FXQUASAR is a fully automated Forex robot that is compatible with the Metatrader 4 and Metatrader 5 trading platforms. According to the developer, it uses a reliable trading strategy that shields your account from losses while generating profits at a steady rate.

The current price of this EA is $279, which is pretty close to the market average. By purchasing it, you get access to a single lifetime license and a detailed user manual. You can run it on demo or live accounts and change the account number online. The vendor offers free updates and a 30-day money-back guarantee.

If the drawdown on your account exceeds 35%, the company will initiate a refund provided you have been using the recommended settings. We don’t know exactly when the EA was launched, but its live trading account has been active since July 06, 2020.

Is FXQUASAR good?

This robot is not very expensive and it is supported by verified trading statistics. However, it trades with a high drawdown and is sold by a vendor with no reputation. Also, there is a severe lack of vendor transparency.

Features of FXQUASAR

This EA is compatible with NFA-regulated brokers. You can use it with any type of broker and account. FXQUASAR does not use indicators. It analyzes the market scenario and the recent price movements with the help of quotes and internal algorithms. Based on the results of the analysis, it decides whether to initiate a trade or stand by and in which direction to trade. The EA only works on the AUD/USD pair.

There are six distinct sessions for this robot. Among them, three are used for trading long positions, while the rest are used for short positions. Each of these sessions has its own way of analyzing the market, from the perspective of buy and sell positions.

FXQUASAR also has a risk-limiting system that, according to the vendor, shields your account from heavy losses while also allowing you to recover lost trades.

| Trading Terminals | MT4, MT5 |

| Strategy | N/A |

| Timeframe | N/A |

| Price | $279 |

| Money Refund | 30 days |

| Recommended Deposit | N/A |

| Recommended Leverage | 1:500 |

| Money Management | No |

| Customer Reviews | N/A |

What strategy does FXQUASAR use?

We have little or no information on the trading strategy used by this EA. The devs claim that the system trades without the help of indicators. However, it is not possible for us to determine what techniques it uses for analyzing the market scenario and the price movements.

Backtesting vs live trading results

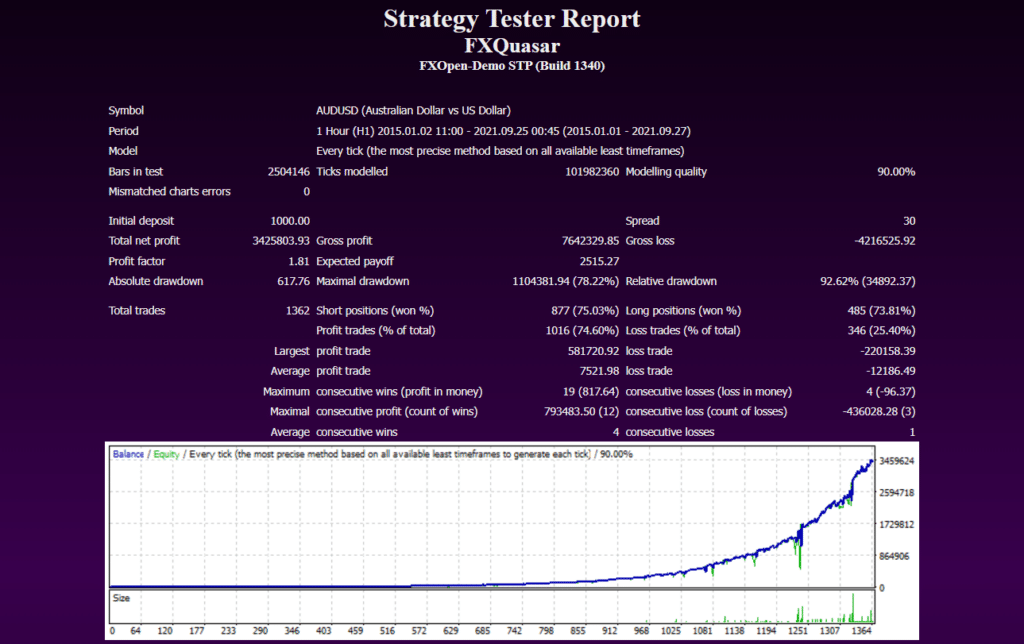

Here we have the results of a backtest conducted from January 2015 to September 2021. The EA used an every tick model and the H1 timeframe for conducting these trades. It started with an initial deposit of $1000, placing 1362 trades and generating a total net profit of $3425803.93. The win rate was pretty satisfactory at 74.60%, while the profit factor was a decent 1.81. Here, we must mention the extremely high drawdown of 92.62%, which is indicative of a high risk of ruin.

