Forex Flex EA works on multiple currency pairs and comes with multiple live records so that traders can gauge the output of the algorithm. The developer states that there are numerous inbuilt features of the robot that make it stand out amongst other expert advisors in the market. We will go through each of them in our article and see if they make the EA profitable and fit for use by retail traders.

Is Forex Flex EA good?

Forex Flex EA has a good amount of floating loss which makes it difficult for us to recommend the system for traders. The robot can result in a margin call so traders should be careful with the EA.

Features of Forex Flex EA

Forex Flex EA has the following features:

- It has a 30-day money-back guarantee.

- There are multiple live records available on the tracking website.

- Traders can adjust the risk management according to their taste.

- The robot can employ 12 different strategies.

| Trading Terminals | MT4 and MT5 |

| Strategy | N/A |

| Timeframe | N/A |

| Price | $399 |

| Money Refund | 30 days |

| Recommended Deposit | $1000 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | 4.16 for 79 reviews on FPA |

What strategy does Forex Flex EA use?

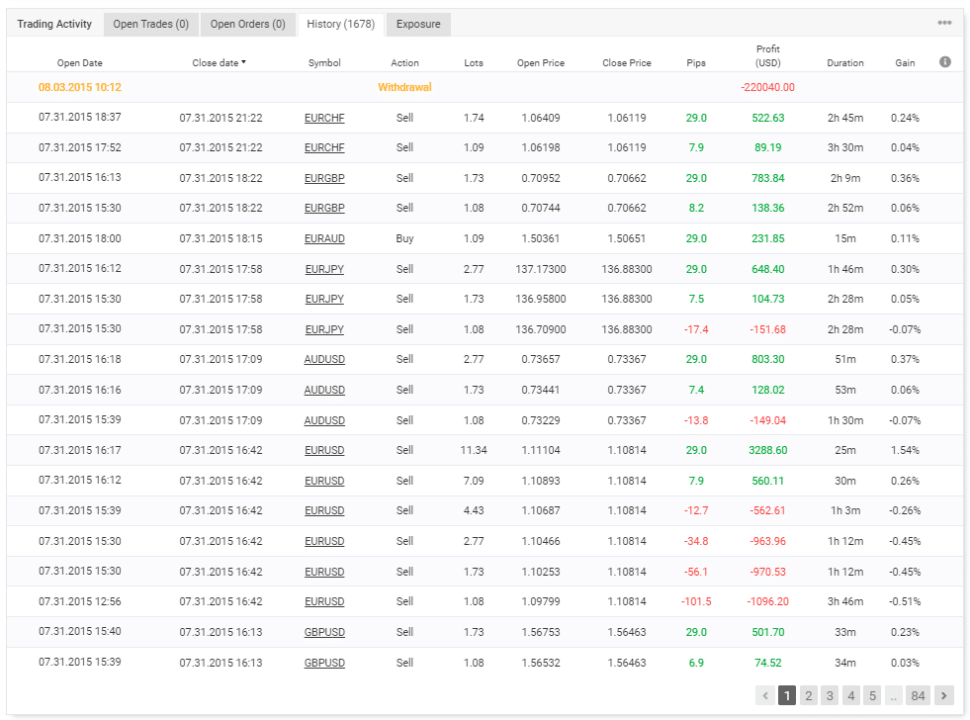

The developer states that the algorithm can use 12 different strategies but shares information about none of them. They state that the EA trades virtually to find entry points in the market. Through the history of Myfxbook, we can see that it implements grid and martingale game plans which are extremely dangerous. It can trade on multiple pairs.

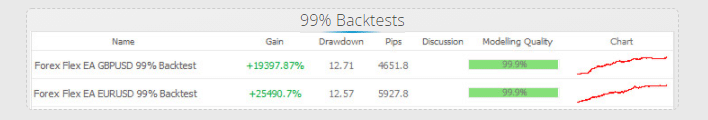

Backtesting vs live trading results

The developers provide an image of backtesting results which show tremendous gain but do not share the detailed statement or statistics. The drawdown ranked at 12.71%, and the modeling quality stood at 99.9%. We cannot conclude anything from the records as there are no verified figures.

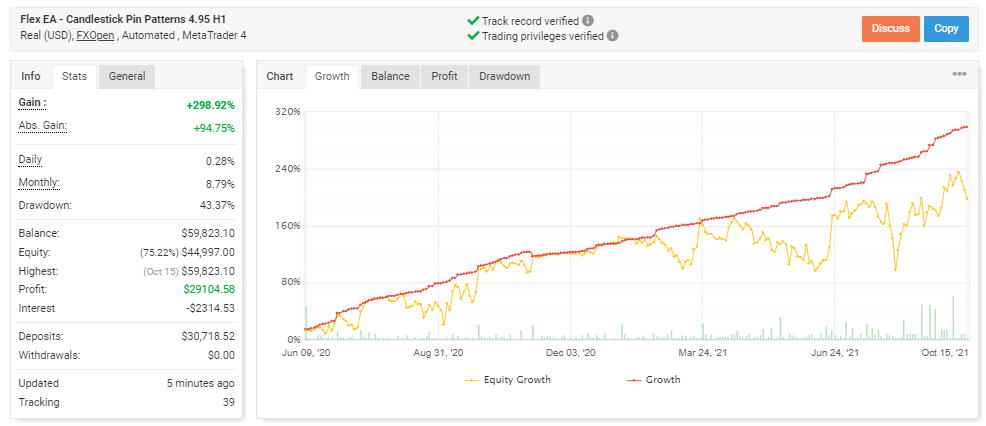

Live trading results are available on Myfxbook, which presents performance from June 09, 2020, till October 15, 2021. The robot had an average monthly gain of 8.79%, with a drawdown of 43.37%. The value of drawdown is high here which means that the algorithm can lose huge money before making any profits. There were 600 trades in total, with 140.01 lots traded. The expert advisor traded with a winning rate of 75% with a profit factor of 3.15. The average winning trade was $94.51, while the worst one was -$90.72. There is a frequent separation between the balance and equity curve which shows a good amount of floating drawdown.

The core team

The developers are not keen to share the records of their experience in markets and development. We are left stranded while trying to find out the names of the people behind the program.

There are multiple customer reviews present at Forex Peace Army giving the company a rating of 4.16 for a total of 79 pieces of feedback. A customer states that he can not use the algorithm and the company’s website is currently down. He says that he hasn’t made any profits from the algorithm.