Investment apps’ easy accessibility and affordability have made them immensely popular among market participants. Resultantly, investors can start building their wealth and begin their investing journey by just making a few taps on their phones.

Moreover, market participants can choose from dozens of investment apps with unique features and designs that best suit them. According to CNBC, the number of retail investors utilizing investing apps climbed from 28 million in 2016 to more than 90 million in 2020, and the number can reach 150 million in the first quarter of 2022.

So, do you want to know about Wealthfront investing app, an excellent robo-advisor platform with more than 450k+ clients and $28 billion in clients’ funds? Read this review to understand the specifications and drawbacks of this investing app.

How does the Wealthfront investing app work?

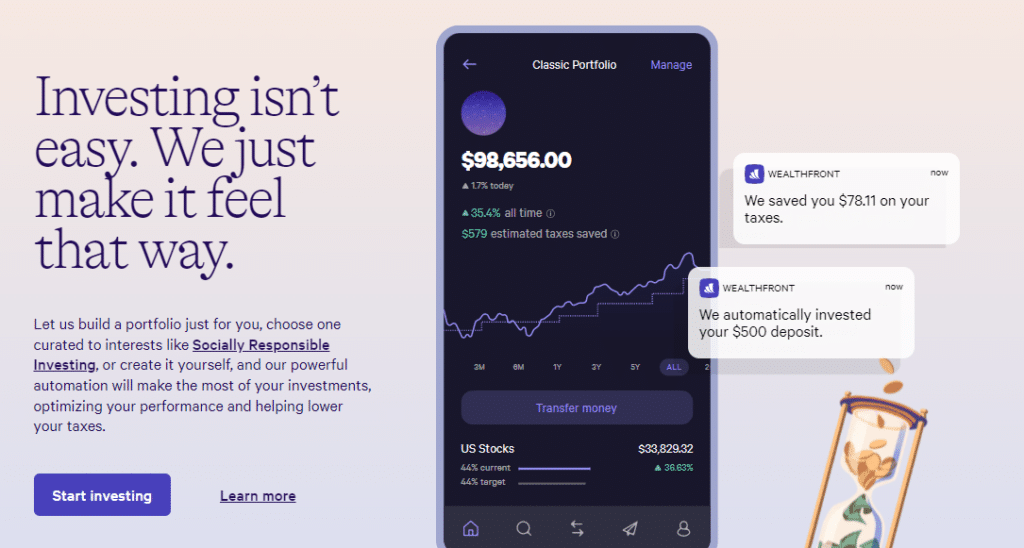

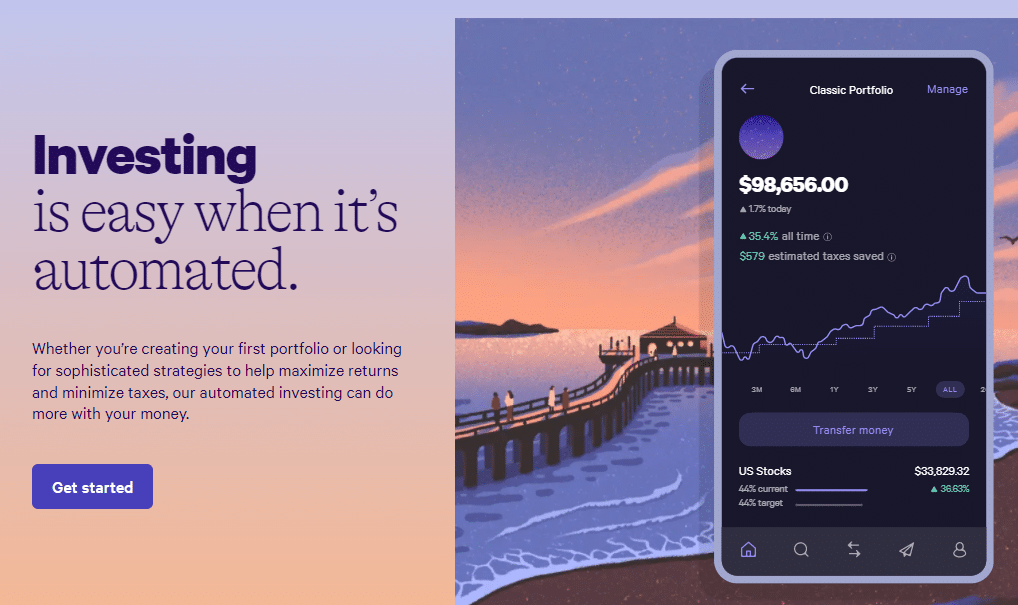

It is a leading robo-advisor investment app that provides professional and automated financial management at the lowest possible costs. The platform drafts tax-privileged and cost-effective investment portfolios according to the individual goals and risk appetite.

