FX Deal Club offers complete management of FX deals assuring no margin calls. The vendor claims that the service is reliable and transparent. Proven strategies, ease of use, and good security are the main focus of the company. For managing your FX account, the service charges 35% of the profits you make. The share is charged every week. As per the vendor, the service has been available since 2001.

Is FX Deal Club good?

From our analysis of the FX managed account service, we find that the system has verified trading results. The vendor claims that the risk is very low with the maximum drawdown for the account being 40%. However, the lack of strategy explanation, high risk seen in the trading results, and high charge are factors you should consider before you use the service.

Features of FX Deal Club

Some of the key features that the vendor focuses on for this service are:

- The company has over two decades of experience in the FX market.

- It uses price action and daily trends as its core strategies.

- All deals are monitored 24/7 to identify the best profitable deals.

- The vendor promises a return on investment of 30% to 50%.

- Customer support is provided 24/7.

- The service uses risk management features like smart hedging, portfolio diversification, and a profitable risk to reward ratio.

- A minimum deposit of $500 is required and the recommended deposit is $5000 or more

- The company assures a drawdown ranging from 5% to 20%.

| Trading Terminals | MT4 |

| Strategy | Trend and Price action |

| Timeframe | N/A |

| Price | 35% profit share billed weekly |

| Money Refund | N/A |

| Recommended Deposit | $500 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | Good (4.385 out of 5 rating based on 3 reviews on FPA) |

What strategy does FX Deal Club use?

According to the vendor, the approach used includes daily trend and price action methods. Every order is executed after a detailed fundamental and technical evaluation. The company monitors the market situation 24/7 and identifies lucrative opportunities to help generate high returns for its clients. For managing risk, the company uses smart hedging, portfolio diversification, and a profitable risk to reward ratio. The vendor states that the main objective of the approach and risk management is to provide safe and consistent results for clients.

Backtesting vs live trading results

No backtesting results are present for this FX service. It is a known fact that backtesting does not predict future performance as it is based on historical data. However, traders prefer backtests as they help provide a deep insight into the approach and the efficacy of the strategy. The lack of backtests makes it difficult to know about the effectiveness of the approach.

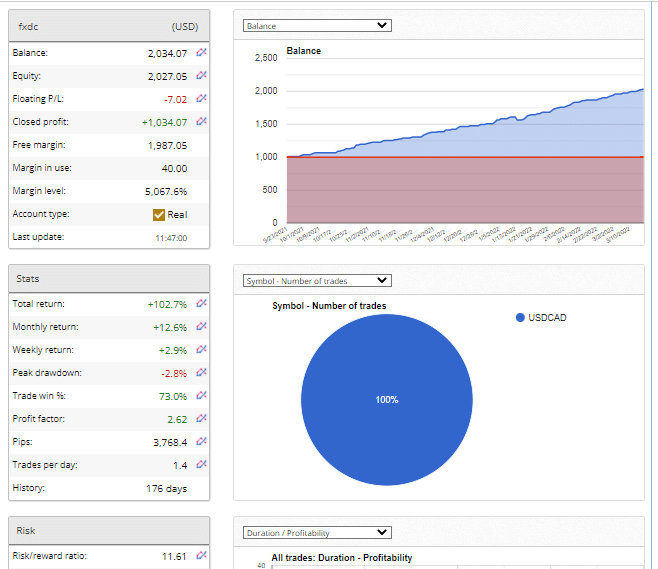

Real live trading results verified by the FX Blue site are present for the service. Here is a screenshot of the live results:

From the trading info, we can see the real USD account that started in September 2021 has generated a total return of 102.7%. The monthly and weekly returns are 12.6% and 2.9% respectively. A drawdown of 2.8% is present for the account. Profitability of 73% is present with a profit factor of 2.62. A risk to reward ratio of 11.61 is present which denotes a high-risk value. From the results, we can see the account has achieved a profit of 1,034 after completing 176 days of trading with the initial deposit of $1000. While the profit is high, the risk is also high which does not corroborate the low-risk claim of the vendor.

The core team

As per the info present on the official site, the company started in 2001 and is based in the UAE. It comprises a professional team of FX traders. It aims at providing transparency, integrity, and excellence. The vendor claims that each client portfolio is given personal attention and the strategy is constantly improved to minimize failure. Unfortunately, we could not find info on the developers, their expertise, and their experience. For support, an online contact form is present.