Cryptocurrency is one of the year’s most popular investments, but it is also the riskiest. The future of this technology is still up in the air; no one knows whether it will be successful or not.

However, specific cryptos are riskier than others. Thus, crypto investment is still more dangerous than investing in stocks. There is a long history of steady growth in the stock market, but cryptocurrency is a new investment. Therefore, if you decide to invest in crypto, you should be aware that it has the potential to be very volatile.

A good investment in Bitcoin may not be suitable for everyone, and that’s okay. However, there are a few options for those who want to get their feet wet in the crypto world. If you’re averse to risk, you may be better suited to investing elsewhere. Meanwhile, you can avoid risk as much as possible.

Can you make real money with crypto?

For sure, you can make real money with crypto. Crypto is a significant investment but risky at the same time. However, you can reduce the risk by investing in safe coins listed below.

How to earn with crypto?

You can earn with crypto by taking advantage of its volatile nature and trading by using different strategies.

How to start with crypto?

All of the coins listed below are well-known and readily available on crypto trading platforms such as Binance, Kucoin, etc.

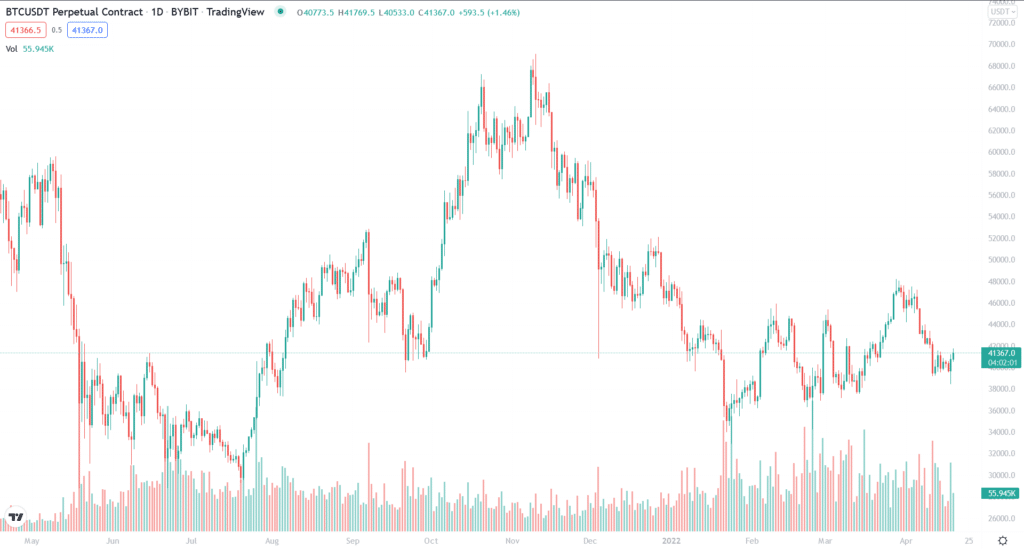

Bitcoin (BTC)

Summary

Bitcoin was the first and most well-known cryptocurrency on the market. As a result, it is one of the most commonly traded cryptos, providing liquidity to investors. Bitcoin is the undisputed king of retail and institutional adoption. If Bitcoin has a poor day, altcoins may drop in value.

Bitcoin may be a good investment since the price is still below its all-time high of $69,000. Bitcoin’s value rises in tandem with its user base. There are only 21 million BTC in circulation, and around 15% have already been lost. Every four years, the bitcoin halving happens when the inflation rate is half to 1.7%.

BTC price forecast 2022

According to the price estimate, many believe that Bitcoin will reach $50,000 before the end of the year. Therefore, it has due stability and significant trading conditions.

Thanks to Taproot, a new technological breakthrough, the Lightning Network, and smart contracts will be possible. Bitcoin’s value might thus quickly rise beyond $100,000 in the foreseeable future.

