Robinhood FX EA is an MT4 trading tool that claims to be a profitable system. This FX Robot uses daily market analysis for identifying successful trades. The vendor claims that it trades every hour and uses trade management that does not include the Martingale system.

To purchase this FX EA, you can choose from three pricing packages namely the basic, regular, and business packages. The cost ranges from $127 to $167. Features included in the packages are a lifelong license, 100% auto trading, and 24/5 support. Real and demo accounts are provided and the number differs based on the package you choose.

The vendor does not provide info on the developer or for how long the system has been on the FX market. The lack of vendor info raises doubts regarding the reliability of this product.

Is Robinhood FX EA good?

On our evaluation of the features, recommendations, live trading performance, support, and other characteristics of this EA we find this is not worth its price. The inadequate strategy explanation, short trading sample, and lack of vendor transparency are a few major downsides that prevent this system from being a reliable product.

Features of Robinhood FX EA

As per the vendor, this FX robot is a fully automated system that continues to work round the clock executing trades effectively. Some of the features that the vendor highlights in this FX EA are:

- The EA uses carefully calculated trade entries and exits.

- An advanced SL system is used where the stop positions are placed to maximize profits. And the SL is not revealed to the broker.

- Lot sizes used are based on the size of the account.

- The EA executes trades when specific market conditions occur and if the unfavorable conditions are present, it closes the trades to minimize losses.

- It works in all market conditions irrespective of bad news events.

- It can work with all brokers and with ECN, Micro, STP, or Cent accounts.

| Trading Terminals | MT4 |

| Strategy | N/A |

| Timeframe | H1 |

| Price | $127 to $167 |

| Money Refund | 30 days |

| Recommended Deposit | $100 – $200 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | 1 suspicious review on FPA |

What strategy does Robinhood FX EA Use?

The vendor claims that this FX EA uses a profitable trading approach. There is no mention of the approach. However, the vendor explains that the EA uses capital management and meticulously calculated entries and exits for its trade execution. The vague explanation of the approach raises a red flag for this EA.

Backtesting vs live trading results

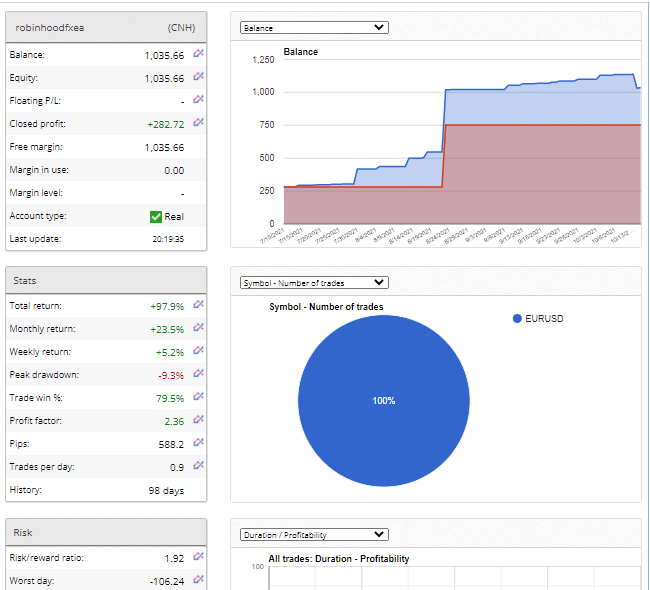

No backtesting results are present for this FX robot. A real trading account of the EA verified by the FXBlue site is shown here.

From the above trading result, we can see the account reveals a total return of 97.95 and a monthly and weekly return of 23.5% and 5.2%. A peak drawdown of 9.3% is present. For a trading history of 98 days, the account has a profitability of 79.5% and a profit factor value of 2.36. The risk to reward ratio is 1.92. From the stats, we can see that although the profits look decent, the sample size is very small for the results to be significant. The trading history needs to be longer for better analysis. The lack of backtesting and the small sample size raises a red flag for this EA.

The core team

We could not find info on the developer or the team responsible for the creation of this FX robot. There is no location address present. A phone number and an email address are present for contact. The vendor does not provide info on the experience and expertise of the developers. Without sufficient vendor information, we suspect this is not a reliable EA.