorithms for slippage control. The FX EA is fully automated and customizable. You can optimize the settings to suit your needs. As per the author, the ATS uses advanced exit algorithms.

This EAis available for $249. Only three copies are remaining at this price after which the EA will be sold for $599. When compared to the market average, we find the price is expensive. A free demo account is present and there are two rental packages available. The one-month rental costs $149 and for the 3-month rental, you have to pay $199. No money-back guarantee is present for the product. The lack of a refund offer raises doubts on the product’s reliability.

Is Advanced Scalper good?

As per the developer, the FX EA shows good results in the backtesting and real trading results. The real trading results verified by the Myfxbook site show a low-risk approach but the profits are not high. Further, the pricing is expensive and there is no money-back assurance.

Features of Advanced Scalper

The key features of the FX robot that make it competitive as per the author are:

- It works on the EURUSD, USDJPY, and GBPUSD pairs.

- The FX robot uses advanced SL management and SL for each trade.

- A spread filter helps avoid bad market events .

- The slippage control setting avoids loss due to heavy slippage.

- Has proven live results and high quality backtests.

- A minimum balance of $150 is recommended for the FX EA.

| Trading Terminals | MT4/MT5 |

| Strategy | Scalping |

| Timeframe | H1, H4 |

| Price | $249 |

| Money Refund | N/A |

| Recommended Deposit | $150 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Advanced Scalper use?

As per the author, the system uses an advanced scalping method that includes fully automated trading with a high/low breakout system for entries and an advanced algorithm for its exit strategy. It can be used in manual strategies to help in advanced entry and exit strategies.

Backtesting vs live trading results

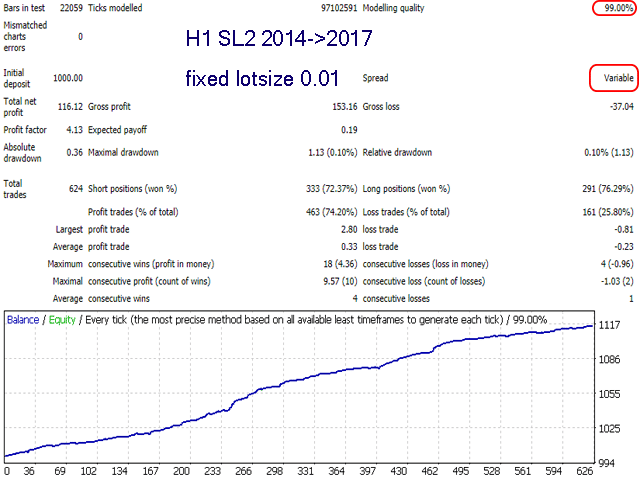

A few backtests are present for the FX EA on the MQL5 site. One of them is shown above. From the report, we can see that the backtesting was done from 2014 to 2017 using a fixed lot size of 0.01. For an initial deposit of $1000, a total of 624 trades were executed with a total net profit of 116.2. A maximum drawdown of 1.13 was present. The profitability was 74% and the profit factor was 4.13. While the small lot size and low drawdown indicate a low-risk strategy, the profits are not high indicating a below-average performance.

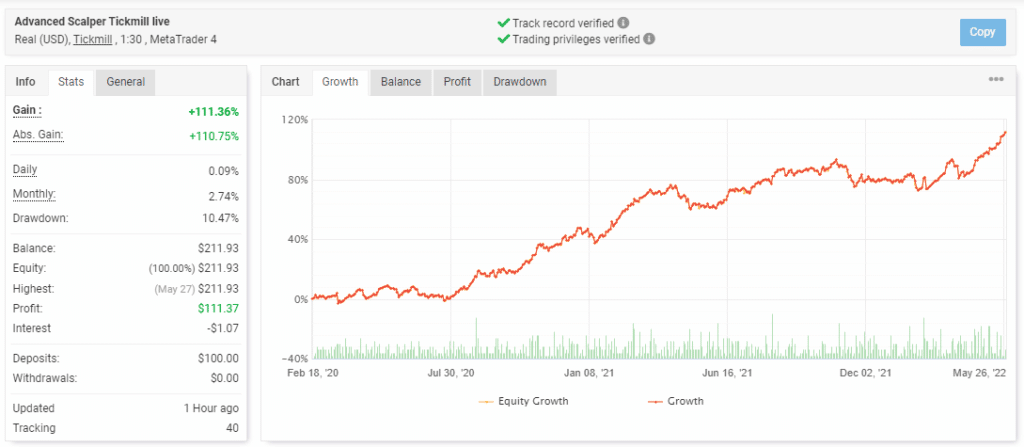

A real live USD account using the Tickmill broker and the leverage of 1:30 on the MT4 terminal is present. The account verified by the myfxbook site is shown below:

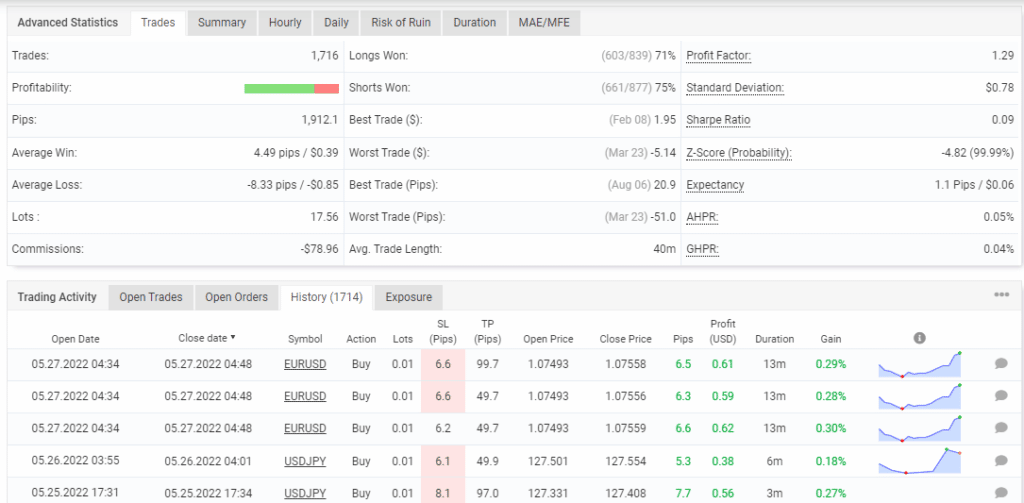

From the trading stats, we can see a total profit of 111.36% is present for the account that started in February 2020 with an initial deposit of $100. The daily and monthly profits are 0.09% and 2.74% respectively. A drawdown of 10.47% is present. For a total of 1716 trades, the profitability is 74% and the profit factor is 1.29. A lot size of 0.01 is used. From the results, it is clear that the system uses a low-risk approach. However, the profits are not very high indicating a below-average performance which corroborates the backtesting analysis.

The core team

This FX EA is developed by Profalgo Limited. The company is founded by Wim Schrynemakers. He is based in Malta and has more than 8 years of experience in developing FX trading systems. The author has created 24 products and 33 signals. Luna, Advanced Scalper, Reaper, Red Hawk, Night Owl, and Gecko are some of the products of the developer. For contact, the messaging option on the MQL5 is the only method available.