BTC price forecast 2025

According to predictions, the price of BTC will rise twofold soon. It may fall short of the 126,000 targets. There is no recognized regulatory structure or institution to back it up.

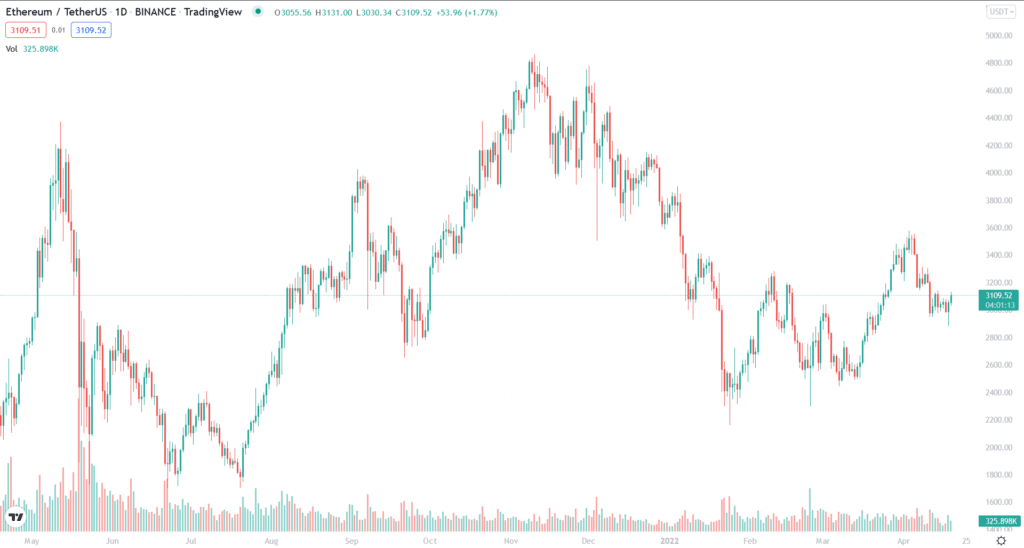

Ethereum (ETH)

Summary

Since its inception in 2015, Ethereum has seen rapid growth as the currency and platform responsible for popularizing the phrase “smart contracts” in the cryptocurrency sector. Ethereum is the second-largest cryptocurrency by market capitalization as of this writing, behind only Bitcoin.

Microsoft, Intel, Chase, and J.P. Morgan are all members of an Ethereum consortium working on enterprise-ready platform versions. Investors shouldn’t rule out Ethereum as a possible addition to their cryptocurrency portfolio as long as it continues to gain momentum and public attention. You may purchase Ethereum on Coinbase, Gemini, and Voyager, among other exchanges.

The Ethereum network also produces the bulk of non-fungible tokens (NFTs). As a consequence of the increased number of NFT buyers, the price of Ether may climb. In addition, because NFTs are exchanged on Ethereum, ETH demand may increase if more individuals want to acquire NFTs from investors.

ETH price forecast 2022

When the ETH 2.0 upgrade was revealed, Ethereum’s price soared by ten, making it the most intriguing component of this phenomenon. Analysts predict that ETH’s price will rise significantly in 2022 due to this upgrading effort, which is expected to continue. As a result, this cryptocurrency is expected to climb in value to moreover US$6,000 by the end of the year.

ETH price forecast 2025

When Goldman Sachs said that Ether had the potential to replace Bitcoin as the store of value, speculation over its worth skyrocketed. So in what form will Ethereum take in 2025? According to predictions, Ether is expected to rise by 250% from its current value to $9,980 in 2025.

Polygon (MATIC)

Summary

When it comes to DeFi, Polygon is assisting in its expansion. Ethereum’s high gas costs have highlighted the difficulties of migrating to Eth2. Vitalik Buterin, the co-founder and CEO of Ethereum, has expressed his support for Layer 2 scaling solutions, which process transactions before sending them to Ethereum’s layer one blockchain. As a result, customers will save money on transaction costs and will be able to finish their transactions much quicker.