In addition, its automated diversion of money to various long-term or immediate plans like paying bills, educational savings, and trips or vacations allow the investors to enjoy effective money handling.

Wealthfront is the app of choice for novice as well as professional investors who want minimal engagement with regular decision-making and prefer robo-advisors instead of human advisory services.

Features of Wealthfront investing app

This platform is the app of choice for novice and professional investors who want minimal engagement with regular decision-making and prefer robo-advisors instead of human advisory services.

Cost and fees

The platform allows a minimum account value of $500 with no trading, withdrawal, or transfer fees. It charges fair advisory fees of 0.25% on your portfolio. For instance, on a portfolio of $1000, you would pay $2.5 per year.

Moreover, Wealthfront’s 529 college plan users pay around 0.42% to 0.46% of their total portfolio. (advisory fee + expense ratio + administration fee).

In addition, the app incorporates ETFs and mutual funds with lower expense ratios ranging from 0.03%-0.39%.

Reasons to get this app

- Passive investing

It is an excellent tool for passive investors who want minimal involvement with financial decisions. By using this platform, investors do not need to continuously track their investments as the app’s automatic algorithms proficiently take care of all the transactions and arrangements.

- Tax-loss harvesting

Wealthfront offers the advantage of tax-loss harvesting that remarkably reduces the tax bills by timely neutralizing capital gains. Moreover, the platform employs more advanced and sophisticated stock-based level tax-loss harvesting for larger accounts around $500k.

- Adjusted portfolio & 12 asset classes

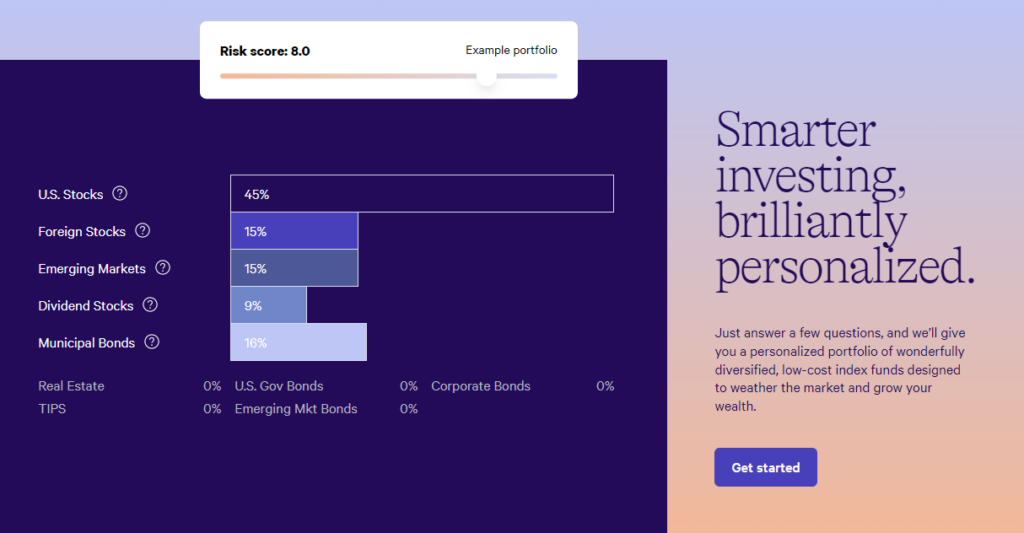

Wealthfront asks its long-term investors a wide range of questions like an investor’s age, investing duration, and investing priorities to determine their overall risk tolerance and preferred portfolio category.

The app drafts the portfolios by arranging and balancing around 12 asset classes, including US stocks, foreign stocks, municipal and corporate bonds, TIPS, and cryptocurrencies, according to every individual’s suitability.

