Night Hawk is an FX robot designed for the MT4 platform. It is a fully automated software that uses a modified version of the Martingale method. The ATS works by using indicators like the Bollinger Band and the candlestick pattern for identifying accurate entries and exits. You can purchase this FX EA for $275. While the vendor does not provide info on the features available with the package, there is a 30% discount on the purchase of subsequent copies.

Is Night Hawk good?

As per the vendor, the expert advisor has several benefits like full automation, money management, real trading, and backtesting results. But there are downsides like the high drawdown, a lack of money-back guarantee, and expensive pricing. Our initial conclusion of the system is that you need to weigh the pros and cons of the system before you decide on using it.

Features of Night Hawk

Some of the significant features that make this FX robot stand apart from the rest as per the vendor are:

- A filter for trade time help you receive only the reliable signals

- The expert advisor works with all brokers and ECN

- Free upgrades and lifetime support is assured on purchase of the package

- The presence of smart filters allows premature withdrawal from a position using set indicator signals

- An inbuilt money management feature that works independently of the trader input

- A unique algorithm for the dynamic orders grid design is used by the average true range indicator

- Low drawdown level with the application of the news and currency filters

| Trading Terminals | MT4 |

| Strategy | Martingale |

| Timeframe | N/A |

| Price | $275 |

| Money Refund | N/A |

| Customer Support | Bad |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Night Hawk use?

According to the vendor, this ATS uses a modified method of the classic Martingale method. The approach has several enhancements and benefits that enable higher returns from market movements. The vendor states that indicators like Commodity Channel Index, candlestick patterns, and customizable filters help in improving the quality of the trades and lower the drawdown.

Backtesting vs live trading results

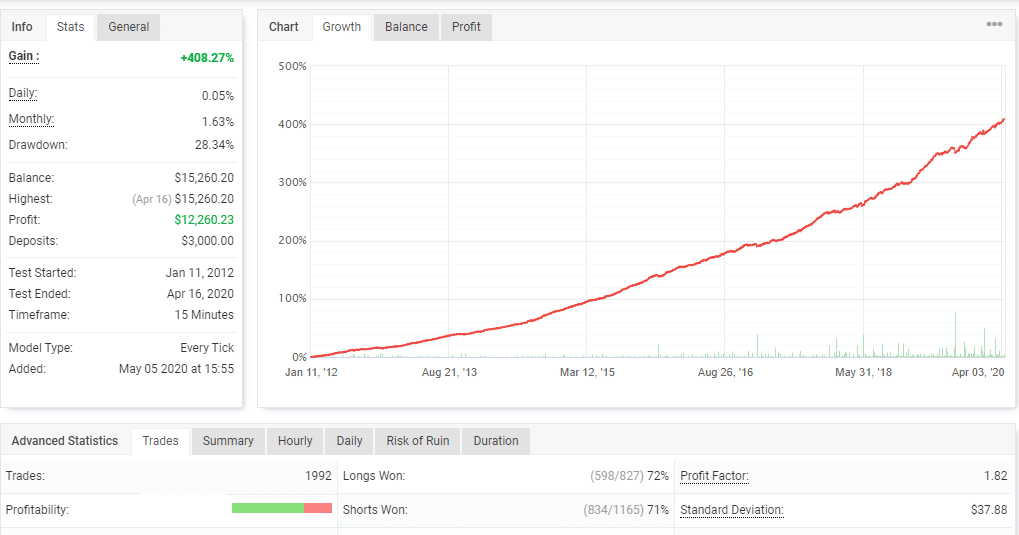

A backtesting report for this FX EA working on the AUDCAD pair using the M15 timeframe is present on the Myfxbook site. Here is a screenshot of the results:

From the stats, we can see the test started in 2012 and ended in 2020. A total profit of 408.27% was generated with a daily and monthly return of 0.05% and 1.63%. The drawdown for the account was 28.34%. A total of 1992 trades were completed with 72% profitability and a profit factor of 1.82. A lot size of 0.09 was used. From the results, we can see that the account has grown steadily. However, the profitability is not high considering the number of trades executed. Further, the drawdown is high denoting the approach used is risky.