Polygon was one of the first to design Ethereum’s Layer 2 sidechains. Moving away from Polygon will incur a short-term cost because assets must be bridged to the sidechain. Coinbase and Gemini support polygon.

MATIC price forecast 2022

This token will be more sought after as the Polygon (MATIC) ecosystem expands and becomes more powerful. Matic’s goal of 2.09 by the end of 2022 will be met if these conditions are met.

MATIC price forecast 2025

Polygon MATIC would cost $5.7 in 2025, according to current forecasts. The lowest and highest expected Polygon costs are $5.2 and $6.1. According to our Polygon Price Prediction, MATIC’s average price may be about $4.74 by the middle of 2025, and if the currency attracts more investors, it may reach $5.06 by the end of the year. MATIC is expected to grow by 117 percent during the following year. In other words, the Polygon price predicting analysis is the only factor that may affect this.

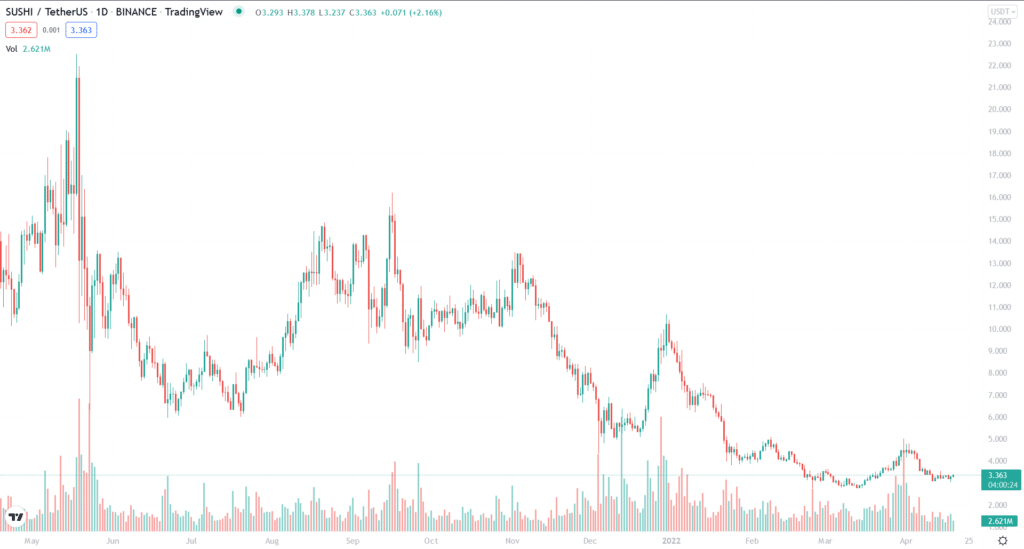

Sushi (SUSHI)

Summary

SushiSwap was initially intended to be a decentralized alternative to Uniswap. Since its inception, the app’s creators have added additional features and capabilities, and more are on the way. Sushi, unlike Uniswap, pays dividends to token holders of Sushi tokens. SUSHI token holders may earn 0.05 percent trading fees by staking them on the platform. This equates to a 10% dividend yield, a substantial sum of money.

In addition to the SushiSwap DEX, decentralized apps provide lending markets, token launchpads, and even leverage trading. For example, sushi plans to launch Shoyu, a new NFT platform, to compete with OpenSea, the current market leader. A 2.5% fee will be paid on NFT sales, distributed as dividends to SUSHI token holders.

SUSHI price forecast 2022

If Sushiswap gains consumers from Uniswap, we expect the price to climb from $10 to $15 in the following several months because of their unique incentives and revenue sharing scheme.

SUSHI price forecast 2025

Sushiswap may draw users from Uniswap, and their special incentives and income sharing approach will likely push them above the $50 milestone.