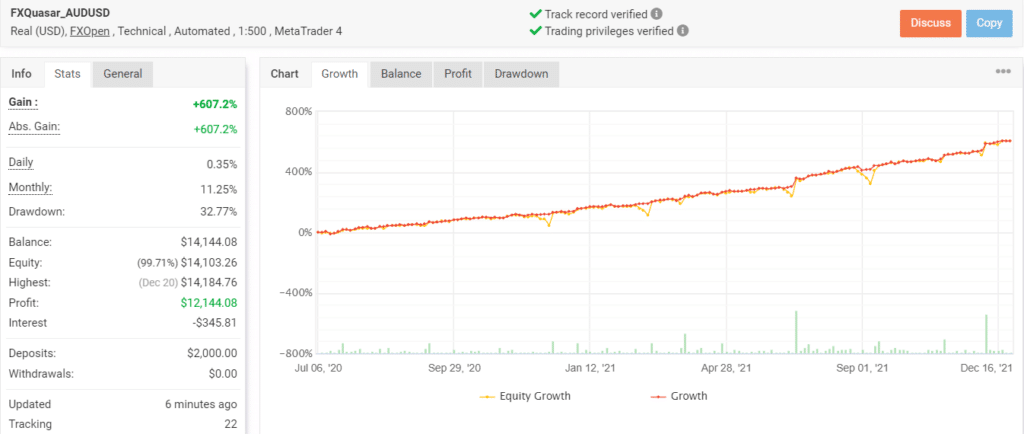

This trading account on Myfxbook has been active since July 06, 2020. After conducting 343 trades, the win rate currently stands at 75%. Thus we can see that the backtest and the forward test have similar win rates. The average daily and monthly gains for this account are 0.35% and 11.25%, respectively. The drawdown of 32.77% can be considered a bit high, although it is nowhere close to what we saw in the backtest.

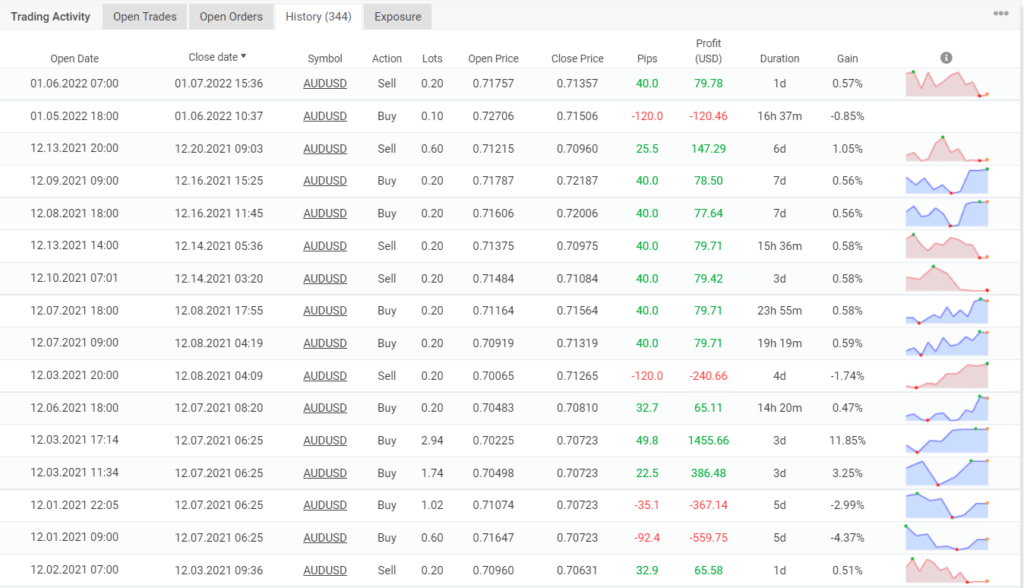

From the trading history, we can see that the EA wins small profits when the lot size is around 0.20. By increasing it to 1-3, it can generate larger profits. Also, it occasionally suffers consecutive losses.

The core team

There is no information on the development team. We don’t know where they are located or how long they have been trading in Forex. The vendor has not shared any contact details.