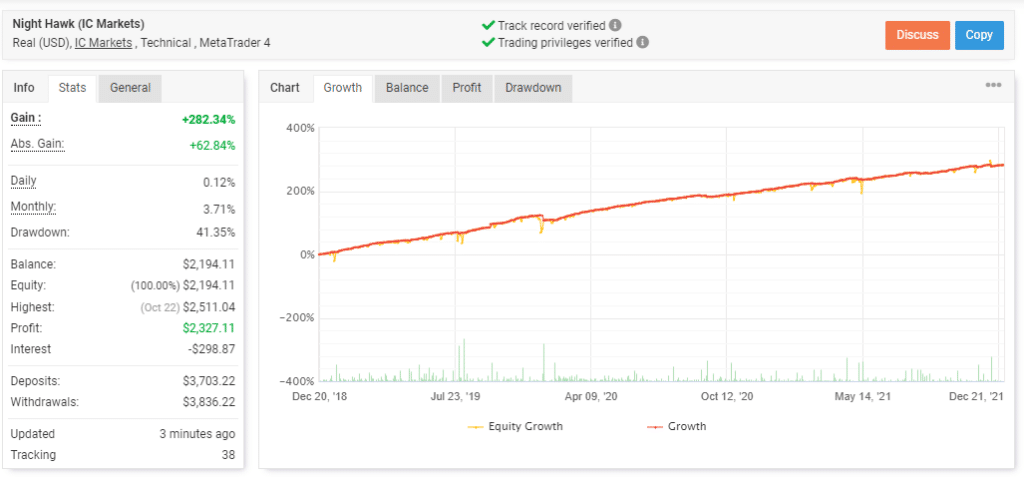

A live real account verified by the myfxbook site is also present for this FX robot. Here are details of the trading shown in the screenshots below:

From the above stats, we can see the EA has generated a total profit of 282.34%. An absolute gain of 62.84% is present for the account started in December 2018. The big difference between the two values looks suspicious. The withdrawals and the approach are mostly responsible for the difference in the values. A daily profit of 0.12% and a monthly profit of 3.17% are present which shows decent profits. The drawdown is 41.35% which is very high and indicates the modified Martingale approach is risky.

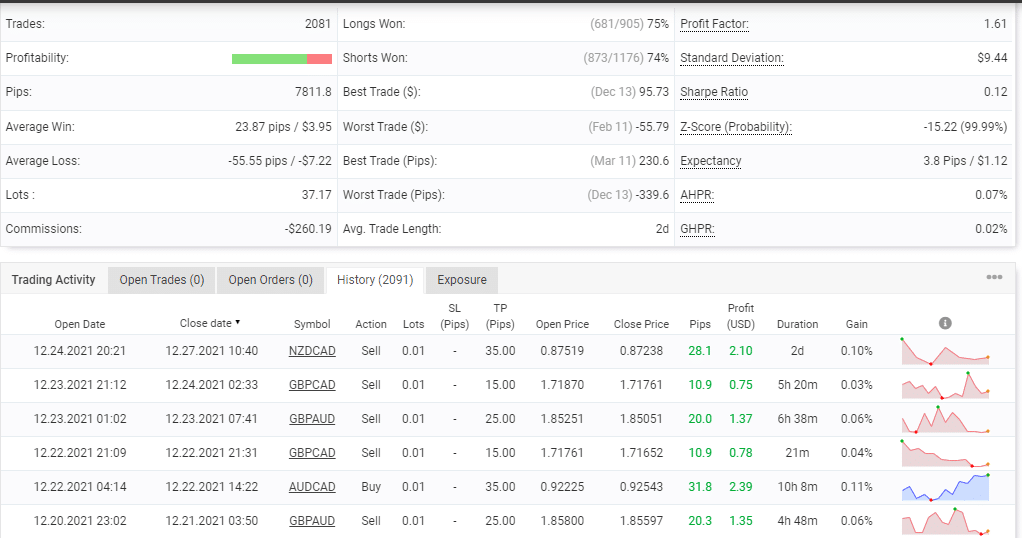

For a total number of 2081 trades, profitability of 75% is present and the profit factor is 1.61. A lot size of 0.01 is used for the trades with the initial deposit for the account being $3,703. While the growth is consistent as seen in the backtests, the drawdown is higher indicating a very high-risk approach that can put your capital in danger.

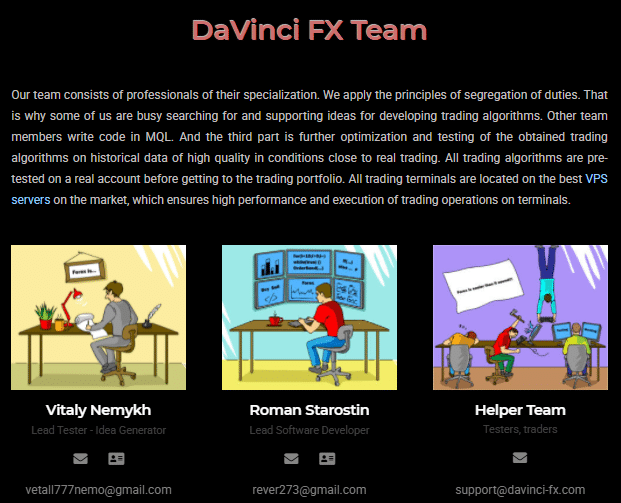

The core team

As per the info on the official site, the DaVinci FX group comprises team members with specialization in different spheres including developers, analysts, and expert traders. Vitaly Nemykh is the lead tester with experience in the FX market since 2006, Roman Starostin is the lead software developer with experience in the field since 2013 and in developing MQL based algorithms since 2015. Email addresses are provided for the team members and the support team. A phone number and email address for support besides an online contact form are present for the company. There is no location address present.