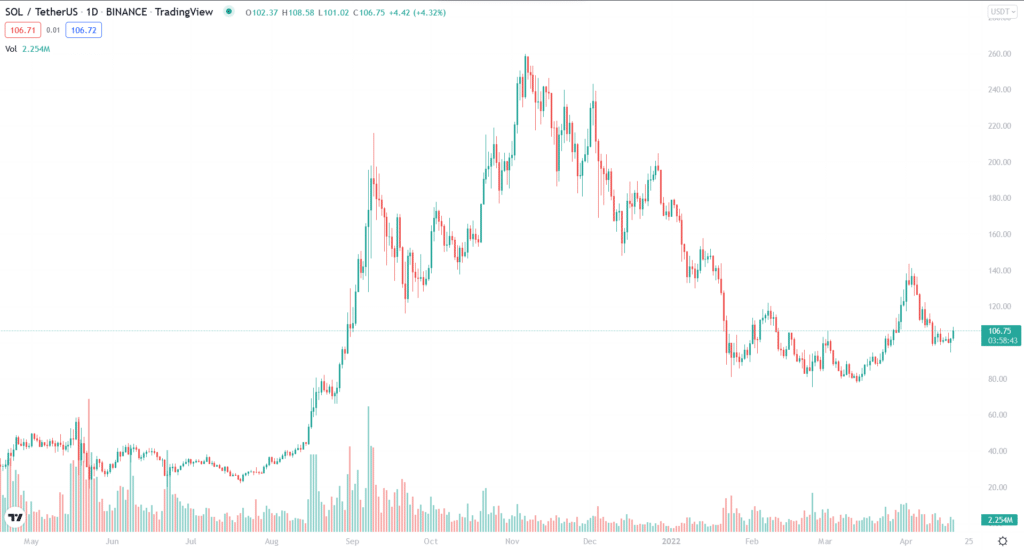

Solana (SOL)

Summary

Solana, one of Ethereum’s key competitors, has seen its value skyrocket in 2021. Solana has climbed from a low of $1 in 2021 to about $100 now. With tens of billions of dollars of BTC stored on its ledger, Solana is one of the largest decentralized financial blockchains. Several investors are using Solana’s blockchain for both NFTs and DeFi.

Solana has the edge over other smart contract blockchains since it is focused on scalability. Solana uses a proof of stake consensus technique with proof of history to execute thousands of transactions per second. As a result, Solana’s transaction fees are 99 percent less expensive than Ethereum’s for average traders who cannot afford to pay Ethereum’s three-figure gas costs.

SOL price forecast 2022

Many cryptocurrencies experienced a bumpy start to the new year, including SOL. With markets in turmoil, SOL’s price fell to $175. Despite this, Solana’s arrival on OpenSea in April 2022 has resulted in tremendous growth. Solana’s 10,000 collectors are second only to Ethereum’s 12,000 in terms of NFT currency. As the NFT and DeFi markets expand in 2022, the popularity of Solana’s tags and coins is sure to rise.

SOL price forecast 2025

Soon, increased profits and price stability seem to be in store for Solana. Changes in government regulations or legislation may cause a few overcast days, but it’s expected to cruise smoothly between a high of $262 and a low of $211. There’s also a slew of new growth prospects that seem fantastic on paper.

Pros & cons

Let’s look at some pros and cons of crypto.

| Pros | Cons |

| Accessibility and liquidity in the crypto are very high, turning into your profits. | Volatility may go against you, and you lose money. |

| User anonymity and transparency allow the traders to perform transactions safely. | No government regulations may result in a conflict of interest and may not allow you to raise disputes. |

| Independence from a central authority gives more control to the traders. | Transactions are irreversible, so there is no way to claim for a wrong transaction. |

Final thoughts

Investing in cryptos has a high level of risk. Therefore it isn’t for everyone. In contrast, suitable investments may help you reduce your risk. The long-term growth potential of these three cryptocurrencies makes them less risky investments.