- Affordable management fees

Low-capital investors can utilize this investing services due to the availability of cheap investment options and low advisory/management expenses.

- Account types

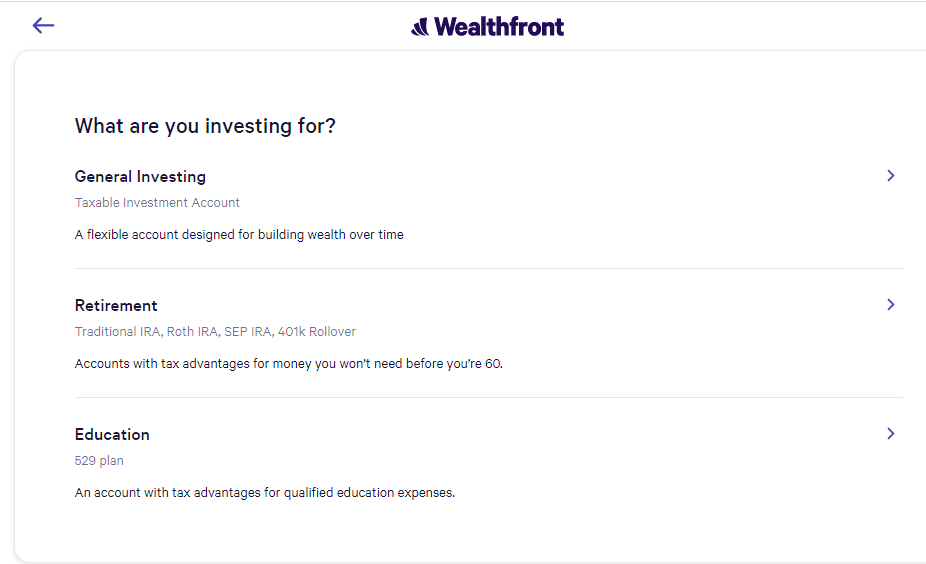

The platform offers a variety of account types such as individual brokerage accounts, retirement accounts (Roth IRA, SEP IRA, Rollover IRAs), joint accounts, and trust accounts. In addition, the platform also provides a 529 college savings account.

How to use it?

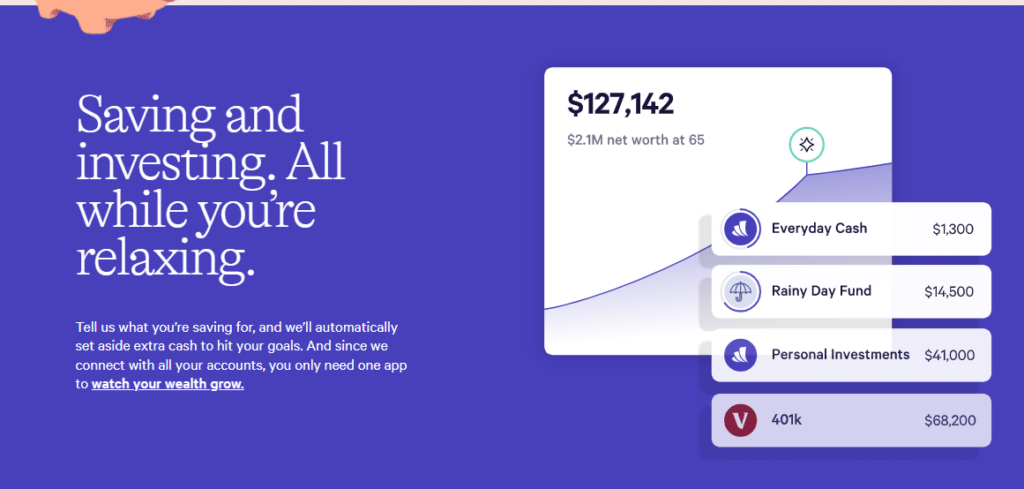

Wealthfront is famous for its goal-setting services provided by the remarkable “Path tool.” Users can utilize this tool to get a comprehensive picture of their financial situation concerning their goals. Clients can link their bank cards or other accounts to let the app assess their average debt, cashflows, and available funds.

