Millions of investors are now utilizing investing apps due to their easy functionality, interesting features, and reliable investment procedures.

However, choosing the right investing app is essential to maximize your benefits and earnings. The selection differs as every investor has different preferences regarding their investment plans according to age, monthly income, duration of investment, and risk tolerance.

Read this article to learn about the working of investment apps and the various components and characteristics of Acorns, a convenient investment app.

How do investing apps work?

They provide a stable platform to enhance your wealth. In addition, micro-investment apps have reduced the high barriers of investing and encourage users to start investing at as low as $1.

These apps allow investors to buy various stocks, ETFs, ARDs, or cryptocurrencies and implement techniques to maintain a good investment return ratio.

Most investment apps like the retailer invest a percentage of the purchase to your investment fund Acorns let the users link their debit/credit card to the investment app. Accordinr’s investment account.

Reason to use for investors

Investors use these apps due to easy access to the stock markets and effortless deposits in their app-linked investment accounts without any significant burden.

Many of these apps allow trading fractional stock shares, an attractive recourse for young or low-budget individuals. Furthermore, most investment apps provide educational courses about investment, trading, economics, and finance.

A leading investment app like Acorns primarily operates on the feature of “Round-Up” change to build up users’ investment accounts. So, for example, if you buy a burger for $5.80 from McDonald’s with your Acorns linked debit card, the platform will deduct $6 from your card and transfer the change of 20 cents to your investment account.

Features of Acorns investment app

It is a comprehensive investment and savings app with a robo-advisor platform. Let us review its features.

Cost

Acorns app is free to download on Android or iPhone and is accessible from web browsers as well.

The platform imparts no deposit fees and no commission charges with no restrictions on minimum account value.

Fees

Acorns charge its users an accounts’ maintenance or service fee with a relatively flat fee structure.

- Lite is the most basic plan with a $1 fee per month, but the platform presents two advanced subscription plans for additional features.

- Personal gives you access to a standard investment account, retirement account, and a checking account for $3 per month.

- Family provides all personal tier accounts with an additional feature to open investment accounts for your kids at $5 per month.

Reasons to get this app

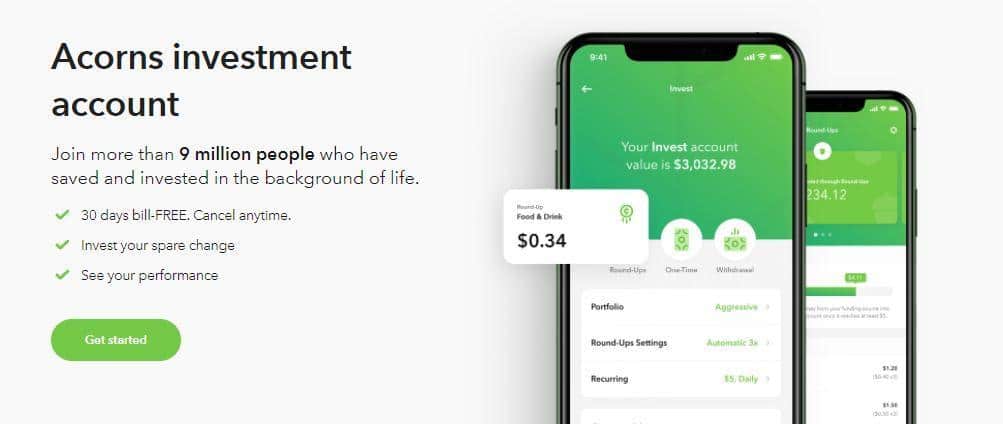

It is one of the most popular apps among investors, with over nine million sign-ups till now. This robo-advisor platform handles your investment automatically, which makes investment effortless and free of worries.

The app uses its “Round-up” feature to add the spare change in users’ funds. Whenever you use the linked card for any purchase, the platform round-ups your purchase to the nearest dollar and deposits that additional amount to your investment pool.

Moreover, you can boost your round-up transfers to 2x, 4x, and up to 10x to increase the investment rate.

Acorns also offer a recurring investment option aside from the round-ups. You can link your bank account and set a monthly deposit amount that would be automatically directed to Acorns every month. The amalgamation of round-up investments and fixed monthly transfers can significantly boost your savings.

Furthermore, Acorns has dedicated a detailed education platform for its users. “Money basics” contain more than 80 articles related to investing, retirement, savings, economy, and student debt.

In addition, Acorns’ “Grow Magazine,” in collaboration with CNBC, provides regular updates regarding financial stories, guides, and news.

