Forex Gold Investor is an expert advisor that assures stable and consistent results. The vendor claims that the ATS executes frequent trades to boost the profit. The developer provides verified and backtest results with different trade settings. Interested in the EA traders can purchase this FX EA for $197. A real money account, multiple demo accounts, an advanced news filter, a unique broker spy module, and a 60-day money-back guarantee are the features available with the package.

Is Forex Gold Investor good?

As a gold trading tool, this robot offers the assurance of high returns with its verified performance results. But a closer look at the results shows that EA uses a risky approach. Further, the lack of vendor transparency is another drawback that makes us suspect that it is not worth its price.

Features of Forex Gold Investor

Some of the significant features of this EA that the vendor focuses on are:

- The system uses two proven approaches in a single currency trading tool.

- With the money-management feature, the MT4 tool helps to safeguard your profits.

- Effective trading recommendations are provided irrespective of the existing market situation.

- The EA uses an adaptive algorithm that helps in successful strategy execution.

- This FX EA is suitable for any type of trader regardless of his or her experience in the field.

Recommendations for this FX robot include the use of an M15 time chart and a minimum deposit of $100 to $500. But the vendor recommends using a higher deposit of $1000 to $5000 for better results.

| Trading Terminals | MT4 |

| Strategy | Impulse and trend-following |

| Timeframe | M15 |

| Price | $197 |

| Money Refund | 60 days |

| Recommended Deposit | $1000 -$5000 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Forex Gold Investor use?

As per the vendor, this system uses impulse and trend-following methods which have been selected from models that have the best performance. The approaches this EA uses consist of efficient and proprietary algorithms that ensure successful returns. We find the strategy explanation is vague and unsatisfactory.

Backtesting vs live trading results

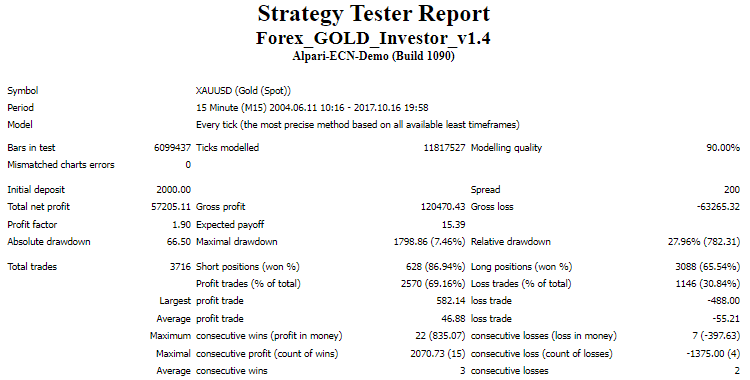

One of the backtesting results for this MT4 tool is shown here. The backtest was done on the XAUUSD pair from 2004 up to 2017 using a modeling quality of 90%.

From the backtesting report, we can see the system had generated a total net profit of 57205 for an initial deposit of 2000. Profitability was 69.16% and the profit factor was 1.90. A total of 3716 trades were executed for the account with a maximum drawdown of 7.46%. From the results, we can see that the total profit was low considering the high number of trades and other factors. The low profits indicate poor performance.

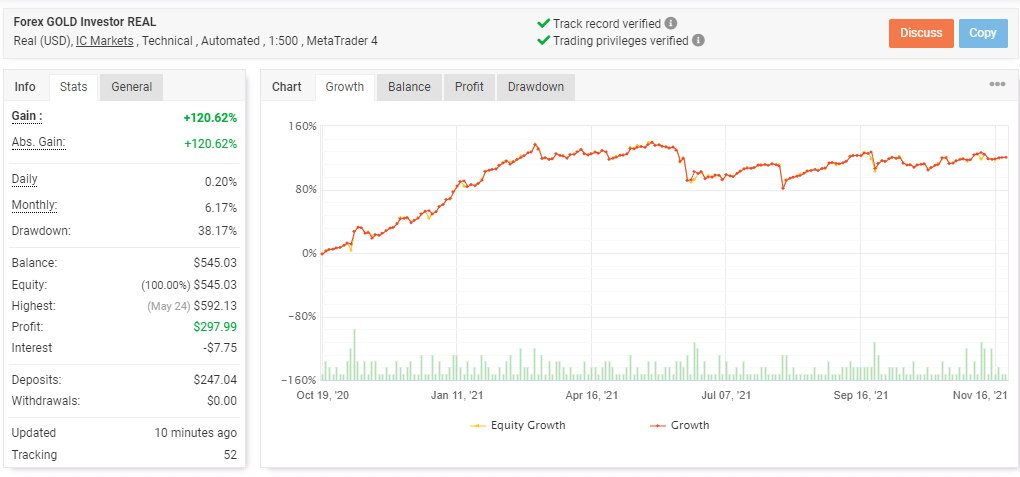

A real USD account verified by the myfxbook site using 1:500 leverage on the MT4 platform is present on the official site.

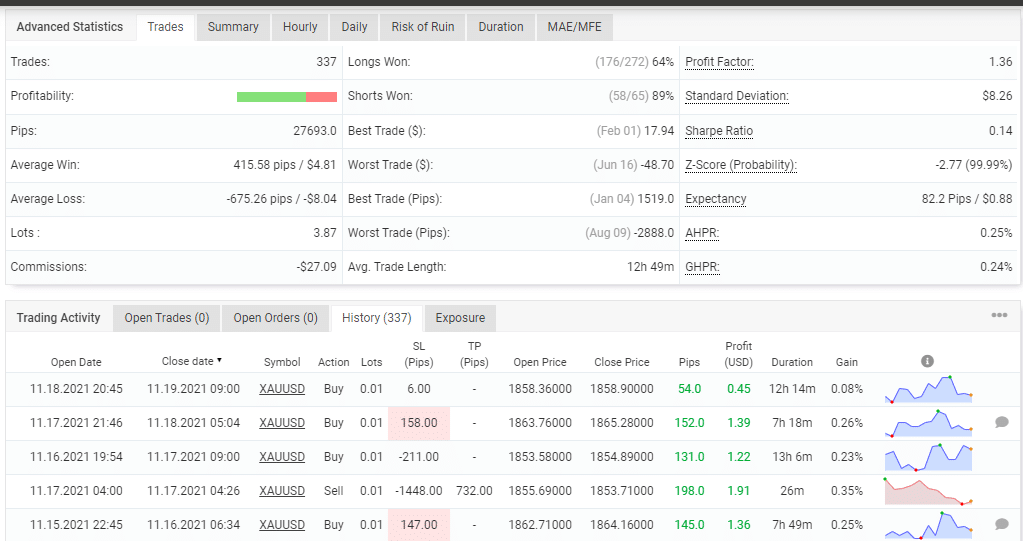

From the trading stats, we find the total and absolute profits are similar at 120.62%. A daily and monthly profits of 0.20% and 6.17% are present for the account that started in October 2020, with a deposit of $247.04. The drawdown for the account is 38.17%. For a total of 337 trades executed, the profitability was 69% and the profit factor was 1.36.

Lot sizes of 0.01and 0.02 are used for the trading. The high drawdown and low profitability indicate a high-risk approach. Further, comparing the backtesting results with real trading info, we find the drawdown is higher in real trading showing the high risk in the system.

The core team

We could not find info on the vendor like their founding year, details of the developer team, a location address, phone number, etc. The lack of vendor info raises a red flag for this EA.