Whether you are planning a tour, a house purchase, or university expenses, Path can exhibit the possibility of your goals while maintaining your other investments. The platform also utilizes third-party data to develop and upgrade efficient savings or investment plans.

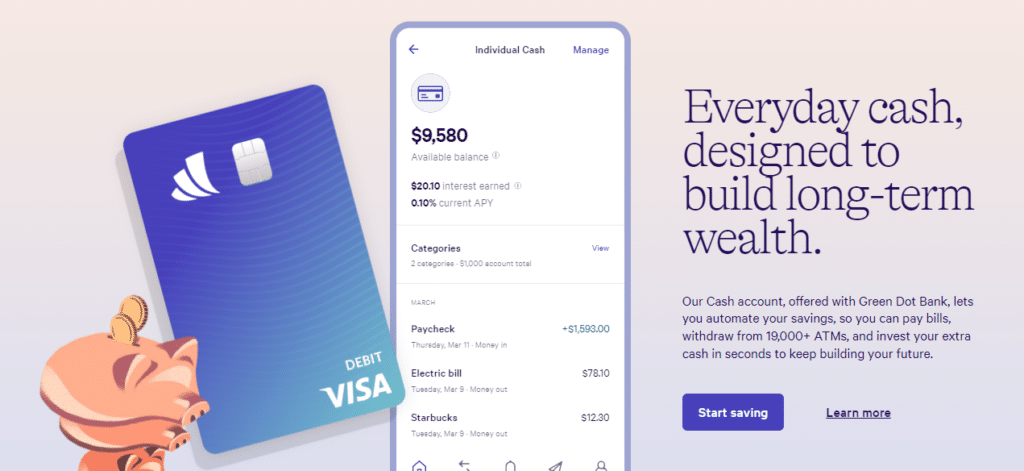

In addition, the Wealthfront Cash Management account amalgamates the features of checking and savings accounts. Investors can get an APY of 0.35%, significantly higher than the average rate. You need just $1 to start using Wealthfront Cash with no ATM or maintenance fees.

Line of credit is an outstanding borrowing feature for investors with more than a $25,000 account balance. Investors can loan up to 30% of their portfolio value with low annual interest rates ranging from 2.40% to 3.65%.

Moreover, the app offers its unique 529 college savings plan that allows the investors to save tax-advantaged money for future college expenses.

How to open an account?

Users can open a Wealthfront banking account with just a $1 initial amount. On the other hand, for opening an investing account, the platform asks about your investing goal (general investing, retirement, or education) beforehand and necessitates a $500 initial balance.

After filling in the necessary details, you can put in extra information about the value of your belongings and other wallets or accounts to acquire a better investment plan.

Wealthfront presents an automatically designed portfolio after the questionnaire filling; however, the platform has also introduced a portfolio-customization feature as of May 2021.

How much could you save for one year?

The answer to this question entirely depends on your initial capital and risk tolerance. Wealthfront determines the risk tolerance score of users to assign portfolios to them.

The average annual return rate can range from 6% to 10% for a regular investor. Aggressive investors can gain more than 20% return rates; however, the risk element also spikes.

Pros and cons

Let us look at the advantages and limitations of using the Wealthfront investing app.

| Pros | Cons |

| Effective goal planning The platform offers an elaborate overview of the investors’ financial standing and manages various plans. | No fractional shares The app does not invest in fractional shares, and the capital remains uninvested if it is insufficient for buying relevant shares. |

| Tax-loss harvesting The app provides tax-loss harvesting that guards against hefty tax bills. | No human advice The platform does not give a human advisory option. |

| Automatic portfolios Wealthfront allocates automatically-made ETFs or mutual funds portfolios to the investors by assessing their financial goals. | Higher account minimum Wealthfront has a relatively higher account minimum limit than its competitors. |

Final thoughts

This app is a leading and top-rated investment platform that takes the concept of efficient investing to the next level by its features like Path, self-driving money, and tax-loss harvesting.

However, Wealthfront presents a sophisticated view of your financial standing with detailed features and a complex interface that could get a little overwhelming for some investors. Nonetheless, if you prefer a comprehensive insight into your financial situation with automated management of your savings and investing plans, this platform may be the right option for you.