How to use it?

It works according to a five-product structure. Investors select one or more products for achieving their investment goals.

Acorns Invest

The basic taxable investment account utilizes your round-up savings or recurrent contributions to invest in ETFs. The platform allocates you a portfolio by taking a survey to assess your long-term goals and risk tolerance.

Therefore, your investments automatically get diversified into ETFs with various stocks and bonds. Acorns also automatically rebalance your portfolio according to morphing needs.

Acorns Later

It accommodates various retirement account types, including Traditional, Roth, and SEP IRAs. Funds transfer to the retirement accounts works similarly to Acorns Invest, i.e., through round-ups or fixed deposits.

Moreover, near your retirement age, Acorns rebalances your portfolio to a safer and conservative side. With Acorns’ plan, you can maintain both Acorns Invest and Acorns Later accounts side by side.

Acorns Early

It refers to the investment accounts for your children like a UTMA/UGMA account. You can begin investing in this account from as low as $5/month with round-up or recurrent transfers.

Acorns Earn

It has made investment further exciting and easier through its Earn feature. With Acorns Earn, the retailer invests a percentage of the purchase to your investment fund whenever you shop from Acorns-partner brands with the app-linked debit/credit card.

Acorns has partnered up with top 350+ brands, including Nike, Sephora, and Walmart. However, the rewards usually take 60-120 days to reach your account.

Acorns Spend

Acorns offers a checking account with a visa debit card that individuals can use for daily transactions and Smart Deposits. It is an FDIC-insured card with no hidden fees.

How to open an account?

Currently, it is only available for US citizens, and it only takes a few minutes to open your account. After downloading the app, you need to specify a PIN code for accessing the account in the future.

Afterward, you need to fill in your personal information, specify a password and link your bank debit/credit cards to Acorns.

Moreover, it asks some questions to determine your investment goals and specify a portfolio to you.

How much could you save for one year?

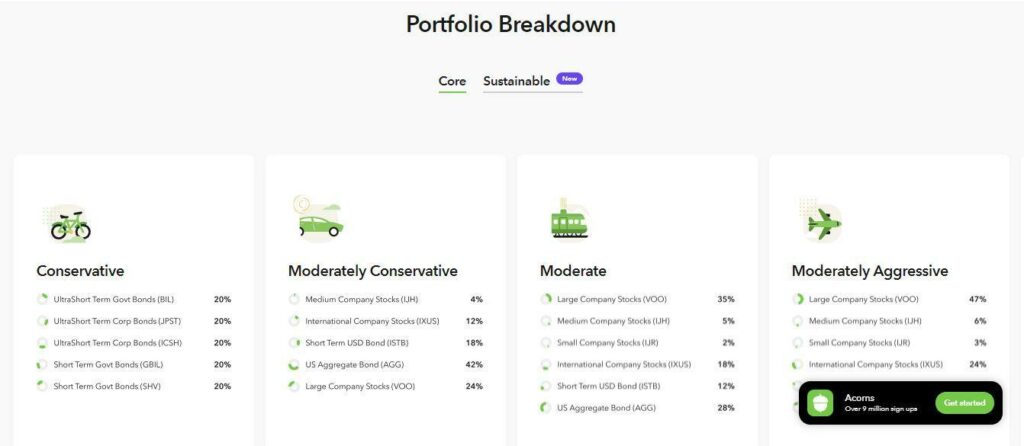

Acorns invest users’ deposits and round up funds in ETFs. The yearly savings depend on the type of portfolio Acorns specifies for investors from a collection of 25 ETFs.

There are five portfolio types in Acorns: Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive. Average investment return per annum can reach up to 7% of your original investment fund by using Acorns.

Pros & cons

Let us look briefly at the pros and cons of this investment app.

| Pros | Cons |

| Automation Automatic investing has made investment easier for people of all backgrounds. | Fee structure The flat fee framework is costly for low-balance accounts. |

| No account minimum There are no restrictions to maintain the account above a certain level. | No human-financial advisor It does not provide human advice to investors who don’t prefer robo-advisors. |

| Acorns Earn Users can increase investments from regular purchases through Acorns Earn. | No tax-loss harvesting It does not offer tax-loss harvesting. |

Final thoughts

With its uncomplicated interface and automated investing, Acorns has become a top choice for millions of investors. Moreover, the platform has remarkably structured its various account types and various perks along with simple features.

In conclusion, it is a suitable robo-advisor app for starting your investment journey early and securing your future financial needs.